PancakeSwap [CAKE] made it into the headlines again as it was among the top cryptos on the BNB chain in terms of social mentions on Twitter.

Here’s AMBCrypto’s Price Prediction for PancakeSwap (CAKE) for 2023-24

🎉 MOST-MENTIONED #BNBCHAIN Projects on @Twitter🚀

🥇 $QUACK @RichQuack

🥈 $CAKE @PancakeSwap

🥉 $BABYDOGE @BabyDogeCoin$SFM @safemoon$FLOKI @RealFlokiInu$LEON @swapleonicorn$SFUND @SeedifyFund$RISE @EverRise$CATE @catecoin$YOOSHI @yooshi_official$VINU @VitaInuCoin#BNB pic.twitter.com/4NsQfgT6IZ— BSCDaily (@bsc_daily) October 19, 2022

Not only this, but several developments happened in the PancakeSwap ecosystem that added much value to the network, including the farm auction. 23 projects joined the bidding for Farms this week.

🔨🥞 Farm Auction #32 starting now!

23 projects join the bidding for Farms this week, bidding $CAKE to win.

Watch the auction in progress:

👉 https://t.co/dlRpSuIJ1l pic.twitter.com/dayFLZw5jp— PancakeSwap 🥞 #BSC (@PancakeSwap) October 19, 2022

However, CAKE’s price action did not correspond to the developments, as it merely registered over 1.5% growth in the last week. At press time, CAKE was trading at $4.42.

Moreover, investors might be concerned now as a look at CAKE’s on-chain metrics suggests that its price could go down in the coming days.

Investors should be cautious

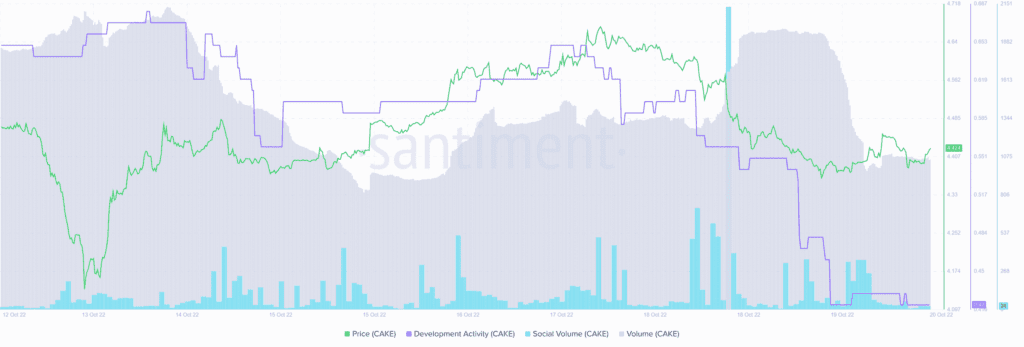

CAKE’s development activity went down sharply over the last week, which is a matter of concern as it represents less effort by developers in improving the network. CAKE’s volume also decreased on 19 October, yet another negative signal for the blockchain.

Curiously, CAKE failed to gain much attention or interest from the derivatives market as its FTX funding rate went down.

However, a few of the metrics were also in support of the token. For instance, CAKE’s social mentions spiked last week, indicating increased popularity of the token in the crypto community.

Moreover, CAKE’s NFT space displayed promising performance as its total NFT trade count increased over the last few days.

Market Indicators preferred CAKE

Interestingly, CAKE‘s daily chart gave some hope to the investors as several of the market indicators suggested that the token’s price might go up in the coming days.

The Exponential Moving Average (EMA) Ribbon indicated the bulls’ advantage in the market. Moreover, CAKE’s Chaikin Money Flow (CMF) registered an uptick, further increasing the chances of a price surge in the coming days.

Nonetheless, the Relative Strength Index (RSI) was resting below the neutral position, which is a bearish signal. The MACD also registered a bearish crossover last week, minimizing CAKE’s chances of going up.