The extreme microeconomic factors, rising inflation, and increased energy cost have impacted the profitability of Bitcoin miners. Amid the ongoing bear market, many Bitcoin miners find it difficult to stay afloat and maintain their operation costs.

Moreover, the Bitcoin hash rate is surging, further increasing the pressure on miners. Most miners obtained high-interest loans, which they could not offset due to the current economic conditions.

According to a Bloomberg report, some mining firms like Core Scientific have warned investors of impending bankruptcy. Other Bitcoin miners, such as Iris Energy and Argo Blockchain, are among the mining firms feeling the pain from the harsh conditions.

HIVE Declares Debt-free Balance Sheet Amid Bearish Mining Returns

However, in all these difficulties, a Canadian Bitcoin miner called Hive Blockchain (HIVE) reportedly released its production report. The report revealed that Hive Blockchain has 3,311 Bitcoin worth $68.8 million.

The report showed that the mining firm is debt-free while its counterparts feel the pinch from the crypto winter.

In October, HIVE mined 307 BTC at an average of 115 BTC per exhaust. In a statement, the executive chairman of HIVE, Frank Holmes, confirmed how proud they are of the results. Holmes said they are happy to produce above 300 BTC monthly.

According to the CEO, they produced Bitcoin of about 1% of the global network, an all-time high despite the problems in the industry.

Glimpse Into Embattled Bitcoin Mining Firms

Argo Blockchain (ARB), a London-based Bitcoin mining firm, is facing insolvency issues. The firm is looking for a source of liquidity after the collapse of a $27 million fundraiser deal last week.

The deal’s failure caused ARB’s shares to plummet by 70%. Earlier in October, the firm signed a letter of intent to liquidate 27 million shares to an investor to ease financial pressures. However, the agreement did not pull through.

Meanwhile, North American-based Compute North, one of the top crypto mining data centres, filed for Chapter 11 bankruptcy. The firm reportedly owed $500 million to about 200 creditors.

Compute North announced news of a $385 million capital raise in February. The fundraising comprises an $85 million series C equity round and $300 million in debt financing. But due to the ongoing struggles in the BTC mining sector, the firm became bankrupt.

Compute North couldn’t maintain its operating costs due to rising energy costs and record issues in BTC mining. In addition, its CEO Dave Perrill resigned, while the chief operating officer Drake Harvey replaced him.

Furthermore, Core Scientific declared its inability to stay afloat after its shares declined 77% in October. According to the Firm, it would declare bankruptcy if other currently explored fundraising alternatives fail.

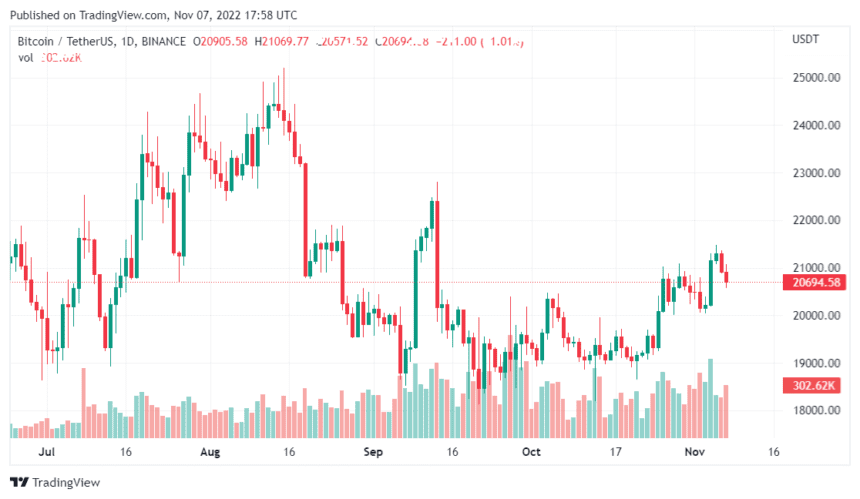

Featured Image From Pixabay, Charts From Tradingview.com