Tesla’s third-quarter balance sheet shows that the electric car company is still holding $218 million in bitcoin. CEO Elon Musk claims that Tesla could be worth more than Apple and Saudi Aramco combined. The executive is also “excited” about acquiring Twitter.

Tesla Still Holds $218 Million in Bitcoin

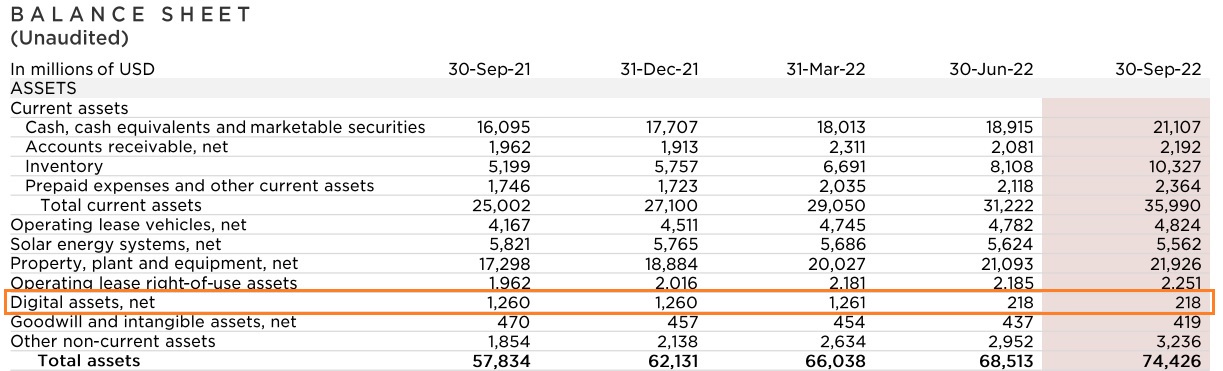

Tesla Inc. (Nasdaq: TSLA) released its third-quarter earnings results Wednesday. The company’s Q3 financial statements show that Tesla did not sell any bitcoin during the quarter. Its balance sheet still shows $218 million in digital assets, unchanged from the second quarter.

At the time of writing, the price of bitcoin is $19,188 based on data from Bitcoin.com Markets. Tesla bought $1.5 billion worth of the cryptocurrency in early 2021 and has not purchased any more since. The company sold about 75% of its BTC holdings in the second quarter of this year.

In the third quarter, Tesla’s revenue rose to $21.5 billion, compared with analysts’ projections of $22.1 billion. Profit excluding some items rose to $1.05 a share, exceeding the $1.01 average of estimates compiled by Bloomberg.

During the company’s Q3 earnings call, Musk said Tesla could be worth more than the combined value of Apple (Nasdaq: APPL) and Saudi Arabian Oil Company (Saudi Aramco) in the future. The two are currently the world’s largest companies by market cap. “For the first time I see a way for Tesla to be roughly twice the value of Saudi Aramco,” Musk said, elaborating:

This is the first time I’ve seen that potential.

At the time of writing, Saudi Aramco’s market cap is $2.09 trillion while Apple’s market cap sits at $2.31 trillion. Tesla’s market cap is $695.76 billion.

Elon Musk on Recession

Musk also shared his economic outlook during the call. He explained that “China is experiencing a recession of sorts,” mostly in the property markets, and “Europe has a recession of sorts driven by energy.” The Tesla executive continued:

North America’s in pretty good health, although the Fed is raising interest rates more than they should, but I think they’ll eventually realize that and bring them down again.

Recently, Bank of America CEO Brian Moynihan and JPMorgan & Chase CEO Jamie Dimon also said that the U.S. economy is doing well and consumers are in good shape despite inflation. Over the weekend, President Joe Biden said the U.S. economy is “strong as hell.”

Musk ‘Excited’ About Acquiring Twitter

The Tesla CEO also commented on his Twitter acquisition. He said:

I’m excited about the Twitter situation … Myself and other investors are obviously overpaying for Twitter right now … [However] the long-term potential for Twitter in my view is an order of magnitude greater than its current value.

Musk recently revealed that buying Twitter accelerates the creation of “X, the everything app.” He originally tried to back out of buying the social media platform but reversed course this month and decided to go through with the purchase. The court has given Musk until Oct. 28 to close the acquisition to avoid a trial.

What do you think about the comments by Elon Musk? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer