Data shows Bitcoin miners have eased up their dumping over the past month, now selling only at a 50% rate compared to in early September.

Bitcoin Miner Net Position Change Now Has A Value Of 4.4k BTC Per Month

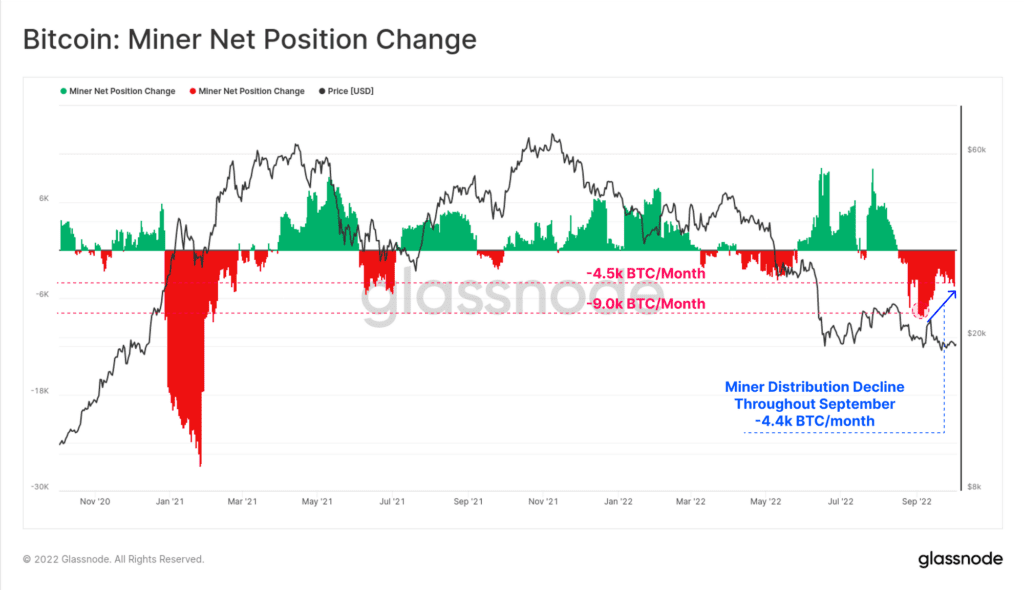

As per the latest weekly report from Glassnode, the BTC miners were selling at a rate of 9k BTC per month at the start of last month.

The relevant indicator here is the “miner net position change,” which measures the total net amount of Bitcoin being withdrawn or deposited by the miners over the last 30 days into or out of their wallets.

When the value of this metric is positive, it means miners have been transferring coins out of their reserve during the last month. Such a trend, when prolonged, can be a sign of accumulation from their chain validators, and hence can be bullish for the price of the crypto.

On the other hand, the indicator having a negative value implies this cohort’s wallets have lost a net number of coins recently. Since miners usually withdraw their BTC for selling purposes, this kind of trend can be bearish for the price.

Now, here is a chart that shows the trend in the Bitcoin miner net position change over the past couple of years:

The value of the metric seems to have been red in recent days | Source: Glassnode's The Week Onchain - Week 40, 2022

As you can see in the above graph, the Bitcoin miner net position change has had a deeply negative value for quite a while now. This suggests the cohort has been in a dumping phase during recent weeks.

In early September, the indicator hit a peak as miners were distributing their coins at a rate of 9k BTC per month. Since then, however, miners have slowed down, now moving only 4.4k BTC out of their wallets.

This is still a significant amount of selling pressure, but is nonetheless 50% less than what was there during the start of last month.

Due to the bear market, miner revenues have come under severe pressure, leading to them having little choice but to dump their reserves. But this recent trend of decline in their distribution can hint that their situation has started to ease up a bit.

BTC Price

At the time of writing, Bitcoin’s price floats around $20.1k, down 1% in the last week. Over the past month, the crypto has gained 1% in value.

Looks like the value of the crypto has surged up over the last day | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com