If you were one of the few people that realized we were in the midst of a non-fungible token (NFT) bubble last year, then hats off. You managed to do what most people failed to do – making a great analysis of the long-term macro trend of the crypto market and summing up 1 + 1. Because it is not the first time we sailed into unknown waters and ended up disappointed. Remember the ICO (Initial Coin Offering) bubble in 2017/18?

What is different this time?

Well, it isn’t the first time (luckily?) we have had a boom and bust cycle in the crypto market. Looking back at the ICO bubble in 2017/18 everyone praised this new fundraising instrument as superior to the boring Initial Public Offerings (IPO) conducted in fiat currencies. Now, five years later, we know that this hype cost dear.

Similar to what happened to NFTs in 2021, the ICO bubble was accelerated by higher highs on the markets and the entrance of seemingly never-ending showers of fresh investor capital, driving up price.

A macro trend, never before seen, pushed the price of Bitcoin up to $18,000 and $1,100 for Ethereum. An expanding monetary policy with an almost 0 % interest rate in the two major world economies, the USA and Europe, pathed the way to risky investments, which include crypto and NFTs in particular.

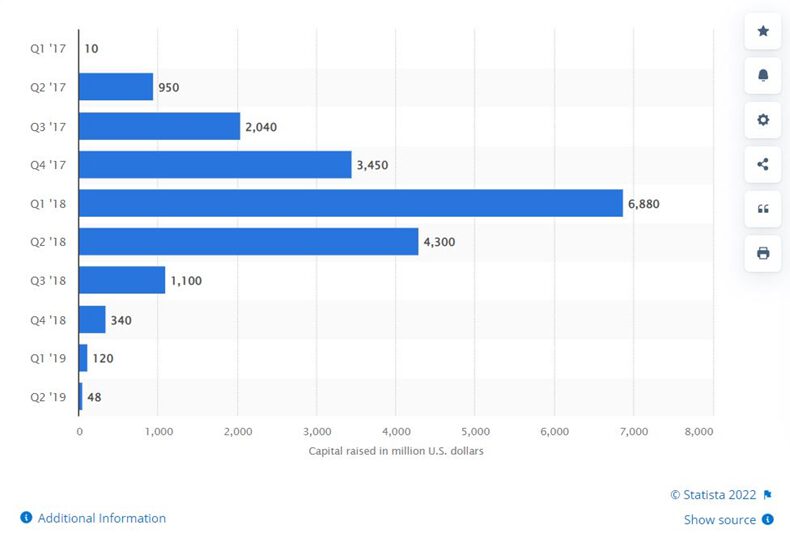

The image above shows the total funding by ICO from 2017 to 2019 worldwide. After the bubble burst in Q1 2018, the capital received by the projects kept going strong until Q2 2018 when VCs eventually realized the train has passed.

In Dec. 2018, prices started to slowly decline, besides the fact that there was no particular external factor we could blame for the downfall. No central bank raising interest rates, no Putin declaring war on Ukraine, and no COVID-19 responsible for excessive money printing.

It was solely to blame on the crypto market cycle lasting approximately four years and until now resulting in higher highs each time it reached its peak. What comes after a steep climb is a short but mostly not less steep fall. The bulls went to sleep, clearing the stage for the bears.

What has changed?

We have come a long way since ICOs: NFTs, DAOs, DeFi and stablecoins are just a few of the innovations to name.

After DeFi had its high in summer in 2020, NFTs were the next big thing, kicking off with the sale of Beeple’s Everydays. The NFT auctioned by Christie’s sold for a record price of $69 million, starting a craze all over the world.

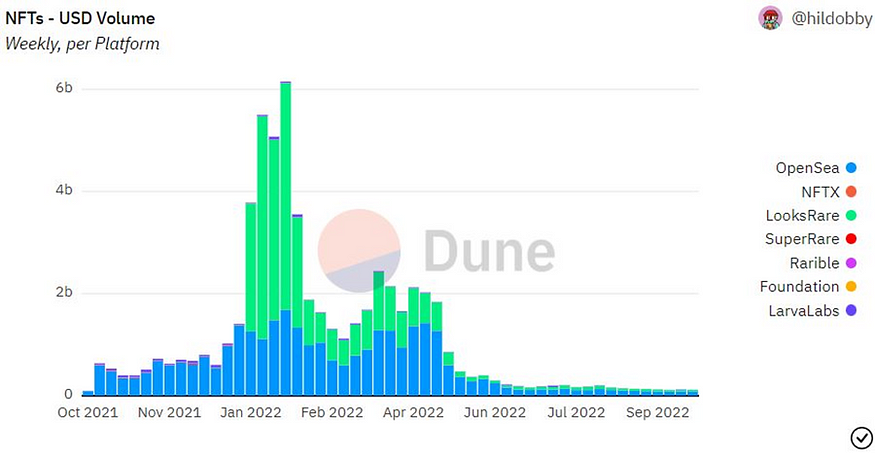

The following image describes best what happened in the months coming – the weekly NFT sale volume in USD dropped significantly from a peak of 6 billion to roughly $100 million.

Again it was a market downturn resulting in declining prices for NFT collections and lower sales volume. Similar to the ICO bubble, the highest sales volume (VC capital for ICOs) occurred after the market capitalization reached its high in the months before.

In this example, the crypto market cap reached its peak in Nov. 2021, just to see higher NFT sales volume from Jan. until April 2022 respectively.

This time it went pretty fast: Unlike in 2017/18 there was no Chinese New Year or some other made-up reason for the quick downfall of the crypto market, but the over leveraging of various companies.

After crypto lender Celsius filed for Chapter 9 insolvency, the whole space seemed to wobble on their toes and try to find a solution to what is about to happen. With prices falling, highly collateralized companies saw themselves getting liquidated rather sooner than later.

3AC, Nuri and Voyager are a few companies to name.

Will NFTs Survive This Bear Market?

As with every bull market, not only fresh capital floods the market, but also highly-skilled employees (especially developers) looking for work. These employees and projects are progressing and achieving milestones regardless of the market situation, just to skyrocket in market cap when the bulls are back.

We have seen it with ICOs, and we will see it with NFTs. ICP, Polygon and Solana are just a few examples of successfully funded ICOs during a bear market.

What is fundamentally different comparing NFTs and any instrument is that the macro trend, as well as the fundamental data, speak for the latter.

Macro Economics Have a Major Part To Play

Just before the interest rate raises by the Federal Reserve (Fed) in Nov. 2021 there were rumors that the crypto market would collapse, and that NFTs were about to cool off.

As a consequence, all markets stumbled, whether it is the S&P 500, NASDAQ or commodities like gold. Since the financial crisis of 2008, the world had not seen such drastic interest rate hikes, and since crypto had a 0.6 correlation to the NASDAQ, a sharp fall was predetermined.

Investors were adjusting their investments to less risky assets and decided to pull money out of crypto. Additionally, a Russian leader decided to attack Ukraine, resulting in a long string of reactions all over the world, including the boom of electricity and gas prices all, leaving investors with a big question mark about the best risk-reward for assets.

As soon as the banks start to lower the interest rates/or the war in Ukraine ends and the crypto market cycle heads upward, the bulls should take over the steering wheel.

Fundamentals Are Critical, as With All Investments

As with every crypto investment, the fundamentals of NFTs give us insight into the potential upside. According to a study from DappRadar, the unique wallets in Q3 of 2022 grew 36% compared to Q3 of 2021.

Furthermore, the technology is developing rapidly. With three different NFT standards – ERC-721, ERC-1155 and ERC-4907 – technology is offering us a wide array of use.

On the one hand, companies are working on innovative solutions to real-world problems, also trying to educate and onboard new users. On the other hand, artists are being handed the tools to engage with their community and finally get what belongs to them — mostly resulting in higher gross profits from sales. And this is only the beginning!

With a growing sector comes utility. NFTs can be used to tokenize property and provide gamers with in-game wearables, such as Avatars, in the fashion industry or even for ticketing and events.

Companies like Telegram, Twitter, Meta, Starbucks, Nike, Adidas, and LG have already integrated NFT technology as a product for their users.

Bear markets usually provide investors with a great opportunity to scoop in some cheap assets, as the floor price for the Bored Ape Yacht Club shows. Compared to May 2022 the floor price almost halved.

With a 50% discount, also seen with many other successful collections, it could now be the time to invest in NFTs. It will eventually pay off in the next bull cycle, whether it may come in 2023, 2024, or later — in bear markets you invest, in bull markets you make the money.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.