Solana (SOL) bounced considerably on Dec 4, preventing a breakdown from the current bullish structure.

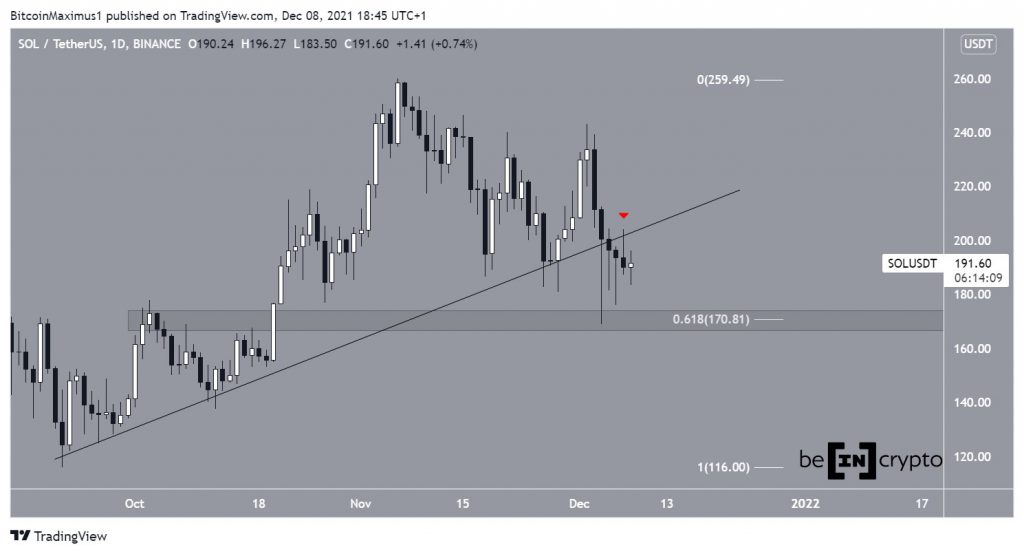

SOL has been falling since reaching an all-time high price of $259.9 on Nov 6. The decrease continued until a low of $169 was reached on Dec 4.

During the descent, SOL broke down from an ascending support line that had previously been in place since Sept 22. Therefore, the breakdown suggests that this portion of the upward movement is complete. Furthermore, the token validated the line as resistance on Dec 9.

However, after breaking down, SOL bounced at the $170 support on Dec 4. This is both a horizontal support area and the 0.618 Fib retracement support level when measuring the upward movement.

This is a very crucial support area that could initiate numerous short-term bounces. As long as SOL is trading above it, the price action can still be considered bullish, despite the breakdown from the support line.

Short-term descent

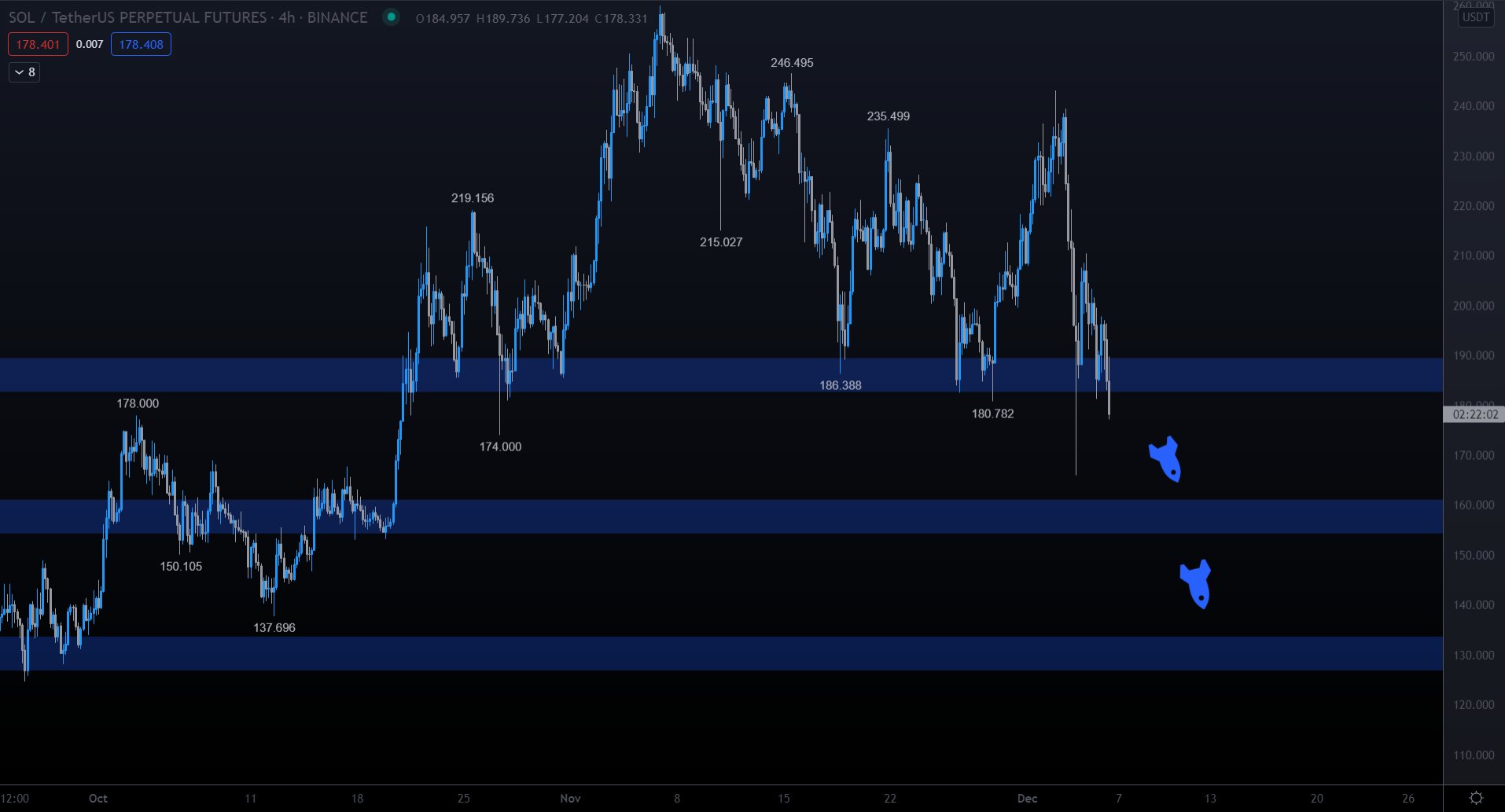

Cryptocurrency trader @TradingTank outlined a SOL chart, stating that the token could decrease to $150 and potentially $130.

However, the token has bounced slightly since the tweet. The bounce transpired at the $186 horizontal area, which has been in place since Oct 23. So far, it has caused six bounces (green icons).

Furthermore, SOL is trading inside a descending parallel channel, which is considered a corrective pattern. This means that an eventual breakout from it would be expected.

However, it is still trading in the lower portion of the channel. If it is able to reclaim the middle of the channel, it would greatly increase the chances of a breakout in the near future.

If a breakout occurs, SOL would likely increase towards a new all-time high and beyond.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.