Ethereum and Bitcoin miners saw a further decline in revenue during the month of July as prices of both digital assets failed to reach new highs.

July proved to be the worst month for Bitcoin miners thus far in 2022. BTC miners were able to generate around $574.89 million in revenue during the seventh month of the year, according to Be[In]Crypto research.

Bitcoin miners’ revenue for July was a 13% decline from June’s value of approximately $667.94 million.

Aside from this, the total profitability of BTC mining revenue over the past year was also down by 40% since July 2021, which saw about $971.83 million in revenue recorded.

Ethereum outpaces Bitcoin mining revenue again

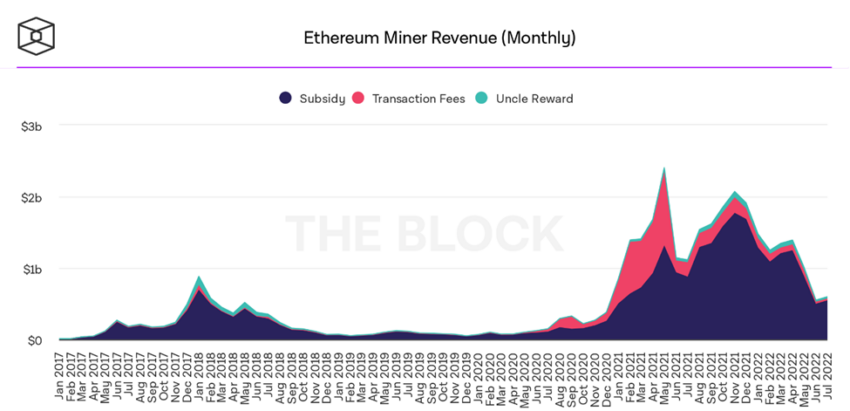

While Bitcoin miners managed to rake in $574.89 million in July, Ethereum miners generated roughly $596.33 million. Unlike Bitcoin, Ethereum’s revenue soared by 8% from June. June 2022 saw Ethereum mining generate total revenue of $549.58 million.

Like Bitcoin, Ethereum mining also saw a year-over-year monthly fall in July. July 2021 saw around $1.11 billion in revenue generated, while 2022’s figure dropped by 46%.

Miners still profit more from Ethereum in July 2022

Although BTC remained the most popular and largest digital asset by market capitalization in July, miners made more from contributing power to the validation of transactions involving ETH than BTC.

Aside from June when miners made more profit from Bitcoin than Ethereum, Ethereum miners have had the lion’s share in the rest of the months in 2022.

What caused the tumble in mining revenue?

To understand the tumble in mining revenue, you should have a clear understanding of how mining revenue is calculated. We calculate miners’ revenue by multiplying the total number of coins earned as rewards within July by the price of the coins (BTC and ETH).

With this under perspective, we can conclude that waning market prices of digital assets were the cause of the dip in mining revenues.

Throughout July, Ethereum traded between $1,034 and $1,760. In relation to the same period in 2021, Ethereum traded in the price range between $1,722 and $2,551.

In July, Bitcoin traded in the price range between $18,967 and $24,573. In July 2021, miners made more from revenue while BTC traded between $29,361 and $42,236.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.