Ethereum [ETH] has been on the receiving end of a lot of sell pressure, especially post the Merge. However, even after Ethereum’s decline in prices, validator interest and revenue had a different picture to convey.

____________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Ethereum for 2022-2023.

____________________________________________________________________________________________

It should be noted that garnering interest from validators could help Ethereum reach its potential.

Validation from validators

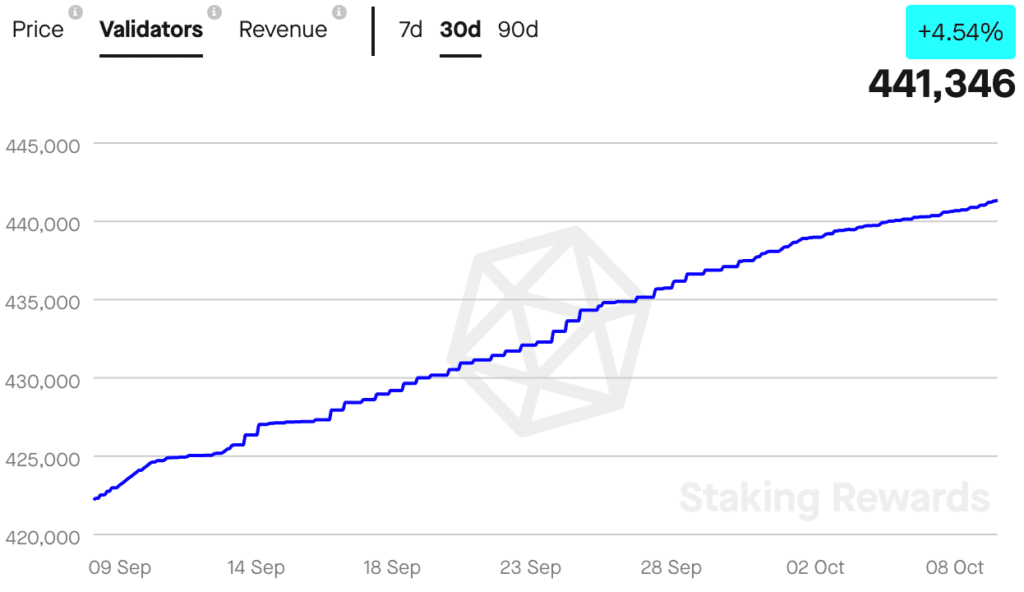

As can be seen from the image below, the number of validators on the Ethereum PoS network witnessed an uptick over the past 30 days.

Despite Ethereum’s declining prices, validators stayed put through the turbulent time and proceeded to have faith in the Ethereum network as their number continued to grow.

Furthermore, despite the altcoin’’s price in a constant decline, staker revenue for Ethereum was observed to go up over the past few days. The total revenue amounted to $824 million as of 8 October.

If the miner revenue keeps increasing over time, validators would be more incentivized to hold their staked ETH instead of selling it. This could prove to be a positive catalyst for Ethereum in the long run.

But it’s not just stakers that showed interest in Ethereum. Some other factors too were responsible for the growth observed in Ethereum.

According to Glassnode, a crypto analytics firm, Ethereum observed an all-time high in addresses holding more than one ETH. As of 8 October, the number of addresses holding more than one ETH was 1.5 million. This was the highest it had ever been.

This development could be attributed to not just interest from retail investors, but also an increasing interest from Ethereum whales.

ETH sailing from tide to tide

On 8 October, Whalestats, a platform dedicated to tracking crypto whales, stated that whales had been showing interest in the largest altcoin. In the tweet, Ethereum ranked second in terms of most purchased tokens by the top 500 ETH whales.

🏆 Top 9 purchased tokens by 500 biggest #ETH whales today

🥇 $USDC

🥈 $ETH

🥉 $USDT

4️⃣ $WETH

5️⃣ #FTX Token @FTX_official

6️⃣ $wstETH

7️⃣ $aWETH

8️⃣ $UNI @Uniswap

9️⃣ $LDO @lidofinanceWhale leaderboard 👇https://t.co/tgYTpOmDm0 pic.twitter.com/4p9PHaxCKp

— WhaleStats (tracking crypto whales) (@WhaleStats) October 8, 2022

The increasing interest from whales could provide Ethereum’s prices a much needed boost.

In addition to this, the king of altcoins also witnessed growth on its network. Ethereum’s network growth observed a spike over the past few days. This meant that the number of new addresses that transferred Ethereum for the first time grew indicating an increase in Ethereum adoption.

However, there was a decline in Ethereum’s Market Value to Realized Value (MVRV) ratio over the past few weeks. This could be perceived as a bearish signal by potential investors. At the time of press, Ethereum was trading at $1,310 and had depreciated by 1.4% over the last 24 hours.

Traders who want to “buy the dip” and are planning to go long on ETH could have a look at other data points to better understand their position.