Ethereum (ETH) price has failed to establish above the $1,360 mark, despite some groundbreaking network growth over the last few days. While long-term prospects look bright, ETH’s short-term momentum lacks immediate bullish catalysts.

Ether price has remained rangebound in close proximity to the $1,300 mark since Sept 23. While ETH’s short-term price momentum has a larger bearish undertone, there’s more to it than meets the eye.

ETH price still below $1400

At press time, Ether traded at $1,308.80 noting a 1.29% drop in the daily time frame. ETH’s price after charting a 30% fall from the $1,700 price level on Sept. 23 has consolidated in a tight band between the $1,280 and $1,350 mark.

From a price perspective, ETH’s daily RSI was still in a downtrend as sellers dominated buyers since Sept. 12. As trade volumes maintained low levels presenting a larger market skepticism it was evident that ETH had few short-term catalysts in ETH’s trajectory.

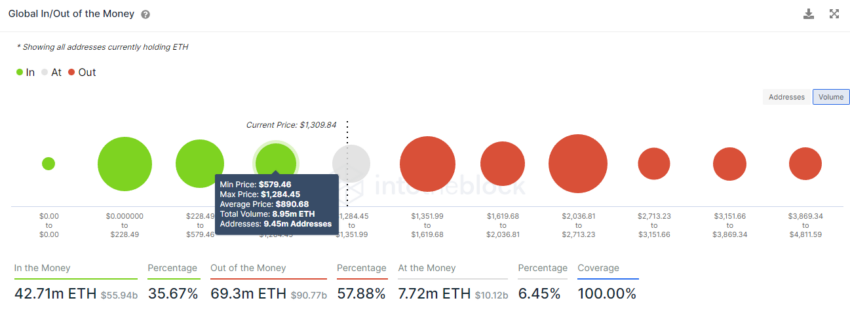

Going forward, the $890 mark would act as the next solid support for ETH’s price as 9.45 million addresses held over 8.95 million ETH around that price level. Currently, ETH price is battling the $1280 level but a fall below the same could lead to retesting of the lower support level at $890.

Nonetheless, with on-chain metrics glimmering the same could provide a cushion to ETH’s price going forward.

Network growth peaks

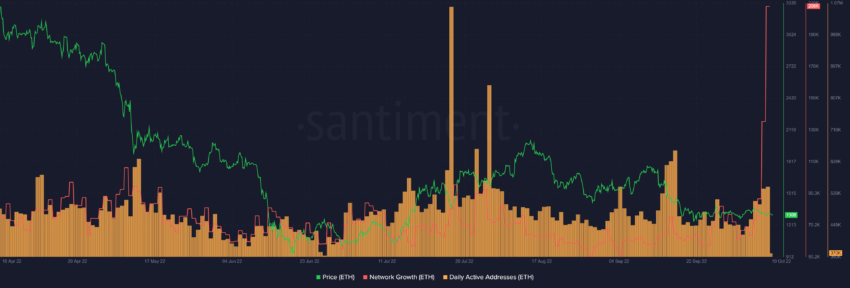

Ethereum’s network growth presented a massive uptick of over 180% in just one day alongside a healthy rise in daily active addresses indicative of a rather vibrant network despite the rangebound price momentum.

Additionally, Ethereum’s Number of New Addresses (7d MA) also made a 4-month high of 3,422.512 which meant that despite the sluggish price momentum participants were still flocking to the network.

However, a slightly bearish supply-demand signal was that Ethereum Exchange Outflow Volume (7d MA) reached a 22-month low of $8,566,693.60 which meant that even though the network indicators glimmered there were no major exchange outflows as HODLers were still skeptical of ETH’s short-term price momentum.

Going forward, retail euphoria and larger market conditions could play an important role in ETH’s trajectory. If network growth aids the price, ETH could face the next resistance at the $1,350 mark, however, if bears take over a pullback to the lower $1,200 range could be expected.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.