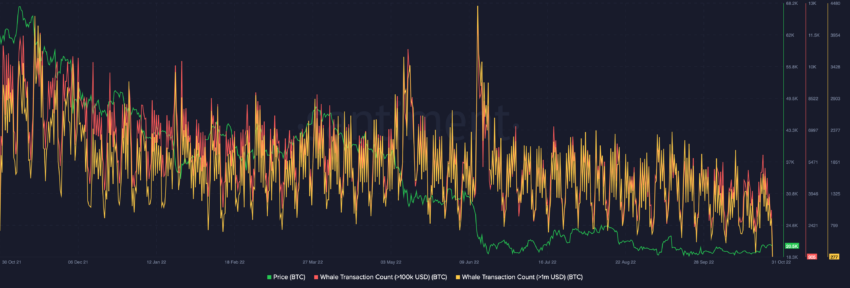

Bitcoin whales have maintained an eerily calm stance throughout last year after Bitcoin price made its $69,000 all-time high.

Bitcoin (BTC) price, after making a 6-week high of $21,085, has retraced back to the $20,470 level with price noting a 1.44% pullback over the last 24-hours. With sentiment still in fear and considerable profit-taking at the $21,000 price level, whale movement can be of value to judge where price movement can go next.

Bitcoin whales still in a dilemma

Whale addresses are often key to long-term price trend changes. For the most part of last year, large institutional holders and whale addresses have been dumping their Bitcoin holdings.

Whale entities had been accumulating quite heavily up until late 2021 before taking profit in late October right before the final all-time high in early November.

However, of late this cohort has shown no to low interest or movement in the market as seen in the whale transaction count data which presents no major spike.

While a positive trend was observed as 10,000 to 100,000 coins percent which saw a rise in their holding from 11.2% in early October to 12.13% at press time.

The same was more or less reversed as 100,000-1 million coins reduced their holding from 4.34% to 3.56%. All in all, whales still seemed to be skeptical of BTC’s price movement with price action still in a larger drawdown.

How does BTC price look post profit-taking?

Age bands for BTC give a good insight into the current market condition. A look at the age bands suggests that supply from 1-day to 1-week is accumulating. Supply of less than 1-day (blue) started to rise before the recent rebound of Bitcoin but is now declining.

Data from CryptoQuant presented that on a longer timeframe, from 1-week to 1-month (purple) supply is moving sideways. This supply has been held and transferred to the 1-month to 3-month supply (red box).

On the other hand, the supply for 1-month to 3-month (green) noted a minor decline until recently, but is currently on a slight rise. Thus, as additional buying momentum weakens in the short term, it’s unlikely that the rise will continue.

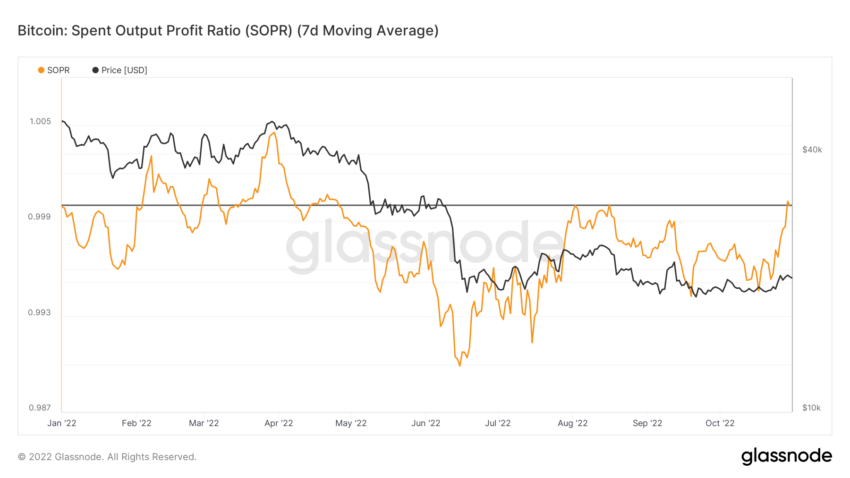

Furthermore, BTC price was still in a larger downtrend despite the recent gains. While short-term gains activated the retail side buying, profit taking still ensued. A spike in SOPR suggested that there was an increased urge to take profit at the $21,085 level even among the seasoned HODLers.

Without much activity from whales and such minor gains from BTC price such profit-taking activities could continue to be the norm.

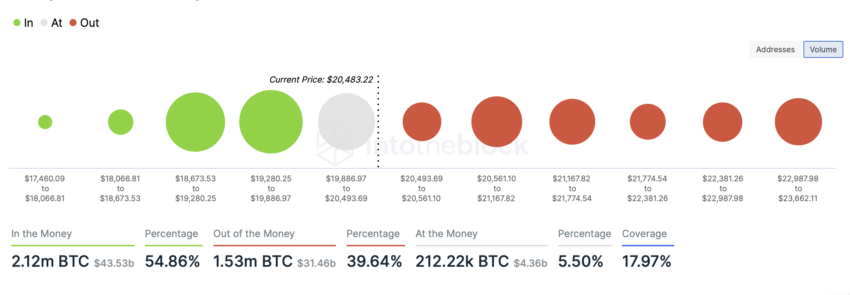

Bitcoin has built a significant demand zone between the $19,000 and $20,700 price level where over four million addresses purchased roughly 2.3 million BTC. In the short-term, the $20,850 and then the $21,167 mark would act as a key resistance for BTC’s price.

While the $19,540 mark would play as a strong support for Bitcoin’s price.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Got something to say about Bitcoin whales or anything else? Join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.