A Crypto-Asset Reporting Framework (CARF) has been presented to the G20 countries by the Organization for Economic Co-operation and Development (OECD) for discussion at their upcoming meeting on Oct. 12–13.

The proposal is in response to the G20’s desire to prevent emerging technology from undermining the changes in international tax transparency requirements. Especially since Common Reporting Standards were brought in to increase tax transparency concerning financial accounts maintained overseas.

OECD Secretary-General Mathias Cormann said, “The Common Reporting Standard has been very successful in the fight against international tax evasion. In 2021, over 100 jurisdictions exchanged information on 111 million financial accounts, covering total assets of EUR 11 trillion,” further adding that the new framework for reporting on crypto-assets will further ensure that the tax transparency architecture is current and functional.

Why India plays a key role in crypto

The report also comes at a time of skyrocketing interest across the digital asset class, which has led to increased adoption globally. However, the regulatory shake-up has changed the crypto picture in countries like India.

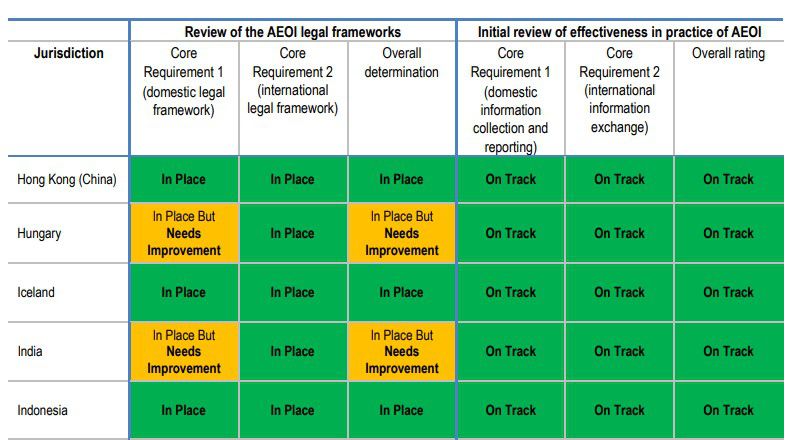

In the Peer Review of the Automatic Exchange of Financial Account Information 2022, OECD found that India needs to improve its domestic framework regarding its Automatic Exchange of Information Standard.

Ashish Singhal, Co-founder, and CEO of crypto exchange CoinSwitch, told Be[In]Crypto, “This is a key week for crypto. G20 ministers and central bank governors are set to review the OECD framework on crypto taxation. The world will be keen to hear India. We have been ahead of the curve on setting a reporting framework, although there’s scope to refine aspects like TDS of 1%.”

WazirX Co-Founder Nischal Shetty also remains optimistic, commenting to Be[In]Crypto that this new framework will “bring forth a uniform compliance structure from all crypto service providers and possibly remove individual tax impositions based on domestic laws. This will not only bring in more transparency but a swift record of transactions and their subsequent tax gains across the globe.”

Global standards for virtual assets

India, which had the second-largest population of cryptocurrency enthusiasts worldwide, had its standing in crypto adoption drop to fourth place year-over-year, according to a 2022 Chainalysis research. Earlier, some top crypto players noted that the 1% transaction tax India imposed on cryptocurrencies this year is hurting trading volumes.

And with a centrally backed e-rupee in the works, private crypto users are still in want of a regulatory framework that goes beyond the domestic taxation policy.

Singhal noted, “India is to assume the Presidency of the G20 later this year. It’s an opportunity to shape progressive policies that can make India competitive and spur innovation. There’s also a lot we could take from the OECD, like the definition of ‘relevant assets.’”

Apart from that, the four main building components that make up the CARF’s regulations include the scope of the virtual assets to be covered, the entities and persons subject to data collection and reporting requirements, the transactions and information subject to reporting, and due diligence procedures to identify crypto users and relevant tax jurisdictions for reporting and exchange purposes. Therefore, the requirements could bring more legislative clarity for players in India.

That said, Singhal also believes that “While a few developed nations have put in place their own crypto regulations and framework, what the industry really needs is a common global standard. After all, crypto is a transformative technology that could profoundly change businesses across the world.”

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.