This is an opinion editorial by Ulric Pattillo, contributor at Bitcoin Magazine and co-author of the Declaration of Monetary Independence.

Author Disclaimer: The following work is a combination of real world commentary and fan fiction, similar to your favorite sci-fi world. I do not intend to infringe or misappropriate any real world ideas or work. Any similarity to concepts or work in the fan fiction portion is purely coincidental. This is Part 2 of a series I call “Bitcoin: What-If?”. Marvel can’t own that, right?

What If … The State

The State as an institution has failed the individual. This is not to place the blame on one party nor “the current administration.” This issue is not rectified by “voting for the right people” or “educating our leaders.” Additionally, the services and agencies employed by elected and unelected officials cannot persist in a future with Bitcoin.

Analogous to the arguments in finance, hyperbitcoinization is not simply adding Bitcoin to the current fiat networks; rather it must be a completely alternate system with the sound money being the dominant unit of account in the world. Bitcoin as a completely trustless and voluntary monetary network conflicts in principle with a system that intermediates and coerces against the incentives of the individual participants in the world at large.

The State, contrarily, exists not by voluntarism or the will of the participants, but the act or threat of violence. Without this feature, The State has no way to generate revenue. The State does not create value, but takes it away in one of three ways: taxation, monetary expansion and confiscation.

Taxation, while portrayed as the upstanding duty of the citizen, is a nothing more than a veiled form of fractional slavery. If one were to be taxed 100%, you would own none of your work and would have no way to acquire property yourself, no different than a slave of times past. If a statist counters that taxes are the fee to live in the domain, then it is then true that there is no such thing as “public property.” If I am a part of the public, why am I paying someone else for what I already own a share in? If taxes are a fee, at what point have I paid that fee in full or may decline the services provided from said fee?

“Taxation is a proclamation of one’s slavery to the kings of this earth. It is a celebration of one’s ownership by a master other than God.” — Anonymous Bitcoiner

Monetary expansion is when someone exercises their unique right to decree more units of money to be created. As government power has grown to the point where it is now too big to exist, this strategy for sustaining must occur. While Keynesians will mock and dismiss this fear from their ivory tower of privilege, their ideal 3% inflation just means 3% of your buying power is stolen annually and given to the group of the thief’s choosing. Maybe it’s cronyism where those benefits are funneled to wealthy corporations. Maybe it’s a welfare state and reallocates wealth to people who are incentivized to refuse work. Maybe it’s a communist state, where the new money is divided amongst the coffers of inefficient government agencies. Whatever combination of those cases, the victims are the value creators in society. The laborer’s rightful fruits are stolen by manipulating their expected share of the value in the economy without their consent.

A third way of theft is direct confiscation. When the need arises, governments will use their monopoly on violence to lay claim to the rightful property of their citizens. It is hard for privileged Americans to imagine consequences of incarceration or death to resist such an encroachment of natural rights. Is the concept of property now a facade due to complacent citizens that sold all their freedoms to the government for the state-sponsored drug of security? It continuously happens around the world, yet news media conveniently do their best to minimize their criticality.

Netherlands farmers are besieged by their own government in a strategic attempt to seize farm land from the rightful property owners. “Nitrogen emission” guidelines designed by the World Economic Forum (WEF) are the rationale for these efforts that can be seen as a malicious attack on food supply where hunger could be used as a tool for control.

While you may see your bank account as unassailable, the Bank of China, the fourth largest bank in the world, declared their customers’ checking accounts to be “investment products,” disabling the ability to withdraw. The government, of course, supported this move with a show of armored force at branches that required protection as banks lay claim to value that is simply not theirs.

Before an American could read these stories and assume immunity, the 5th Amendment to the Constitution (aka the Bill of Rights) clearly states “[not] be deprived of life, liberty or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

The ambiguity of both clauses only needs the “right kind of wrong” political leaders to make the “you will own nothing” dystopia a reality in the U.S.A., a country with a growing dismissiveness of the criticality of individual liberties. Maybe America has avoided such abuses due to citizens’ right to personal armament, but there are obvious campaigns to counter that as well on a regular basis.

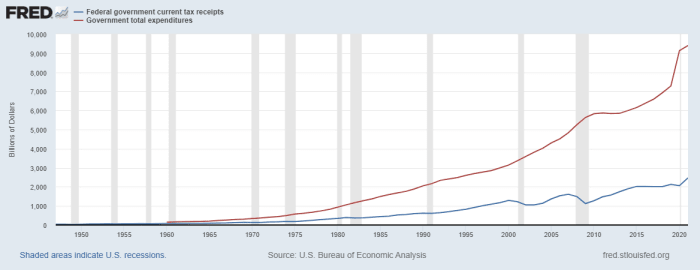

If expropriation was the only infringement on societal abundance, it would be enough to abolish. The failure of the taxation to actually fund the State’s existence causes rational minds to count the costs of the status quo. Would The State exist if it simply did not have a monopoly on violence? It is likely for more leadership turnover, but the root cause is still present: The current ruler will exercise all of their power to survive a hostile world. The monopoly over the power to define money causes an aberration like the financial death spiral shown below.

Is there any justification for the wasteful institution except “this is how it has always been?” In the present day, The State model of governance has bitten off more than it can chew. It has led to unnecessary economic losses, unfathomable theft and disconnection with value. Not until the discovery of Bitcoin, has such a clear light been shined on the criminal nature of The State.

It Is Sometime In The 2050s …

In this future, there is hope. In this future, humanity prospers. Fiat money has capitulated to Bitcoin, the decentralized monetary network, and has consumed nearly all value of the world’s fiat wealth. Through years of violent volatile trading with world governments being public buyers, bitcoin surged through bull and bear markets whose end was only marked by the 2033 Bitcoin International Treaty (B.I.T.) to dismantle central banks across the world for the sake of a new Bitcoin Monetary Standard; 100 years after Executive Order 6102 that forbade the individual ownership of gold by U.S. citizens for a period of time. Nearly all governments in North America, Europe, South America, South Asia, Middle East and Africa came to adopt Bitcoin-backed regional digital tokens (dollar, euro, peso, rupee, dinar, franc). These currencies had centralized oversight and insurance that was more palatable to a segment of the population. But because no one was forced to use it, the free market of value exchange thrived with bitcoin as the dominant unit.

Some countries in Oceania and Asia remain obstinate to a hard money supply like China and Australia. They did not participate in B.I.T. and outlawed owning any alternate currency or token, especially bitcoin. Instead they chose the path of surveilled and coercive CBDCs as they continued to slowly steal the wealth of their constituents. CBDC implementation was made easier upon outlawing emmigration decades before as citizens of some countries became essentially prisoners. People in those regions essentially became pawns of a machine and lost nearly all evidence of individualism.

Because the Bitcoin world virtually ceased currency inflation, the exchange rate of 1 BTC steadied at about $25 million. Human innovation and advancement gradually increased the purchasing power of all people in the free world as technology drove asset deflation. Just a couple decades after the age of central banks came to a close, governments also began divesting into other areas of society in which they dominated. The world quickly discovered the limitations of government reach when sound money is the root of all human action.

Post Office Privatized By Hard Money

Since the turn of the century, the USPS only saw three profitable years (2003-2006). After decades of bleeding value, even years after incorporating bitcoin as the international standard, it was clear that the system just did not work. The Constitution reads “to establish post offices and post roads” in Article 1, Section 8, Clause 7. Historically, it had been interpreted to additionally “carry, deliver and regulate the mail.” In 2051, the Supreme Court declared the statement to be “of necessity for the establishment of an infant nation, not intended to be in perpetuity,” as it had degraded to a liability to the nation rather than a benefit. Just as the postal roads became obsolete due to infrastructure advancement, so the decision was made to divest the post offices to the free market in auctions to national, regional and even local enterprises desiring to find profitability in postal services. Local private postal services popularized P.O. boxes as they provided increased privacy and security services to theft and minimized exposure to the larger harvesting of personal information.

The postmaster general, rather than being completely abolished, is still able to maintain a small agency that can do no more than preserve and protect the integrity of the free market postal industry. The federal government no longer has the funds or means to maintain unprofitable control over the industry. The invasive and costly “legal monopoly” of the USPS is no more.

Welfare Made Obsolete By Hard Money

Ever since welfare spending doubled year over year in 2020, there was a steady annual increase. With all the government intervention in the 2020s, it became clear the poverty problem was not going to be solved by The State. The existence of an option to burden others with one’s livelihood became an increasingly favorable choice to the population. Shortly after the B.I.T. of 2033, the trust in money returned. WIth that trust came a desire to acquire it. Many socialist and communists that advocated for UBI and welfare were fearful that bitcoin would cause a deflationary depression. To the contrary, workers were found to be more industrious and there were a record number of job applications across many industries. Businesses were operating at efficiencies they never had before because of the influx of willing workers. This effect alongside the deflationary money caused prices for goods to drop steadily. By 2043 the welfare state, at least for those that adopted a Bitcoin standard, became virtually a thing of the past. The money was finally worth the effort. Private organizations funded on voluntary donations assisted risk groups like orphans and widows to find homes and employment, respectively. These organizations were more efficient and effective than government welfare because the goal was to minimize time in the program rather than enable perpetual benefit takers.

Police Defunded By Hard Money

Almost 35 years after the salacious political movement to defund the police, it has made a resurgence in the 2050s; but, probably not in the way expected. States and major metro areas were institutions that became too large to operate efficiently. Police were slow to react, gave preferential treatment to secure affluent areas and sacrificed lower income areas to crime and decay. The citizens receiving this service in certain neighborhoods did not feel the police properly defended their interests because their police did not reflect their values nor were incentivized to do so. They were paid by the government, therefore their incentives reflected that government. With the growth of Bitcoin came the reduction of the belief in debt-based IOUs. Police departments were unable to operate as they were in the fiat past.

However, what self-custody taught humanity was the importance of self-defense. This led to the arming of private individuals more than ever before. Additionally, they formed coalitions in towns and neighborhoods to help protect each other. These security coalitions reacted to crime more swiftly than any government police department because of the incentive to preserve their small domains. For some communities, it behooved them to adopt the services of a growing number of private security companies that were growing in a time of weakening state-owned police forces. These groups did not feel at odds with the communities they served because they were directly employed by the communities rather than The State. Any sort of critical misalignment of vision, and either the security party or customer would not seek renewal at the end of the contract period. Some security firms even taught arms training to their customers. Rather than fear for their relevance, this practice reduced crime against weak targets while establishing companies as trusted members of communities thus elongating the business relationship. Never since colonial times in history was “a well-regulated militia” so commonly practiced.

Politicians Disincentivized By Hard Money

As much incentive as there was to acquire hard, unconfiscatable money, so too was there a reduced valuation in lawmaking positions in government. This is not to say congressmen or senators no longer existed, but the laws that they could impact did not have the same gravity as they did under the fiat standard. There was no government funding of one industry over another, for The State only had enough money to maintain a much simpler existence. There was little to no cost-benefit for corporations to buy politicians’ loyalty because every business and person was already paying much lower taxes compared to the fiat past. That bribe money was better put to research and development or marketing.

Elected presidents found a similar fate to that of royalty after the democracy revolution of the early 20th century. As monarchs are figureheads based on a bloodline, presidents and prime ministers became elected figureheads primarily for diplomatic and ambassadorial engagement. A presidential executive order can only go so far as the budget to enforce it. The most celebrated presidents of this age were the ones that protected the property rights of the people and helped generate ideas to get more industries to operate without a hand from large corporations and The State.

Politicians began to come from all walks of life. They would take a brief break from their industry to help actors in their domain as an impartial entity seeking to provide guidance to entire domains and industries. This was a far cry from the past where careers were made in using the law as a weapon for personal gain. The discipline of “public policy” became ostracized as a tool for grifting and manipulation — this became a relic of the fiat standard. The state could no longer take irrational latitude to operate beyond their capacity because the best money in the world was auditable on the blockchain. Because of this, the life of a politician for the first time in modern history became truly a “civil servant.”

But … We Need The State

It is a crystal clear future, if Bitcoin is a part of it, that governments shrink significantly in a variety of ways. For that to happen, we also as people must change. In the past, humanity often chose its own fate with the inherent desire to have a deity-king within arms reach.

Around 1030 B.C., the Hebrews desired to choose a king like their pagan neighbors apart from the “God who took them out of Egypt.” The Old Testament is full of stories about weak and twisted kings of Israel and how they could never measure up to what the people had in their faith in God:

“5 And said to him, ‘Behold, you are old and your sons do not walk in your ways. Now appoint for us a king to judge us like all the nations.’ 6 But the thing displeased Samuel when they said, ‘Give us a king to judge us.’ And Samuel prayed to the LORD. 7 And the LORD said to Samuel, ‘Obey the voice of the people in all that they say to you, for they have not rejected you, but they have rejected me from being king over them.’” (1 Samuel 8:5-7, ESV)

Colonel Lewis Nicola suggested George Washington take on kingship of the colonies after years of revolution bloodshed from separating from the king they already had in London. Washington vehemently refused:

“… If all other things were once adjusted I believe strong argument might be produced for admitting the title of king, Which I conceive would be attended with some material advantages.”

The human desire for the existence of a strong state or sovereign entity, whether to operate or to be subject, may have some part to do with the urge to make others behave or think as you would have them.

This is antithetical to Bitcoin, also known as “the money for your enemies.” Freedom advocates lose their legitimacy without Bitcoin as that centerpiece by leaning on a centralized monetary network. These false witnesses imply we must trust a third party to preserve that freedom. Bitcoin is trustless, so why rely on someone else to allow you to make an economic decision when that may contradict their own incentives? This is a real problem all over the world, and if human nature is true, without Bitcoin, it will come to America too.

This trustless dynamic is infinitely more important than funding an institution that does not create value. Who will maintain roads? Adopt-A-Highway is literally a small-scale version of a voluntarism-world of the future. Only a veiled sense of government relevancy stands in the way of privatized roads. Payment for usage of roads are already using transponders in the fiat world. Seems like a no brainer for the Lightning Network. What about the fire department? Voluntary firefighters are and will always be a thing. 722,800 (67% of total, USA) firefighters were volunteer firefighters in 2019. They could be paid for their commitment by communities as easily as the police described in the Bitcoin future above. What about the millions of government workers? In a true free market, if a task is necessary, it will be filled. Perhaps that will expose millions of unnecessary jobs (details below) and relocate them where the free market actually dictates. In a Bitcoin world, we do not have jobs for the sake of having jobs like the communist MMT lie that so many economic elite champion and the unlearned buy into.

Death And Taxes

“Only two things are certain in life: death and taxes.” Bitcoin fixes this. An institution with a monopoly on violence and money creation can levy taxation and monetary debasement on the people. The only options are acceptance or rejection. To reject is to refuse to use or marginally participate in the fiat economy. This was not a realistic possibility until Bitcoin came about, acting as the first significant external economic force since gold’s legitimacy was abolished in 1971.

The state institutions around the world must now count the costs of digital and decentralized hard money adoption or maintain the status quo of limitless currency. Some would say, “bitcoin benefits everyone.” To those I would ask, “Does it benefit the giant when Jack stole away his gold egg laying fowl?” Governments have a remarkable technology that essentially is a goose that lays golden eggs, but the eggs are also stuck on an inescapable track whose speed can be shifted, entirely shut off or even block participants. Who in their right mind would give up that power? Fiat can be weaponized, manipulated and bent to the will of its issuer. For any ruler, Bitcoin is a clear loss in net power. To adopt a hard money with no intrinsic controls means a nation intends to act in its best interests mathematically. Their actions must elicit a net positive value.

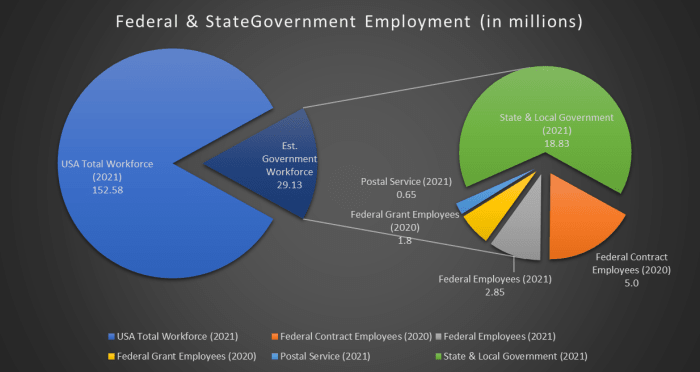

What is given up in authority is made up in efficiency and stability. For The State, one of the most glaring signals of its inefficiency is the obscene size of the bureaucracy. Nearly 20% of all Americans in the 2020-21 were employed by the government and funded via monetary expansion and did not participate in free market competition. These agencies cannot hope to maintain employment numbers if the government cannot create money to pay them.

Bitcoin, as the next evolution of cash, creates a burden of identifying pseudonymous commerce on a shrinking government. Under a hard money standard, it would be very hard to convince another 87,000 agents to work for IOUs from the IRS. Compounding that shrinking reach with pinpointing tax responsibility within a complex, pseudonymous Bitcoin network, causes theft via taxation to be multiple times more difficult. Hyperbitcoinization suffocates The State, disabling the parasitic action of stealing from value-creating transactions. Bitcoin is more akin to cash than checking or credit, so the ability to audit the network for such obligations would be a bigger cost-burden than the potential returns. Any revenue in taxes to the cumbersome state would turn into a voluntary donation. Donations cannot keep a bad actor alive. The State cannot forcibly take bitcoin. Every time a state actor would attempt to freeze or confiscate from third-party custodians, they would drive thousands of more people to self-custody. Every bitcoin spent by The State puts money back in the hands of value creators who will remember when The State tried to attack their ability to trade.

There Is No Second ₿est

Bitcoin is designed to take the place of not only the fiat monetary unit, but the institutions that drive it. The dollar as we know it battles for the same place on the food chain as Bitcoin. If Bitcoin were to succeed as a monetary network for the people, this would disable the dollar and other fiats from all the things we have accepted as normal: illicit sanctions on commoners, monetary debasement and bordered payments.

“There is no second best.” Every other option gives away your ability to exist if you disagree with the owners of your domain. Do not fall for the facade of public property or voting rights. The powers in this world have not acquired such status by giving normies options. Bitcoin denies elites the ability to co-opt its network. The only option is to participate honestly or destroy the internet entirely. Bitcoin is literally essential for true freedom going forward. To opt out of Bitcoin is to opt into a slave economy. Which is it going to be for you?

This is a guest post by Ulric Pattillo. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.