Ethereum Classic saw more than a 100% increase in total value locked (TVL) due to the pouring of more liquidity into the project in anticipation of the Ethereum Merge.

Ethereum Classic (ETC) has been one of the best-performing cryptocurrencies in the last two months.

The blockchain increased by 158% in TVL in July. On July 1, TVL was $93,213 and rose to $241,388 on July 31, according to Be[In]Crypto Researched based on data from DeFiLlama.

New to Ethereum Classic?

Originally known as Ethereum, Ethereum Classic was launched in 2015.

It was conceived by Vitalik Buterin and the Ethereum Foundation.

It came about due to the decentralized autonomous organization (DAO) hack in 2016.

This led to a split in the blockchain with the current Ethereum being forked out of what is now known as Ethereum Classic.

As an open-source blockchain, it can be used for building distributed applications and smart contracts.

What contributed to the rise in TVL?

Ethereum Classic TVL spiked in July due to an increase in value locked in the decentralized applications (dApps) in its ecosystem.

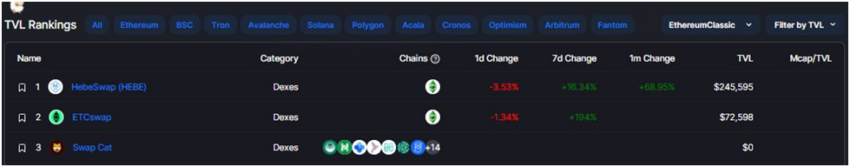

Decentralized exchange (DEX) HebeSwap (which has the most TVL in Ethereum Classic) ascended by more than 60% in the last month.

Another DEX, ETCswap, also played a significant role in the rise in TVL.

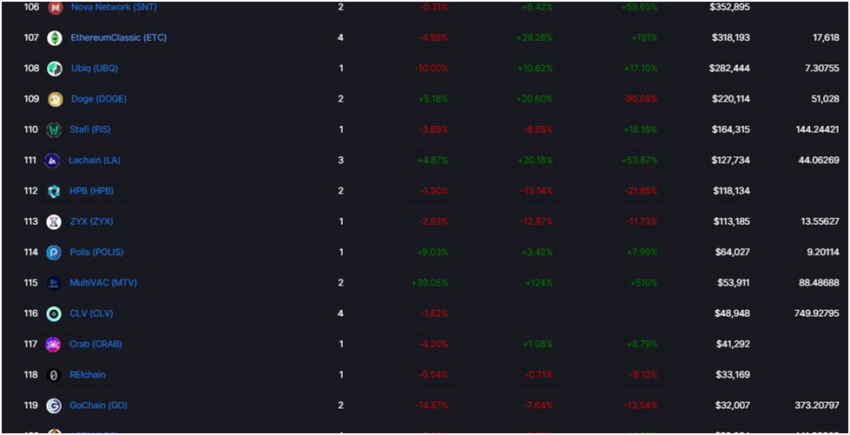

The latest metric has seen the chain rise above others such as Dogecoin, Lachain, Crab, Ubiq, and Polis.

ETC price reaction

ETC opened on July 1, with a trading price of $14.93, reached a monthly high of $44.97, tested a monthly low of $13.48, and closed the month at $36.45.

Overall, this represents a 144% increase between the opening and closing price of ETC in July.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.