Bitcoin miners are finding it no longer profitable to mine BTC. Increasing energy prices, inflation, and a looming recession have put many of these companies under duress.

Mining Bitcoin has become an increasingly difficult task as crypto miners can no longer afford it. As a result, the hashrate of the network is expected to drop because miners simply can’t make a profit, let alone recover the costs.

In the last few months, several Bitcoin miners have experienced several financial stressors. This includes Core Scientific, Argo, Compute North, and Iris Energy.

Meanwhile, Luxxfolio offered an operations update recently that spoke about the pressure the mining industry was facing. The miner highlighted that it was unprofitable, though it had reduced its debt and moved to lower-cost immersive mining. Most notably, it said that if it did not find a partner or purchase for its mining operation in New Mexico, it would have to consider permanently shutting down operations.

Iris Energy is also under a high level of duress. Its financial update also revealed a dire state, saying,

“Certain equipment (i.e., Bitcoin miners) owned by the special purpose vehicles currently produce insufficient cash flow to service their respective debt financing obligations, and have a current market value well below the principal amount of the relevant loans. Restructuring discussions with the lender remain ongoing.”

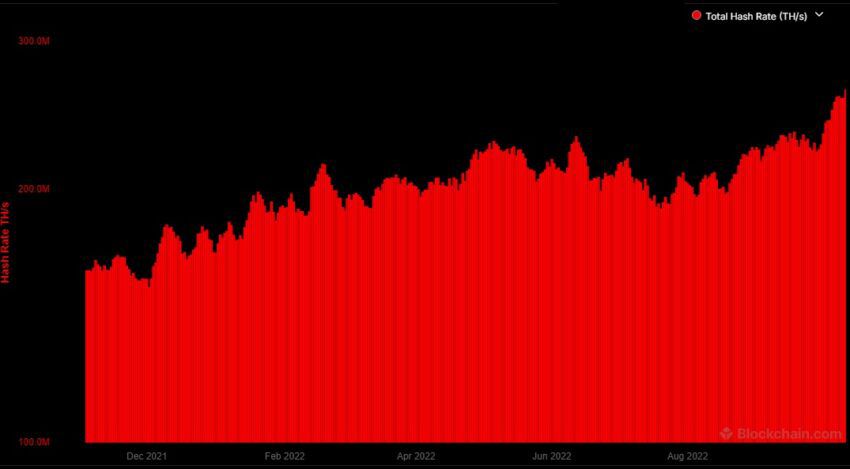

These conditions are representative of what the larger mining industry is going through. What investors are concerned about is the reduction in the hashrate.

BTC Hash Rate May Suffer

The difficulty and hashrate both hit all-time highs in October. This was seen as good news, as a higher hashrate means a more secure network. However, the situation has changed quickly.

With Bitcoin mining not being profitable enough anymore, there could be more shutdowns on the horizon. It currently costs about $19,300 to mine 1 BTC, and in the current economic environment, that is unfeasible.

Energy prices have also gone up in 2022, and this has also contributed greatly to the mining industry’s slowdown. Inflation and an upcoming global recession are also playing a part.

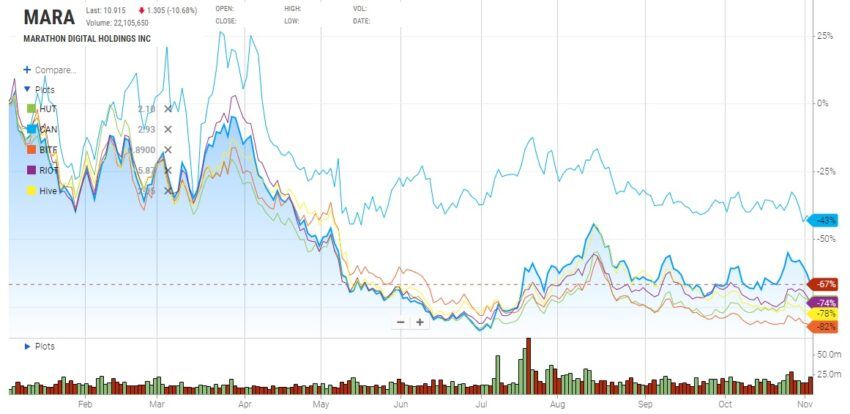

Bitcoin mining stocks seeing huge drops

Meanwhile, the stocks of Bitcoin mining companies are taking a strong hit. Hut8 is down 73% year-to-date (YTD), while Canaan is down 44%. Other big drops include Bitfarms at 82%, Riot Blockchain at 73%, and Hive at 77% YTD. The same is the case with the Argo blockchain, which is down by a whopping 90%.

Plummeting stock prices across the sector clearly show how the bear market is impacting big Bitcoin miners.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.