Key Takeaways

- On-chain data helps analyze investor behavior and potentially identify market trends.

- While blockchain data brings a unique perspective on investor behavior, one should also consider technical and fundamental analysis to make well-informed trading and investing decisions.

- Phemex, one of the most popular cryptocurrency exchanges in the industry, offers a wealth of information about on-chain metrics to help you become a successful trader.

Share this article

On-chain analysis (also known as blockchain analysis) is an emerging field that obtains information about public blockchain activity.

Leveraging On-chain Data

For anyone unfamiliar with the technology, blockchains are public databases where information regarding network transactions (but not the identity of who transacts) is accessible by anyone.

While technical analysis focuses on the price and volume of an asset, on-chain analysis focuses on extracting data from the state of the blockchain, such as transaction activity patterns, the concentration of token ownership, social sentiment, or exchange flows.

This area of analysis emerged in 2011 with the creation called Coin Days Destroyed (CDD), a metric used to verify the age of tokens transferred on a given day to measure market participation. Since then, we’ve seen the creation of a much broader number of on-chain analysis tools (Glassnode alone has developed over 75 on-chain metrics).

The following section is a summary of the most useful and widely used on-chain indicators crypto investors can use to evaluate activity on the blockchain:

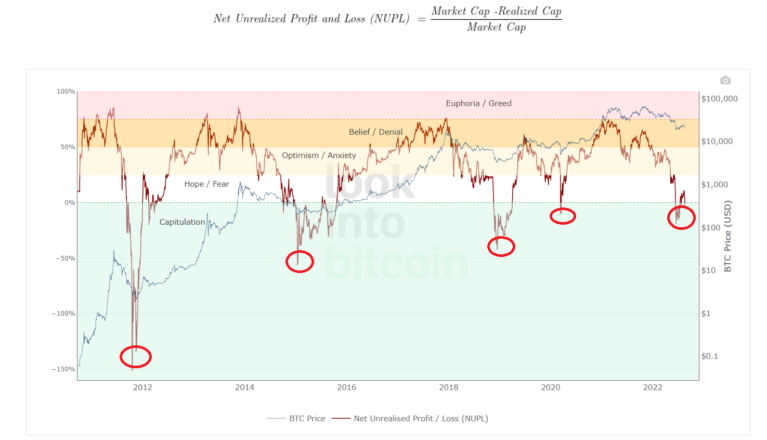

Net Unrealized Profit or Loss (NUPL): NUPL tells us if the market as a whole is holding an unrealized profit or loss. According to lookintobitcoin.com, Unrealized Profit/Loss is obtained by subtracting Realized Value from Market Value.

Market Value refers to the current price of a token multiplied by the number of tokens in circulation. The Realized Value is an average of the added value of each coin when it was last moved, multiplied by the total number of coins in circulation.

By dividing Unrealized Profit/Loss by Market Cap, we obtain the Net Unrealized Profit/Loss.

A NUPL greater than zero means investors on aggregate are currently in a state of profit. If it’s less than zero, the market as a whole is holding an unrealized loss.

Market Value to Realized Value (MVRV): this metric has helped predict Bitcoin tops and bottoms. It determines whether the current market cap is overvalued or undervalued. MVRV is calculated by dividing Market Value by Realized Value daily.

The higher the ratio, the more people will realize profits if they sell their tokens. And vice versa: the lower the ratio, the more people would take a loss by selling their coins.

Funding Rates and Open Interest: investors use both indicators to weigh the interest levels in the crypto market.

Funding Rates are regular payments that perpetual contracts (perps) traders have to pay to maintain an open position. Perpetuals are a type of Futures contract that doesn’t have an expiry date. These payments ensure that the perp price and spot price coincide regularly.

On the other hand, Open Interest (a volume-based metric) is the sum of all open futures contracts. However, Open Interest doesn’t tell us if the contracts are long or short. Open Interest is helpful as it shows how much capital flows into a market and can help predict market tops and bottoms when combined with price trends.

Spent Output Profit Ratio (SOPR): this is another tool that helps gauge market sentiment. The ratio indicates if investors are selling at a profit or loss at a given time. It is obtained by dividing the USD value when the UTXO (wallet balance) is created by the value when the UTXO is spent.

A ratio greater than one means that, for a specific timeframe, more people are selling coins at a profit. Conversely, a SOPR of less than one implies that more coins are being sold at a loss compared to their purchase price.

Exchange Flows: Exchange Flows track the movement of coins entering and leaving exchanges.

When exchange inflows are predominant, we assume traders sell their tokens to protect gains. Heavy inflows could indicate the beginning of a bear market or correction.

Exchange outflows may indicate that token buyers are sending their assets to self-custody wallets with the intention of holding, hence creating a shortage of tokens in exchanges and increasing their price.

Combining on-chain analysis and other technical and fundamental indicators can help investors make wise investment decisions. Phemex provides all this knowledge in one hub, allowing users to get the most out of their on-chain and trading skills, filter out the noise, and make profits by predicting the next market move.