Ethereum continues to recover from bearish market trends due to a renewed interest in digital assets which has led to a significant rise in the market value.

Ethereum remains the second most popular and second-largest digital asset by market capitalization in Aug.

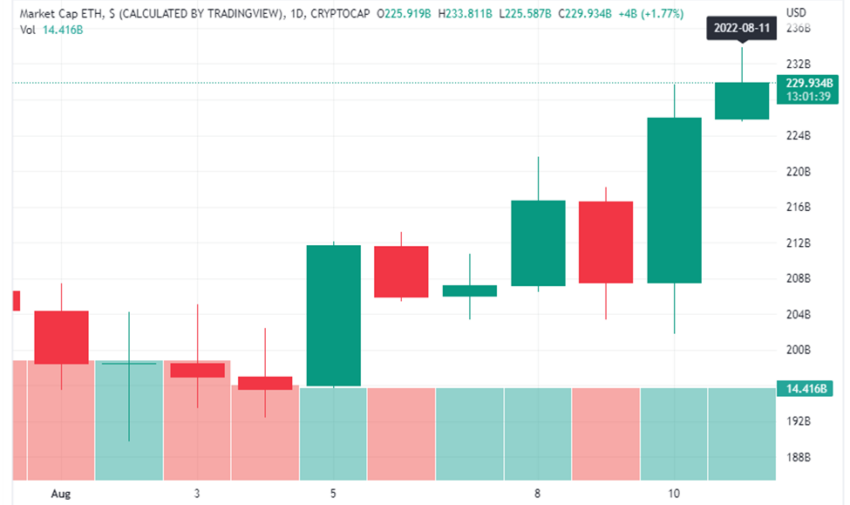

ETH had a market capitalization of approximately $229.92 billion on Thursday, based on data from TradingView.

This was a 10% increase from the closing market cap on Tuesday. On that day, ETH saw a trading volume of $16.37 billion, and this corresponded to a market capitalization in the region of $207.89 billion.

Why the rising market capitalization?

The success of the final testnet, called Goerli, which took place on Aug 10 and simulated a process almost identical to what the main network (mainnet) will experience in Sept during the Merge, has been credited for the spike in the market value of Ethereum.

With this out of the way, the crypto community is waiting for Ethereum to transition from a proof-of-work (PoW) to a proof-of-stake (PoS) network.

Ethereum price reaction

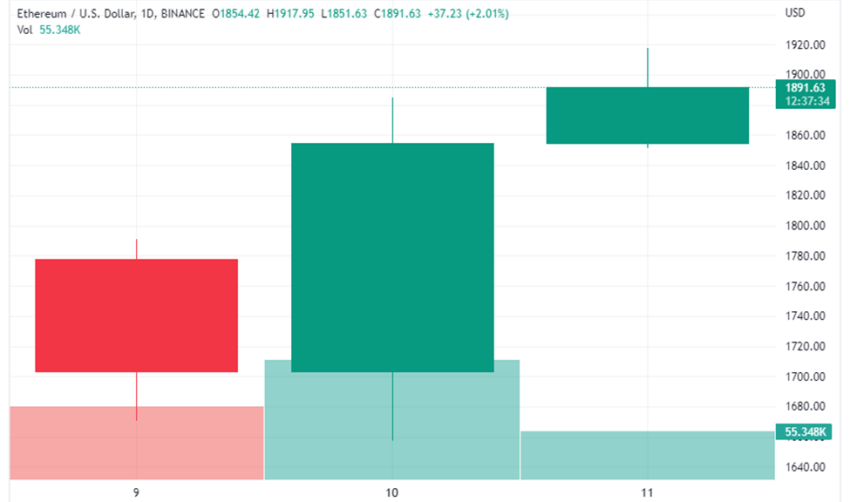

ETH opened on Tuesday with a trading price of $1,776.07, and reached an intraday high of $1,908.20 on Thursday.

At the time of writing, ETH had seen an 81% rise in trading volume in the past 24 hours and was exchanging hands for $1,889.28.

Overall, this equates to a 6% increase in ETH’s price in less than 48 hours.

The much-anticipated Merge may also result in increased institutional adoption, it is claimed. Bloomberg Intelligence says in a report that the transition could accelerate Ethereum’s ascent to an institutional level investment.

However, one DeFi researcher does not expect that Ethereum fees will come down after the Merge. He argues that fees are a function of blockspace demand and that the switch to proof-of-stake will not have an impact on this.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.