Chainlink [LINK] recently made it into the news for releasing its latest update, the Chainlink node software version 1.9.0. This update would make node management easier and increase the capability and flexibility of Oracle jobs.

#Chainlink node software version 1.9.0 is now available 🏗️

This update makes node management easier and increases the capability and flexibility of oracle jobs.

Explore the changes in more detail on the official documentation: https://t.co/D2NgA9gf0P pic.twitter.com/NKtsgqZppJ

— Chainlink (@chainlink) October 15, 2022

This development looked quite positive for the coin. However, it didn’t reflect on the coin’s chart according to CoinMarketCap. LINK dropped by more than 5% in the last seven days.

At press time, LINK was trading at $7.05 with a market capitalization of more than $3.46 billion. Incidentally, several on-chain metrics also indicated a similar outcome of the price decline.

______________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction of Chainlink (LINK) for 2023-24

______________________________________________________________________________________

LINK— The troublemaker

Despite showing negative signs on charts, LINK managed to be one of the most popular coins among the top 500 Ethereum [ETH] whales as it was among the coins that the whales were holding. However, things did not look quite well for LINK as most of the on-chain metrics didn’t favor LINK.

🐳 The top 500 #ETH whales are hodling

$127,602,952 $SHIB

$78,108,805 $MKR

$69,495,505 $BIT

$56,496,983 $UNI

$46,563,664 $LOCUS

$43,821,246 $LINK

$36,877,664 $MOC

$36,682,793 $MANAWhale leaderboard 👇https://t.co/tgYTpOmDm0 pic.twitter.com/ezFhXkOqib

— WhaleStats (tracking crypto whales) (@WhaleStats) October 15, 2022

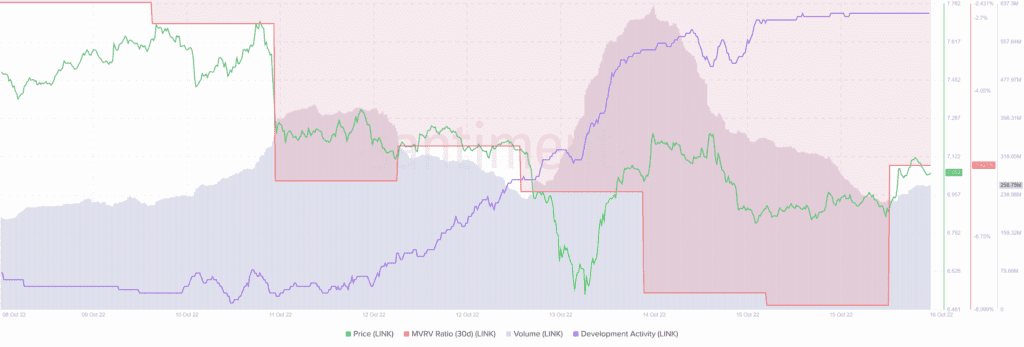

For instance, LINK’s volume registered a decline after a spike last week, which is a negative signal for a blockchain. Not only that, but LINK’s network growth also registered a decline, increasing the possibility of a price decline in the days to come.

Though LINK’s Market Value to Realized Value (MVRV) registered an uptick, it was still much lower as compared to last week. This was yet another red flag for the blockchain.

Nonetheless, a few metrics did favor LINK. For instance, LINK’s development activity surged considerably over the last week, which was good news for the coin as it represented increased effort from developers towards improving the network.

Moreover, LINK’s social mentions also registered an uptick last week, representing a rising popularity of the coin.

Expect the unexpected…

A look at LINK’s daily chart revealed a different picture. The Exponential Moving Average (EMA) Ribbon displayed a bullish crossover, increasing the chances of a price surge in the coming days. Furthermore, the Relative Strength Index (RSI) also registered an uptick and was moving towards the neutral position.

However, LINK’s Chaikin Money Flow (CMF) was in a freefall at press time, which might restrict LINK’s price from going up.