Litecoin [LTC] just concluded its most bullish week since June after delivering an impressive rally. It has also kicked off this week on a positive note after confirming a new network integration. But is this enough to ensure continued bullish dominance?

Here’s AMBCrypto’s price prediction for Litecoin (LTC)

Litecoin started off this week with bullish news after recently confirming its integration with Wanchain. This announcement represents a positive step in the right direction for the network especially in terms of interoperability.

Such announcements tend to have a positive impact on price action. But will that be the case for LTC?

⛓️ Connected network: #Litecoin#Wanchain creates new use cases. @litecoin

The future is interoperable.

🌐 https://t.co/mgaJrv8MDy pic.twitter.com/8UAPKWjWXY

— Wanchain (@wanchain_org) November 5, 2022

LTC might not continue extending its upside for longer especially considering its current position. This is because the cryptocurrency is already deep in overbought territory after its latest upside. Its leading indicator RSI, at press time, was also showing signs of a potential reversal.

A keen look at its price action reveals more potential for sell pressure. For example, the LTC price action has been moving in an overall ascending channel since its bottom in June. It concluded last week with a resistance line retest, thus increasing the chances of a bearish retracement.

In fact, Litecoin managed to rally by as much as 33% in the last seven days. Its attempts to exit the lower range will likely be watered down by short-term profit-taking.

However, this will be subject to the lack of bullish pressure, a situation that will give way to the bears. This provides an ideal opportunity for short sellers.

Litecoin traders are taking short-term profits?

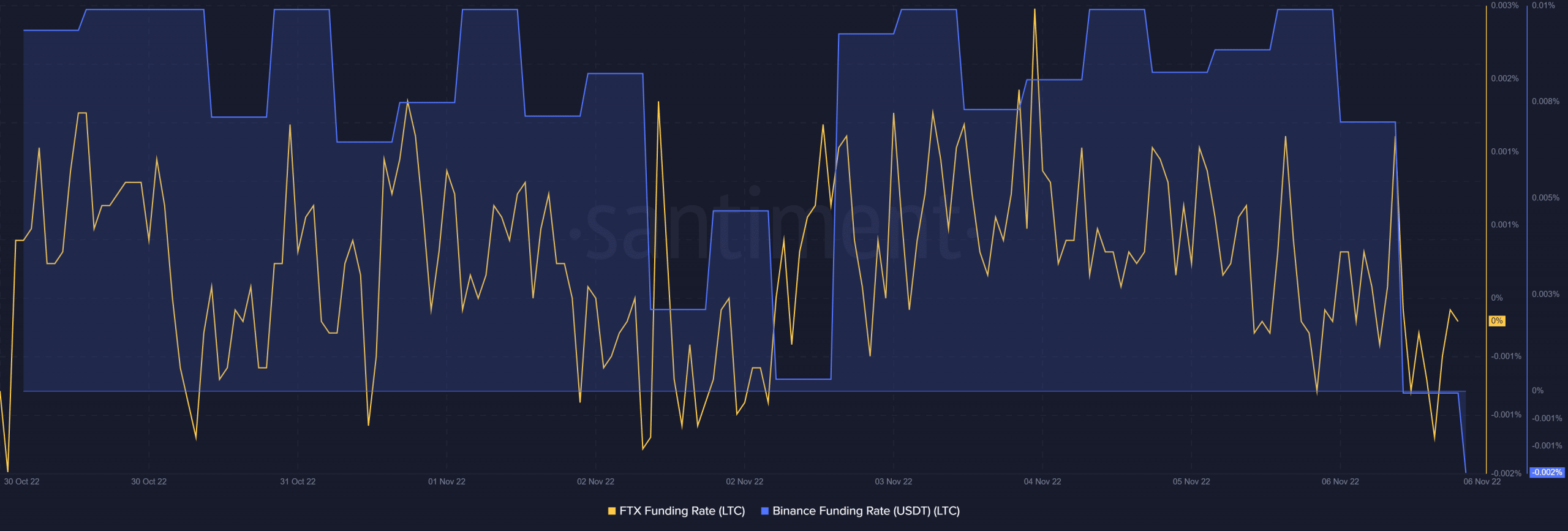

Litecoin’s demand in the derivatives market has notably slowed down. This is evident by the downside in the Binance and FTX funding rates especially in the last two days.

This confirms that the bullish demand is tapering off and will likely pave the way for a bearish retracement.

LTC’s demand in the derivatives market often mirrors the spot market. If the same is expected in the spot market, then the chances of a bearish pullback are quite high.

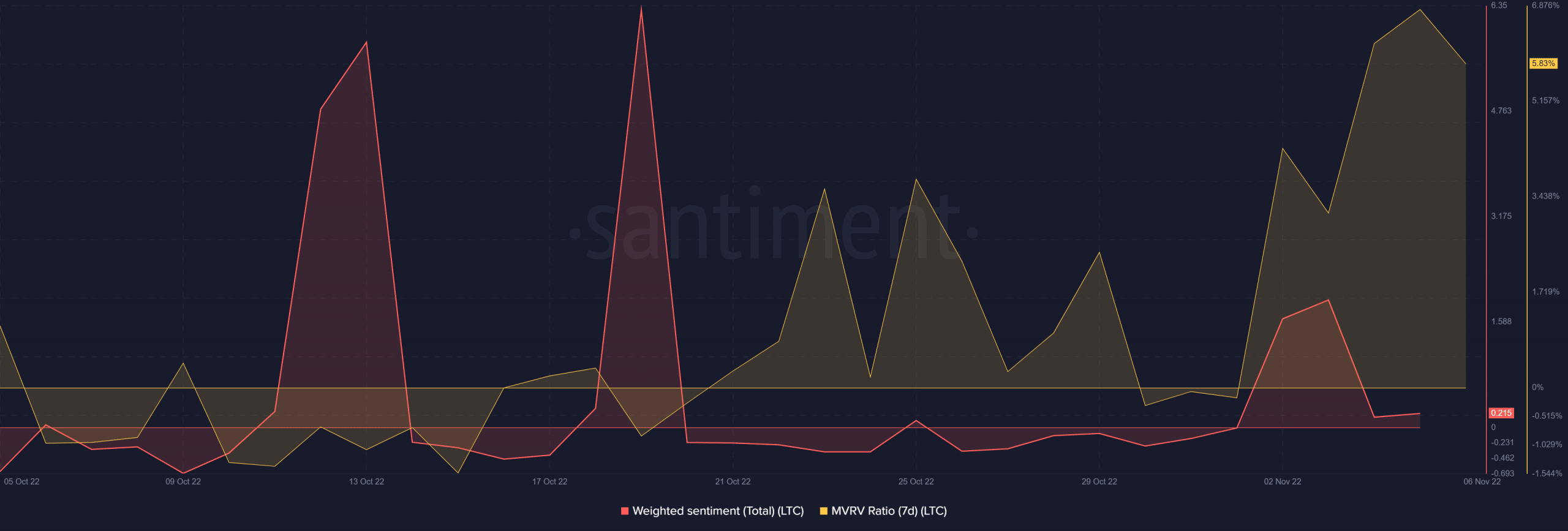

A drop in the weighted sentiment in the last few days further solidifies this expectation.

In addition, most of the traders that bought the dip in October are now in profit according to the MVRV ratio. However, the same ratio dropped slightly in the last 24 hours, confirming that there has been a significant sell-off.

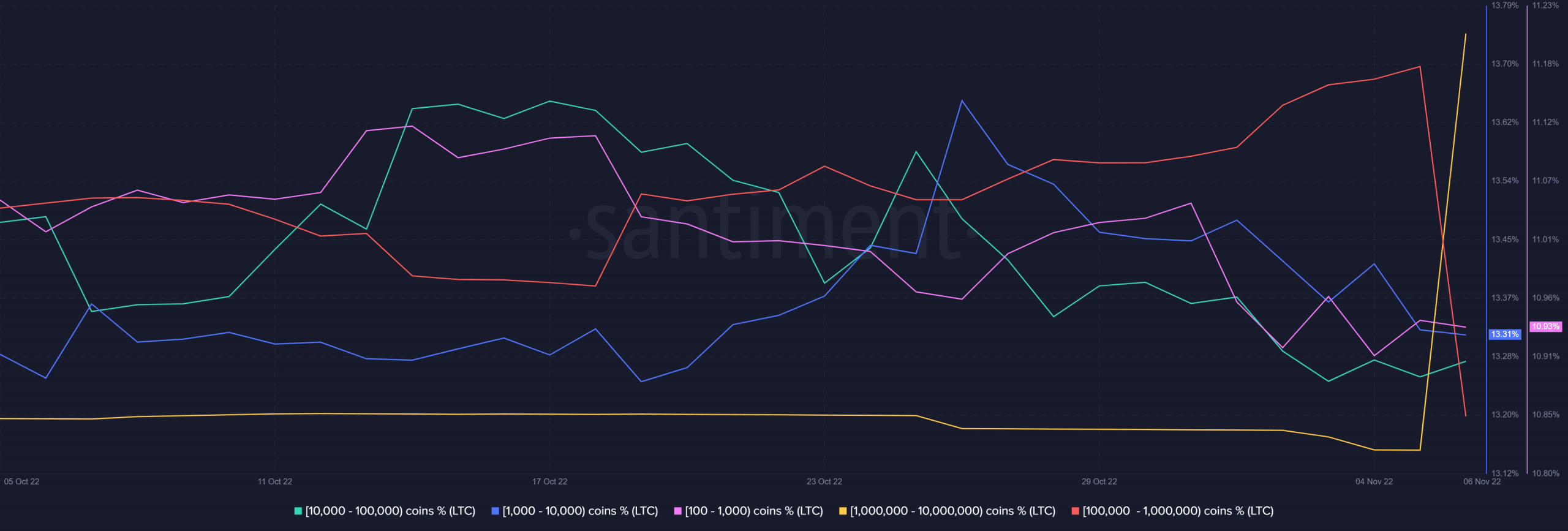

The best way to assess the prevailing demand levels is to look into what whales are doing. Litecoin’s supply distribution by balance of addresses reveals that large addresses holding over one million coins bought aggressively in the last 24 hours. This category of whales controls just 11.5% of the circulating supply.

The same metric reveals that addresses holding between 100,000 and one million LTC coins have been selling in the last 24 hours. Note that this category controls the largest share of the circulating supply at 34.5%.

The current scenario reveals a bit of a stalemate between the whales. More accumulation by top addresses may support some more upside.

Litecoin investors should watch out for changes among the top whales which could determine its direction in the next few days.