Mutant Ape Yacht Club (MAYC) was among the digital collectibles hit hard by the lack of investor interest for non-fungible tokens (NFTs) in July.

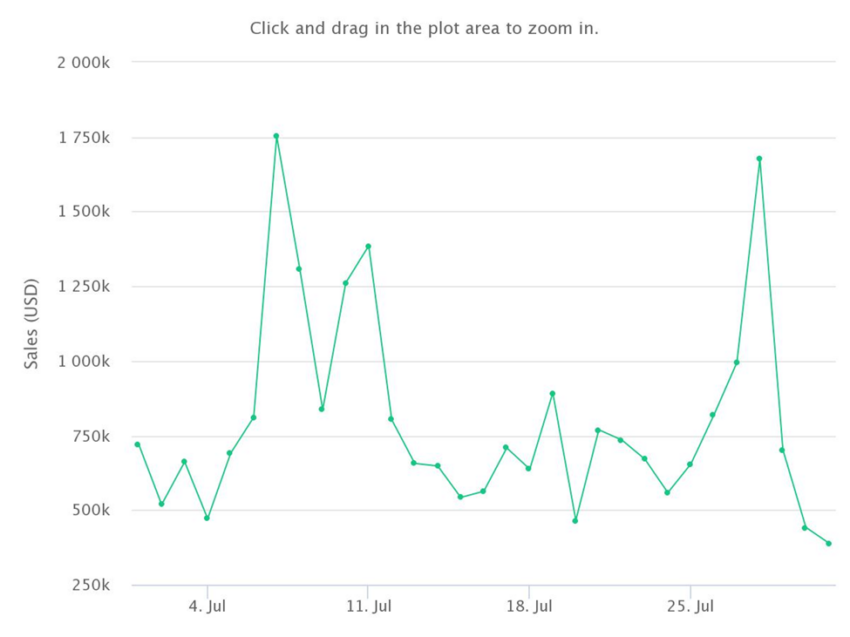

MAYC is the fourth highest selling NFT by all-time sales volume with approximately $1.7 billion. Mutant Ape Yacht Club had a sales volume of roughly $24.7 million during the seventh month of 2022, according to to Be[In]Crypto Research based on data from CryptoSlam.

Generating more than $20 million in sales during a bearish market looks impressive when compared to volume from Moonbirds, The Sandbox, VeeFriends, and Meebits.

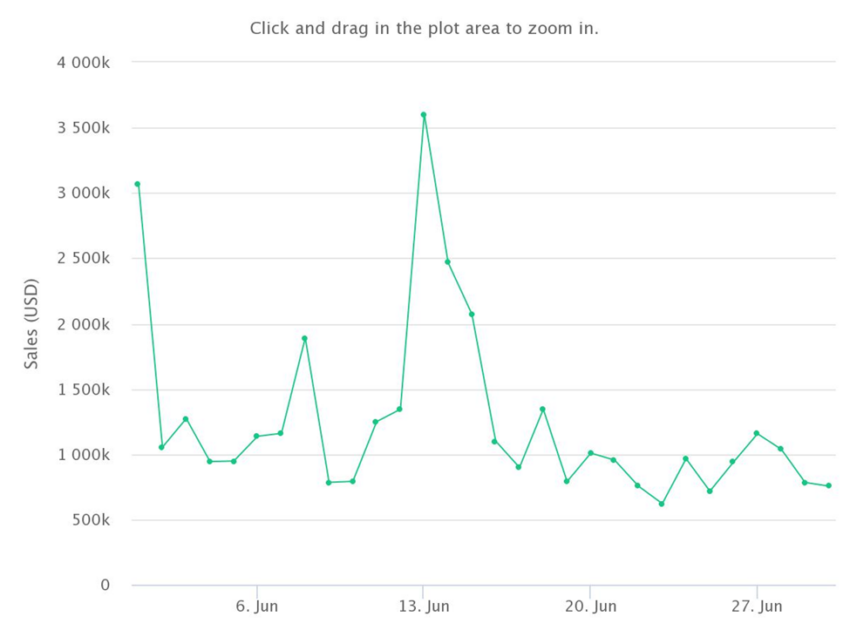

With that said, MAYC sales were far below its sister project the Bored Ape Yacht Club (BAYC) and Otherdeeds. However, July’s statistic was down by 34% from June. In June, sales stood at $37 million.

Why the drop in sales?

When you explore the number of unique buyers from July, the decline in sales volume led to a drop in the transaction counts of Mutant Apes, with 740 unique buyers, and 1,108 transactions.

In contrast to April of this year when MAYC reached a yearly high in monthly sales, there were 1,876 unique buyers and 2,812 total transactions. April sales of the digital collectibles were around $261 million.

By generating less than $30 million in sales for the first time, volume fell by $236 million. In addition to unique buyers and transactions, average sale value also took a massive hit. There was a 75% plunge in average sale value from $92,874 in April to $22,326 in July.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.