Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Avalanche witnessed a reversal pattern, can it sustain a breakout rally?

- The crypto’s development activity and funding rates revealed an edge for the buyers.

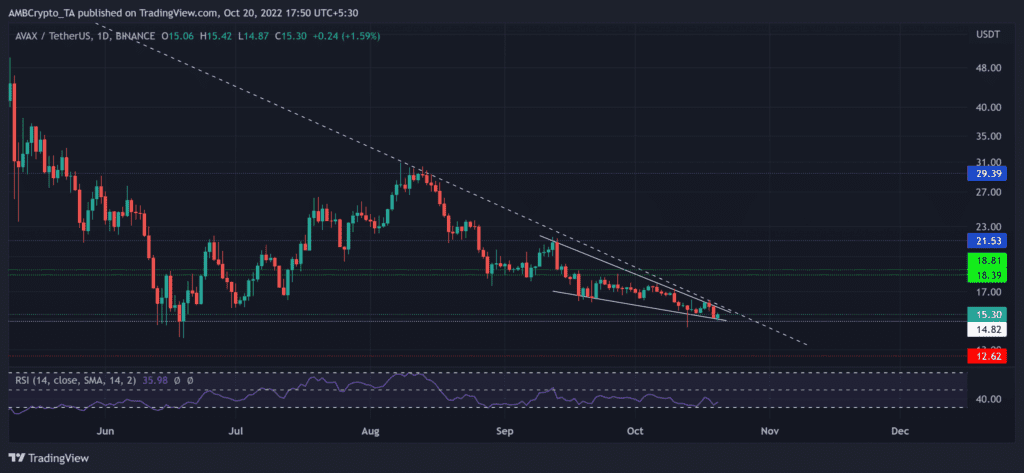

While the trendline resistance (white, dashed) shunned buying efforts for the last seven months, the recent reversal put Avalanche [AVAX] below the south-looking EMA ribbons.

Here’s AMBCrypto’s price prediction for Avalanche [AVAX] for 2023-24

In finding fresher lows, the alt eyed to test its long-term support level in the $14.8 region. The bulls could now aim to swoop in to induce a convincing patterned break in the coming sessions.

At press time, AVAX was trading at $15.3, down by nearly 1.51% in the last 24 hours.

AVAX formed a reversal pattern near its long-term support

While the seven-month trendline resistance countered the recent buying pressure, AVAX marked an expected pulldown, one that spurred an over 49% loss over the last two months.

Meanwhile, the EMA ribbons undertook a bearish flip and looked south to uncover the underlying selling edge. After a relatively high volatile move over the last two days, AVAX entered into a compression over the last few weeks. In the meantime, it chalked out a falling wedge structure on its daily chart.

A close above the trendline resistance and the 20 EMA would confirm the chances of a potential breakout rally. In these circumstances, the buyers could look to test the $18.3-$18.5 range resistance.

On the flip side, any decline below the immediate support can aid the sellers in expediting their edge. In this case, the first major support level would lie in the $12.6 region.

The Relative Strength Index (RSI) reversed from the oversold region to corroborate with the bullish comeback narrative. A continued revival from its press time position can aid the bulls in inflicting a near-term recovery in the coming sessions.

Improved development activity alongside the funding rates

Until May 2022, AVAX exhibited a relatively high sensitivity with its development activity. Over the last five months, the activity continued to grow but the price action succumbed to the broader market liquidations. Should the broader sentiment improve, the price would look to regain its northbound movement to follow the metric, as it did previously.

To top it up, the funding rates on Binance marked a consistent incline over the past month. As a result, they turned positive and highlighted an underlying sentiment favorable for the buyers. But the price action was yet to reflect this sentiment.

Finally, traders should factor in Bitcoin’s movement and its effects on the wider market to make a profitable move.