Key Takeaways

- Ethereum has faced criticism over its centralization since its Merge to Proof-of-Stake.

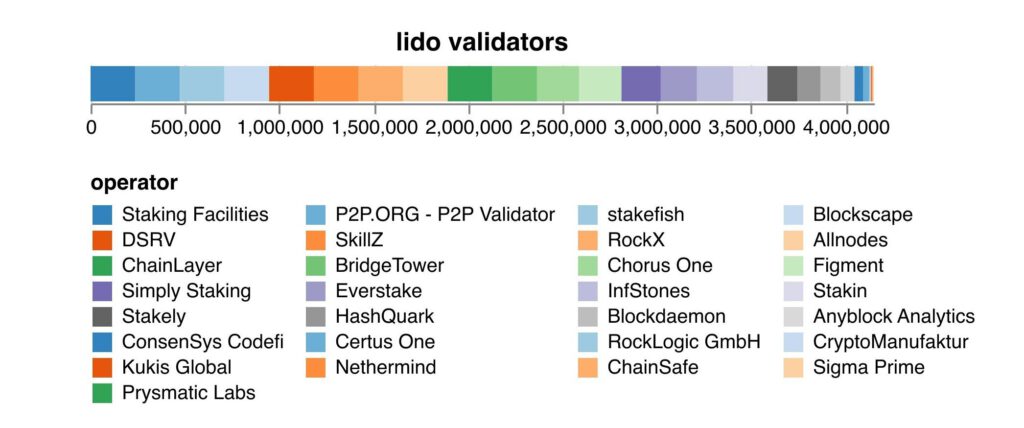

- Critics argue that a small number of validators like Coinbase and Lido control a big chunk of the network, but that argument misses out an important point about Lido’s individual staking entities.

- It’s worth noting that two Bitcoin mining pools account for over 40% of the network’s hashrate.

Share this article

Ethereum’s detractors often say that the network is too centralized. But looking beneath the surface presents a different view.

Ethereum Critics Decry Proof-of-Stake

Today I’m going to cover some of the recent fear, uncertainty, and doubt directed at Ethereum since its Merge to Proof-of-Stake. If you follow any of the top crypto pundits, you’ll likely have seen claims that the switch to Proof-of-Stake has hurt decentralization and open the network to an increased possibility of transaction censorship. Let’s take a look at these claims and see how well they hold up under scrutiny.

One common argument I’ve seen is that just two entities control a substantial chunk of Ethereum’s validators. While it’s true that Coinbase and Lido manage 42% of all validators, that statistic alone doesn’t tell the whole story. In actuality, Lido is merely the “frontend” for 29 different staking entities.

These individual validators maintain control over the ETH staked through them, which means they can act independently of Lido and would all need to collude to censor transactions. In reality, Coinbase is the largest validating entity with control of about 14.5% of all validators.

In crypto, centralization is relative, so one way to judge Ethereum’s decentralization could be to compare it to the supposed “gold standard” of decentralized blockchains—Bitcoin. This might be a hard pill to swallow for any Bitcoin maximalists out there, but now Ethereum uses Proof-of-Stake, there’s a pretty strong argument to say it’s actually more decentralized than Bitcoin.

Bitcoin’s Network Hashrate

As mentioned above, the largest single entity validating Ethereum is Coinbase at 14.5%. Bitcoin, on the other hand, has a mining pool that accounts for about 24.61% of the total network hashrate: Foundry USA. The next biggest mining pool isn’t far behind, putting 43.63% of the Bitcoin network in control of just two entities. As Week in Ethereum News founder Evan Van Ness recently pointed out on Twitter, in a sample of 1,000 Bitcoin blocks, 430 were mined by the top two pools. On Ethereum, 410 out of 1,000 were validated by either Coinbase or a Lido validator.

Of course, there is one substantial caveat to this argument. While Bitcoin miners can easily divert their hashpower to other pools, ETH stakers currently cannot. This is important because if Coinbase, Lido, and a few other Ethereum validators decided to collude and attack the network, those who delegated their ETH to them would not be able to withdraw their stakes to stop the attack. While this is currently an issue, it isn’t a permanent one—if everything goes as planned, ETH stakers should be able to withdraw their funds after the next network upgrade planned for early 2023.

Another important (and often overlooked) point is that anyone with a stable Internet connection and 32 ETH can run their own validator from home. This is not an option for everyone, but it is much easier than mining Bitcoin or running validators for other Proof-of-Stake networks such as Solana or Avalanche.

I think there’s a strong case that Ethereum’s switch to Proof-of-Stake has actually secured its position as the most decentralized blockchain network in the world—and it should only become more decentralized as time goes on.

Disclosure: At the time of writing this newsletter, the author owned ETH, BTC, and several other cryptocurrencies. The information contained in this newsletter is for educational purposes only and should not be considered investment advice.