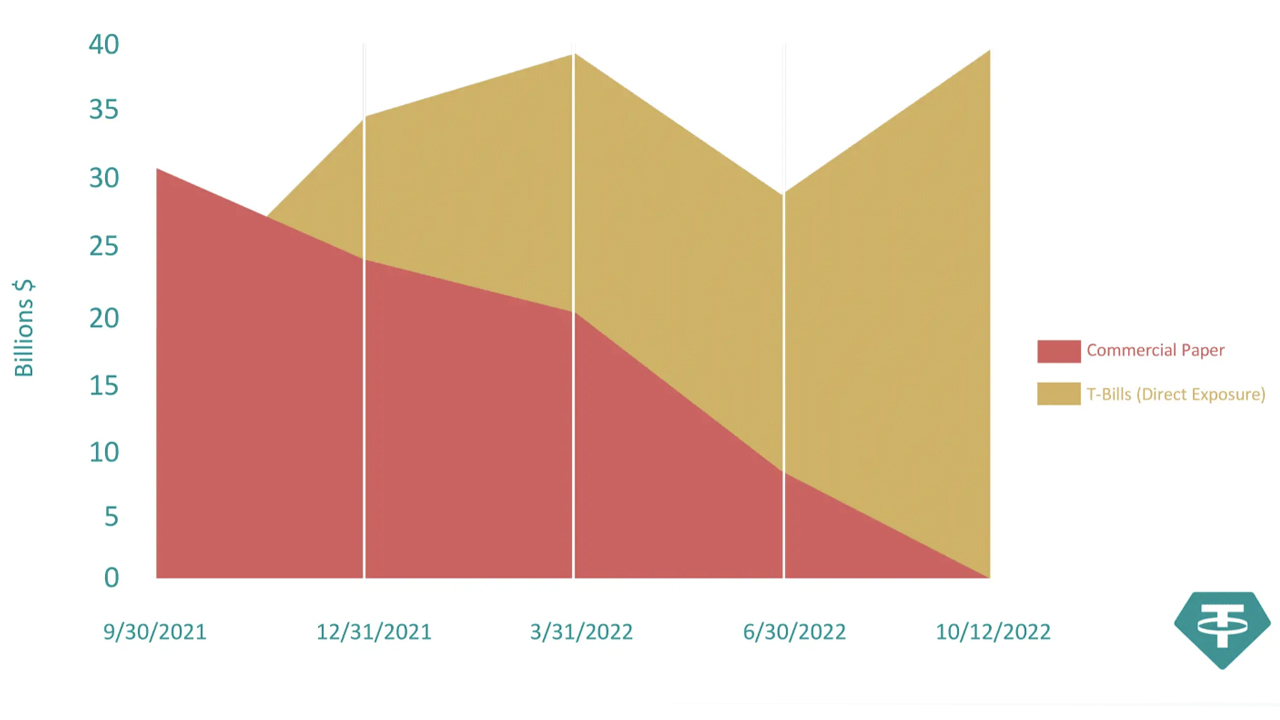

On October 13, 2022, Tether Holdings Limited announced that the stablecoin issuer has reduced the company’s commercial paper holdings down to zero. The company has said it would reach this goal for a while now, and Tether says that shrinking commercial paper holdings down to zero “demonstrates Tether’s commitment to backing its tokens with the most secure reserves in the market.”

Tether Axes $30 Billion Worth of Commercial Paper Holdings, Firm Leverages US T-Bills Instead

The company behind the largest stablecoin by market capitalization, Tether, has revealed that USDT’s reserves are exposed to U.S. Treasury Bills (T-Bills), in contrast to commercial paper holdings. The announcement follows the statement Tether’s chief technology officer Paolo Ardoino made on October 3.

At the time, Ardoino explained that U.S. Treasury bills represented more than 58% of the company’s reserves, and he further said “ [Commercial paper] exposure is [less than] 50M now.” The company that manages USDT, a stablecoin with a market valuation of around $68.53 billion, believes the decision to erase commercial paper holdings is positive for the crypto industry as a whole.

“Reducing commercial papers to zero demonstrates Tether’s commitment to backing its tokens with the most secure reserves in the market,” the company stated on Thursday. “This is a step towards even greater transparency and trust, not only for Tether but for the entire stablecoin industry.”

Tether’s Move Follows the Terra Stablecoin Collapse 5 Months Ago, Both Tether and Usd Coin Have Shed Billions Since Then

Tether’s move follows the issues associated with the Terra blockchain and the UST de-pegging event last May. Furthermore, a handful of stablecoins have de-pegged from the $1 parity following UST’s collapse. The news also follows the stablecoin USDC’s market cap deflating during the last few months down to today’s valuation of around $45.82 billion.

USDT’s market cap dropped as well, following the Terra collapse, as Bitcoin.com News reported in mid-June that the number of USDT in circulation dropped by over 12 billion coins in two months. Despite the drops of USDT and USDC in circulation, the stablecoins are still the top two stablecoin assets by market cap, and the third (USDT) and fourth (USDC) largest crypto assets by valuation.

What do you think about Tether fulfilling the company’s promise to reduce commercial paper holdings down to zero? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tether,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer