Moonbirds was one of the NFT projects that were hit hardest in the decline of the digital collectibles market in June due to decreased investor interest.

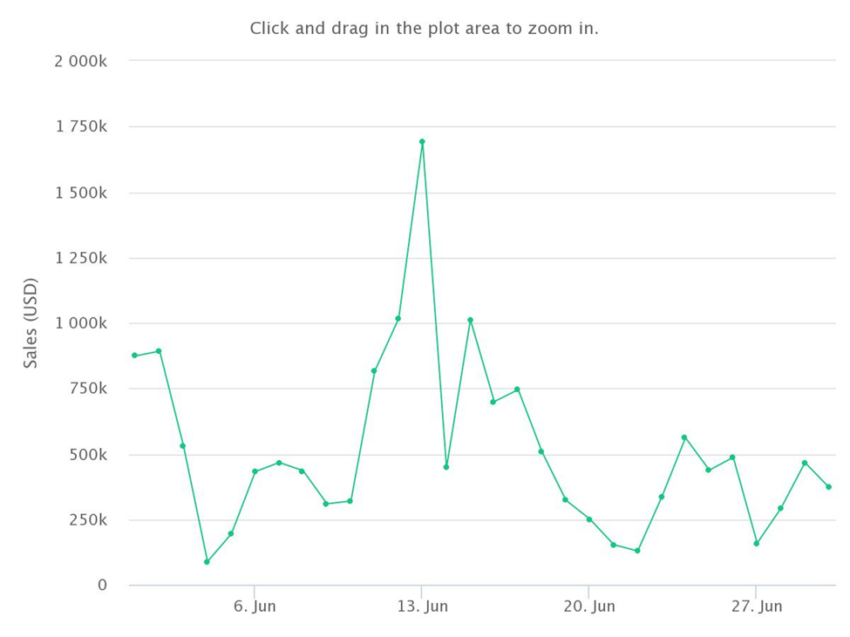

Moonbirds is among the top 10 biggest selling digital collections of all time with a total sales volume of approximately $562.95 million. The NFTs had a sales volume of around $15.43 million in June, according to to Be[In]Crypto research.

Although this value seems low, it was higher than monthly sales for Axie Infinity, Bored Ape Kennel Club (BAKC), and Meebits. On the other hand, it was below sales of Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Otherdeeds.

Moreover, June’s sales volume was a 72% decrease from May’s. In May, Moonbirds’ sales were in the region of $56.1 million.

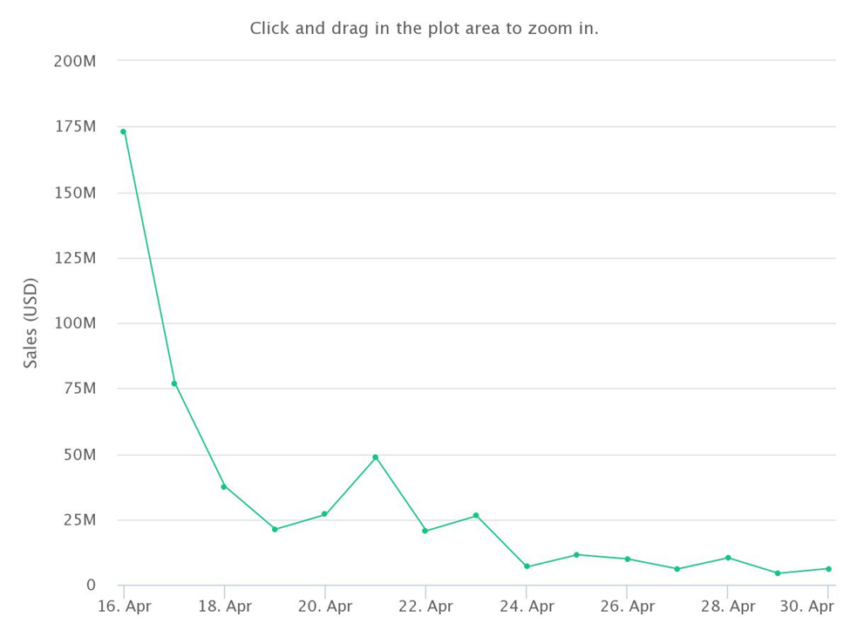

Moonbirds NFT was launched on April 16, 2022, by media start-up, Proof. This firm was founded by Kevin Rose, a venture capitalist.

Like other projects, Moonbirds comprise 10,000 owl avatars that can be purchased from the biggest NFT marketplace, OpenSea.

Why the plummet in sales?

Looking at the decline in the number of unique buyers from June, the dip in sales volume led to the waning transaction counts of the digital collectible, with 467 unique buyers, and 612 transactions.

In relation to April 2022 which was the opening month of Moonbirds’ sales, unique buyers stood at 11,741, and this corresponded to 15,909 transactions. April sales of the NFT were approximately $485.22 million.

By recording sales below $10 million, sales volume fell by $469.8 million. June’s average sale value of $25,205 was also a 17% drop from April’s $30,500.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.