With the global crypto market capitalization still below the $1 trillion mark, the once glimmering decentralized finance (DeFi) total value locked (TVL) has also witnessed a considerable pullback.

Nonetheless, top DeFi tokens like Uniswap (UNI), Aave (AAVE), and Maker (MKR) continued charting gains on a daily chart amid renewed bullish momentum.

With social dominance for BTC on the rise, after the Monday gains, the larger crypto market including top DeFi assets saw a surge in price.

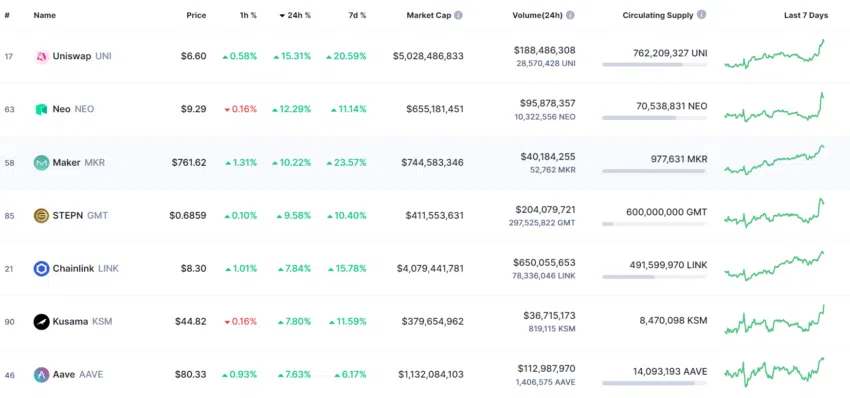

A look at CoinMarketCap’s top gainers in the last 24 hours showed that UNI led market gains with over 15% daily gains at press time.

Apart from UNI, MKR, and AAVE too presented high daily gains of 11% and 7.63% at press time.

DeFi TVL still stuck in the lower range

Despite top DeFi tokens gaining price momentum, there wasn’t a significant change in the TVL in decentralized finance markets. In fact, DeFi TVL lost over 70% value in 2022 from Jan. to Sept.

At press time the TVL stood at $56.15 billion, an over 70% loss from the Dec. 2021 value of $303.8 billion.

According to data published by crypto market data aggregation and analytics platform CryptoRank on Monday, the TVL in DeFi fell by a whopping 40% in the last 30 days – dropping from $106 billion where it stood a month ago, to the current $56 billion.

That said, Maker DAO dominance stood at 13.23%, while the dominance of Ethereum in the DeFi space continued to grow as it accounted for 59% of the entire DeFi TVL.

UNI, MKR, and AAVE gaining ground

Despite the market blues DeFi tokens often manage to make gains when the sentiment turns positive. At press time too, UNI topped the gainers’ chart on CMC returning 17% daily and 21.32% weekly gains.

The recent price reversal soared UNI’s price above the key resistance level at the $6 mark. The token will see a higher price rejection candle at the $6.6 resistance where over 47 million UNI is held by 15.9K addresses.

The Global In and Out of Money indicator presented that after the $6.6 resistance the next key supply barrier would be at the $9.6 mark where over 60 million UNI tokens are held by over 30K addresses.

AAVE, on the other hand gained 7.63% on the daily chart as its 24-hour trade volumes jumped by 17% standing at $115 million.

For AAVE, once the token reverses its mid-Sept. losses the next key resistance would be at the $94 mark.

Lastly, MKR saw a massive spike of over 11% in the last 24 hours making a parabolic recovery from the Sept. losses. Notably Global In and Out of Money for MKR presented a strong resistance at the supply barrier of $942 where over 430,000 MKR tokens are held by around 8,200 addresses.

Furthermore, a steady rise of 26% in the seven-day new address change highlighted a more vibrant ecosystem for the DeFi token as new entities continued to flock to MKR.

A sustained retail euphoria alongside the larger market’s bullishness could aid DeFi token price growth in the near term as UNI, MKR and AAVE continue to chart gains.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.