Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

Bitcoin [BTC] saw nasty volatility the previous day and oscillated $1k within an hour from $18.6k to $19.7k. At the time of writing, the price of Bitcoin stood at $18.7k but the sentiment was quite fearful in the markets.

ApeCoin [APE] had a bullish bias, however, despite liquidating $3.6 million worth of positions within the past 24 hours. It has not yet ceded the support zone at $5.6 to the bears. Can the buyers continue to hold on, and even force some gains in the next day or two?

APE- 1-Hour Chart

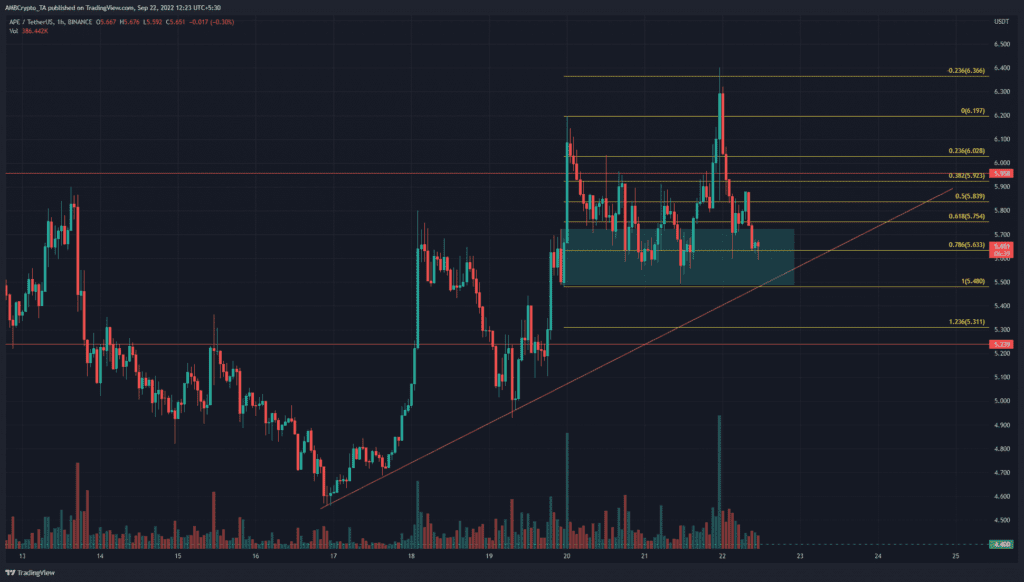

The hourly chart showed the $5.63 level to be a crucial support level. On the four-hour chart, these lows formed over the past two days are the higher lows of the bullish structure. Hence, for the bullish bias to remain, the price must stay above the $5.48-$5.63 area. A drop below would flip the bias to bearish.

The Fibonacci retracement levels (yellow) drawn a few days ago were handy in plotting the 23.6% extension level for APE. The volatility of the past few days saw a move to $6.36 which was quickly sold off.

The ascending trendline support (light red) has confluence with the support zone at $5.6, and a bounce toward $6 could materialize once more.

Rationale

The indicators did not show much bullish ambitions. The Relative Strength Index (RSI) sank below neutral 50 and retested it as resistance to highlight growing downward momentum. The Accumulation/Distribution (A/D) line has crept higher since 19 August and APE bulls’ efforts were evident. Yet, it was unable to beat a local resistance level and was rebuffed yet again.

The Chaikin Money Flow (CMF) indicator was above +0.05 to show significant capital flow into the market over the previous day of trading. The overall picture, according to the indicators, did not really support another leg upward.

Conclusion

The $5.6 zone, if tested once more, could offer a buying opportunity. Given that these are also the higher lows from a higher timeframe bullish structure, it was logical to expect some support in this area. Invalidation would be a drop below $5.48, a mere 2% away from $5.6.

Therefore, despite the bearish stance of Bitcoin, a relatively low risk long position on ApeCoin could be considered, targeting $6.1 and $6.36.