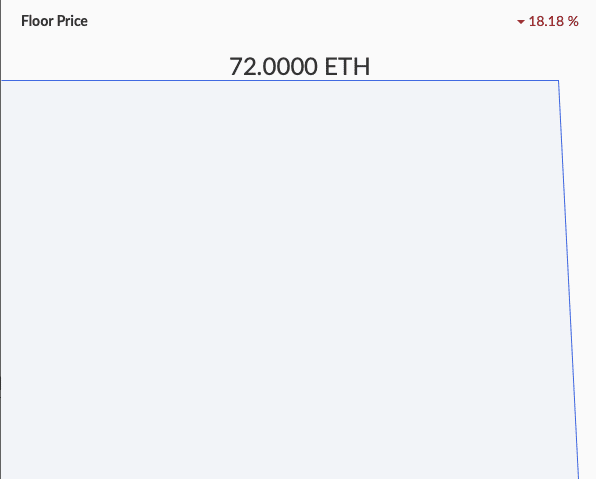

The downfall of the NFT market in recent weeks has been well-documented. Some market sceptics have even gone on to say we are currently in the midst of a “likely first NFT bear market”. One blockchain expert claims that NFT floors are likely to fall as a result of Bend DAO liquidation. He further says that the “NFT market is dry rn (right now)”. This is evident in the fall of BAYC’s floor price which has seen a drop by 18.18% over the past month as shown below.

However, LunarCrush reports on an uptrend in social metrics for global NFT activity in the past week. According to the update, NFT activity was on a downtrend in the past two months and only recently it has started to recover. The data claims that NFTs saw a total of 17.14 million social mentions in the past three months. NFTs also saw over 54.35 billion social engagements during that period from a total of 107,248 social contributors.

More underlying issues

A recent Galaxy study claims that the vast majority of NFTs convey zero intellectual property ownership of their content. Issues regarding intellectual property rights have come into light recently and major issuers, such as Yuga Labs continue to headline this issue. The report also finds that only one NFT collection among the top 25 by market cap attempts to “confer intellectual property rights” to the purchaser; World of Women.

“The central issue pertaining to NFT license agreements is the asymmetric control that the copyright holder has over the license. Copyright holders have the right to modify and revoke an NFT license from NFT holders at their sole discretion if they believe the license agreement has been breached, or for any other reason,” the report says.

While this issue is yet to affect users directly as of now, it can prove to be catastrophic later on. Hence, NFT issuers should update their license agreements with users to avoid legal tensions in the future.