Published 10 mins ago

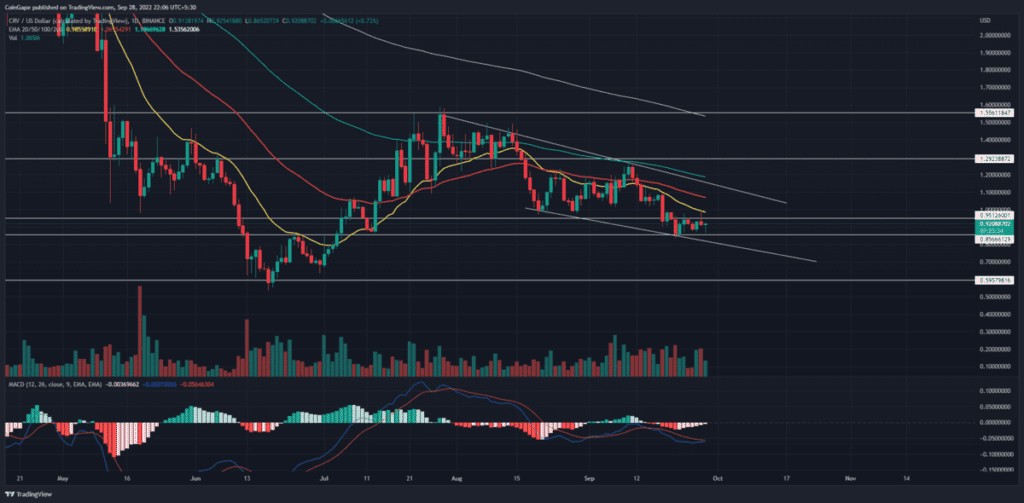

Concerning the ongoing downfall in the crypto market, the Curve Dao price has shaped itself in a falling wedge pattern. The altcoin has resonated within wedge for the past two months and has retested both the upper and lower trendline thrice. The market participants are responding to this pattern, and its breakout should offer a good entry opportunity.

advertisement

Key points From Curve Dao Analysis

- Curve Dao price will continue its downward spiral until it wobbles inside the wedge pattern.

- The coin price is wavering in a no-trading zone.

- The intraday trading volume in the CRV token is $65.6 Million, indicating a 33% loss.

Source- Tradingview

In theory, even though the falling wedge pattern displays itself as a sharp downtrend, the true nature of its setup is to resume prior recovery. Thus, a bullish breakout from the pattern’s resistance trendline will indicate a switch in market sentiment from selling on rallies to buying on dips.

Trending Stories

Following the last bear cycle within the wedge pattern, the Curve Dao price plunged to the combined support of $0.85 and a lower trendline. Furthermore, the buyers tried to rebound from this support, but the recent selloff in the crypto market due to an interest rate hike triggered a minor consolidation.

For nearly two weeks, the Curve dai coin price wavered between the $0.85 and $0.95 barriers. A bullish breakout from $1 resistance should trigger a new bull cycle within this pattern. Thus, in response to this bullish continuation, the altcoin should eventually breach the resistance trendline.

The post-breakout rally should drive the prices 56% higher to hit the last swing high resistance of $1.

However, until the wedge pattern is intact, the downward spiral will continue to pull prices down to $0.85 bottom support.

Technical analysis

Bollinger band indicator: the coin price wobbling below the midline indicates the price action is currently in the seller’s hand.

advertisement

MACD indicator: the narrow spread between the bearishly aligned fast and slow lines indicate a weak selling momentum. Moreover, these slopes nearing a bullish crossover should bolster the bull cycle theory.

- Resistance levels- $1 and $1.24

- Support levels- $0.85 and $0.65

Share this article on:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.