BeInCrypto takes a look at five projects that beat the crypto market last week, more specifically, from Oct. 14 to Oct. 21.

These digital assets have taken the crypto news and crypto market spotlight:

- Casper (CSPR) price is up 25.00%

- Trust Wallet Token (TWT) price is up 12.92%

- Maker (MKR) price is up 12.23%

- Toncoin (TON) price is up 11.91%

- Aave (AAVE) price is up 9.36%

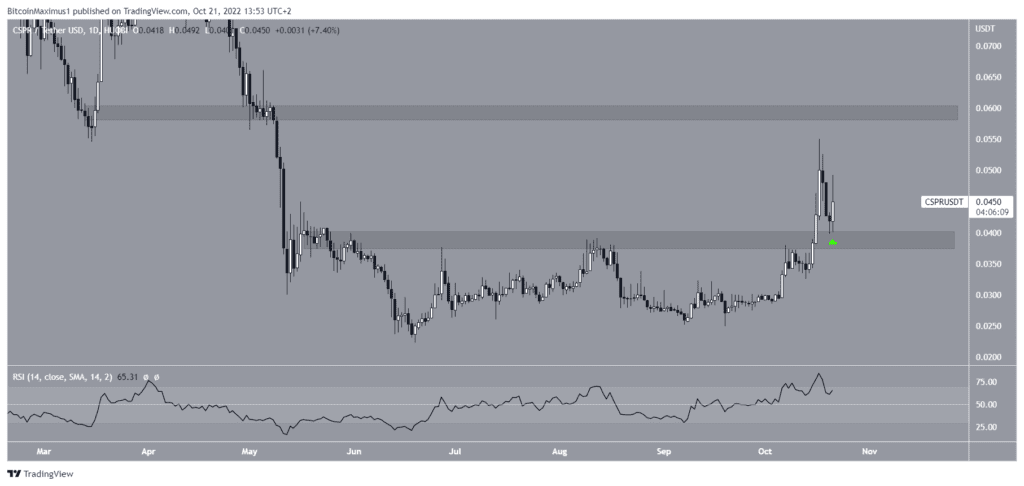

Casper CSPR Price Prediction: Retests Support

CSPR price had been trading below the $0.039 resistance area since the beginning of May. After initiating a sizeable upward movement, Casper price finally managed to break out on Oct. 16. It reached a high of $0.055 the next day.

Casper price has decreased since and validated the $0.039 area as support (green icon). The daily RSI is still increasing and has not generated any bearish divergence yet.

Therefore, after another potential re-test, the CSPR price is expected to increase towards the $0.058 resistance area.

Conversely, a daily close below the $0.039 area would invalidate this bullish prediction in the crypto market.

Trust Wallet Token TWT Price Prediction: Makes Fifth Breakout Attempt

TWT price has been decreasing underneath a descending resistance line since Sept. 2021.

Currently, Trust Wallet Token price is in the process of making its fifth attempt at breaking out (red icons). Since resistances get weaker each time they are touched, a breakout is likely.

Furthermore, the daily RSI is still increasing and has not generated any sort of bearish divergence.

If a breakout occurs, the next closest resistance area would be at $1.33 for TWT price.

Conversely, a daily close below the $0.90 horizontal support area would invalidate the bullish hypothesis in the crypto market.

Maker MKR Price Prediction: Reaches Resistance Line of Wedge

MKR has been falling inside a descending wedge since June 2021. The descending wedge is considered a bullish pattern, meaning that a breakout from it would be the most likely scenario.

Maker price is currently making an attempt at breaking out. It began an upward movement in Sept. 2022 after bouncing at the support line of the wedge.

Additionally, the RSI has finally moved above 50, breaking out from its bearish divergence trendline. This supports the possibility of a price breakout from the wedge. If a breakout occurs, MKR price could increase all the way to $1,970.

A decrease below the yearly low of $581 would invalidate this bullish scenario for Maker price in the crypto market.

Toncoin TON Price Prediction: Bounces at Support

TON has been moving upwards since bouncing at the $1.25 horizontal support area on Oct. 13 (green icon). Shortly afterwards, the Toncoin price broke out from a descending resistance line.

If the upward movement continues, the closest resistance area is at $1.66-$1.77, created by the 0.5-0.618 Fib retracement resistance levels. A successful movement above this area would be expected to take the TON price above $2.

Conversely, a daily close below $1.25 would be bearish and suggest that new lows are expected for Toncoin price in the crypto market.

AAVE Price Prediction: Begins Wave C

AAVE price has been falling underneath a descending resistance line since reaching a high of $115.18 on Aug. 13. The downward movement led to a low of $64.71 on Oct. 13.

The ensuing bounce created a long lower wick (green icon) and validated the $72 area as support. Shortly afterwards, the AAVE price broke out from a descending resistance line.

It is possible that AAVE price has begun wave C of an A-B-C structure (black). If so, it could increase all the way to $135.50. A daily close below $72 would invalidate this possibility.

For the latest BeInCrypto Bitcoin (BTC) and crypto market analysis, click here

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.