Ethereum Proof-of-Work (ETHW) has bounced four times at the support line of the bullish pattern. As a result, a breakout from it seems to be the most likely scenario.

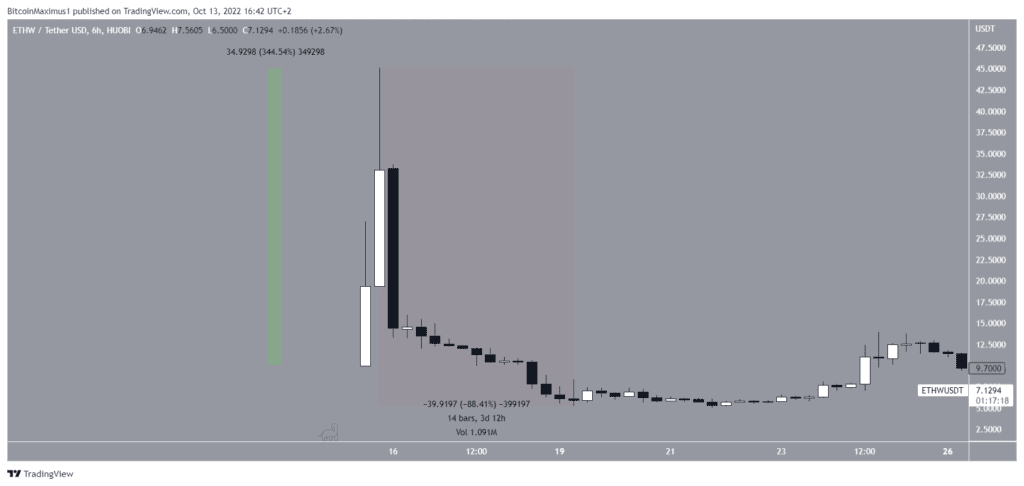

ETHW had a wild ride shortly after its launch. The price initially increased by a massive 344%, leading to a new all-time high of $45.10. However, the upward movement could not be sustained, and the price fell as quickly as it previously arose. In a span of three and a half days, ETHW fell by 88.40%, culminating with a low of $5.30 on Sept. 19. Interestingly, this was considerably below the listing price of $10.

Bullish ETHW pattern could lead to breakout

After the aforementioned low, ETHW initiated another upward movement which led to a high of $13.98 on Sept. 24 (red icon). However, the price has been falling since.

The entire decrease has so far been contained inside a descending wedge, which is considered a bullish pattern. Moreover, the price has bounced at the support line of this pattern several times, creating long lower wicks in the process. Finally, the six-hour RSI has generated a bullish divergence (green line) inside the oversold territory.

Despite these bullish readings, the price has broken down from $7.80, an area that previously provided support. Therefore, the area is now expected to provide resistance. Until ETHW moves above it, the trend cannot be considered bullish.

A movement above this area would also mean that ETHW has increased above the resistance line of the wedge, initiating the breakout.

In that case, the next closest resistance area would be at $11.15, created by the 0.618 Fib retracement resistance level.

Will the breakout materialize?

Due to the bullish pattern and bullish divergence in the RSI, a breakout from the wedge seems to be the most likely scenario. A movement above the $7.80 resistance area would confirm this possibility while a breakdown below the support line of the wedge would invalidate it.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer: Be[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.