Following the Bank of England explaining that it would be meddling in U.K. bond markets and the Bank of Japan defending the yen in the foreign exchange market last week, the Hong Kong Monetary Authority (HKMA) revealed it intervened in forex markets on Wednesday. Hong Kong’s central bank detailed that it interfered in forex markets in order to defend the Hong Kong dollar (HKD) as it showed signs of weakness against the greenback on September 28.

HKMA Interferes in Forex Markets to Defend the HKD From Capital Flight to USD Assets

While the euro and pound sterling lost 12-17% against the U.S. dollar during the last six months, there’s been a significant amount of capital flight to the greenback. The Hong Kong dollar (HKD), however, has fared better than a myriad of fiat currencies worldwide against the U.S. dollar.

On Wednesday, September 28, reports detail that a “flight of capital from the Hong Kong dollar market” pushed the HKMA to step in and defend the HKD in forex markets. South China Morning Post (SCMP) reporter Enoch Yiu explained on Wednesday that the HKMA said it intervened in order to “support the peg after the local currency hit the weaker end of its HK$7.75 to HK$7.85 trading band.”

SCMP details that it’s the first time in seven weeks the central bank defended the HKD in this fashion and the HKMA has chosen to intervene in the foreign exchange market 32 times this year. Year-to-date, the HKD/USD exchange rate is down 0.83% and the de facto central bank has purchased HK$215 billion this year.

The authority sold roughly $27.39 billion USD in 2022 and recent reports detail that the central bank has purchased local dollars “at a record pace to defend the city’s currency peg.” Furthermore, as Hong Kong and Japan recently tampered in the forex arena, India, Chile, South Korea, and Ghana have also defended their currencies in foreign exchange markets.

Hong Kong’s move to defend the local dollar follows the HKMA, Indonesia, and the Philippines raising benchmark bank rates following the United States Fed’s recent rate hike on September 22. At the time, the HKMA hiked the rate by 75 basis points (bps) bringing the lending rate to 3.5%.

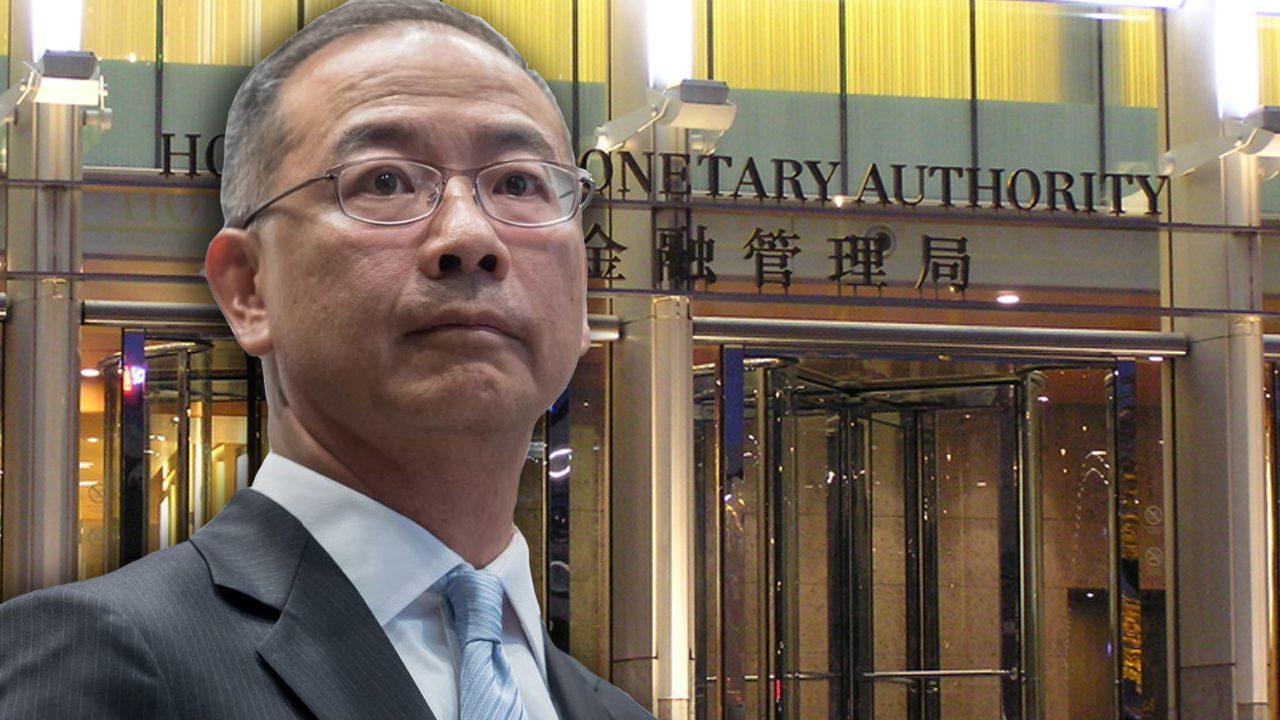

The third and current chief executive of the HKMA, Eddie Yue, detailed that he did not see a major risk to the territory’s housing market. “The latest rate on bad debt is about 1% and may adjust upward a little bit. But it is still low as compared to some international levels,” Yue remarked last week.

What do you think about the HKMA stepping in to intervene in forex markets in order to defend the HKD? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer