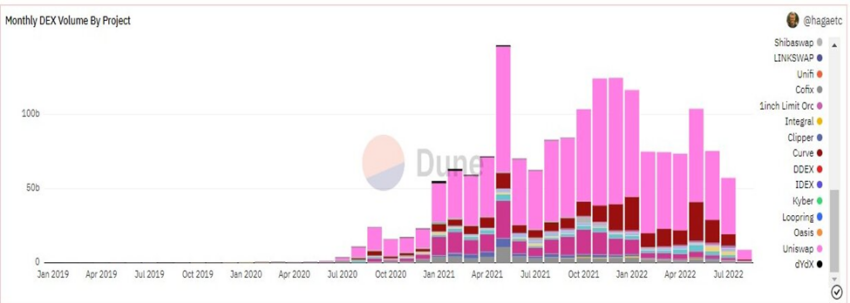

Uniswap saw a further decline in trading volume during the seventh month of the year due to decreased investor interest in digital assets.

Uniswap reached a new low in July as the month proved to be one of the worse periods in the trading history of the decentralized exchange (DEX).

The DEX recorded about $37.8 billion in volume during the first month of the third quarter of 2022, according to Be[In]Crypto Research.

While this value may seem high due to volume recorded by competing DEXs such as 1inch, SushiSwap, Curve, Balancer, dYdX, Loopring, Shibaswap, and Mooniswap, it was an 18% decrease from June. Uniswap volume for June was around $46.4 billion.

After reaching a new low ever since it recorded a volume of $32 billion in February 2021, Uniswap also saw a 4% drop year-over-year in trading volume from July of last year. In July 2021, Uniswap had a trading volume in the region of $39.8 billion.

Overall, July’s statistic was a $24.8 billion fall from the yearly high of $62.7 billion in May.

What caused the dip in Uniswap volume?

An overall bearish market that deepened in May which gained further ground in June, and extended to July has been attributed to as the cause for the drop in the trading volume of Uniswap, decentralized exchanges, and centralized exchanges (CEXs) as a whole.

UNI price reaction

UNI opened on July 1, with a trading price of $4.99, reached a monthly high of $9.74, tested a monthly low of $4.73, and closed the month at $8.37.

Overall, despite a decline in trading volume, the relatively lower prices of tokens saw a 67% increase between the opening and closing price of UNI in July.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.