Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Polkadot pulls back to the 78.6% retracement level

- Two lower timeframe support zones to watch out for in the near-term

On lower timeframes, Bitcoin [BTC] had a bearish outlook after its inability to defend the $20k support zone. A drop below $19.2k would usher in further selling pressure, while a move above $20.2k could suggest a recovery was on its way. Bitcoin’s price development would likely have a strong say in the path of Polkadot on the price charts.

Here’s AMBCrypto’s Price Prediction for Polkadot [DOT] in 2022-23

Polkadot also had a lower timeframe bearish momentum. However, it approached a region of strong support on the charts. A bullish reaction in this zone could send DOT toward the $8 mark. In other news, Polkadot claimed that DOT, which was initially offered as a security, has morphed into software.

A pullback into a daily bullish order block- could the rally continue?

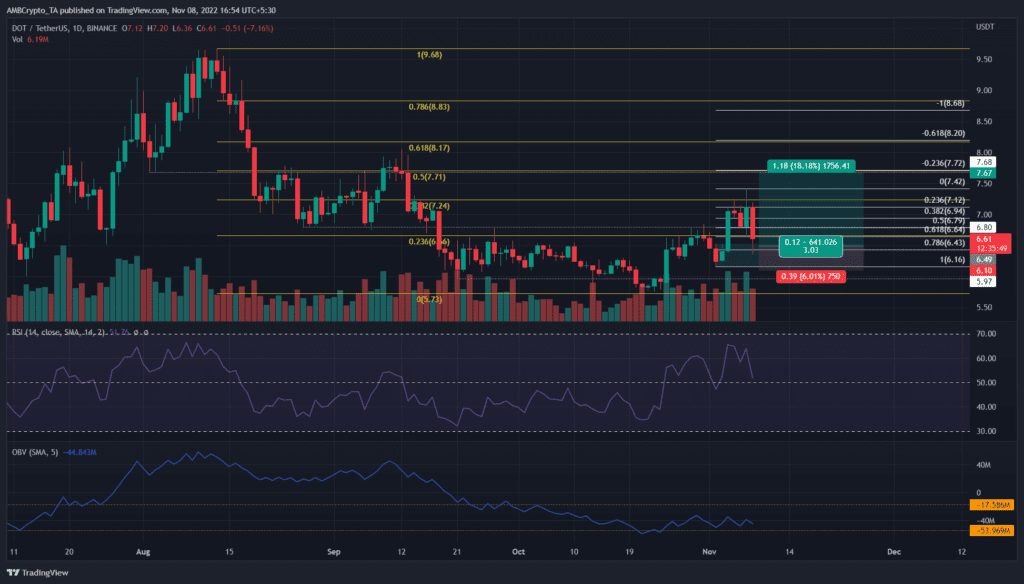

From 21 October, Polkadot witnessed sizeable gains. This could be stated considering DOT’s bounce from $5.73 on 20 October to $7.42 on 7 November, a move that measured nearly 30%.

However, 8 November came with a sharp retracement where DOT moved southward to the $6.4 area. The $6.9-$7 lower timeframe support was broken, but the higher timeframe bias remained bullish. This was because the $6.16 higher low of the rally was unbeaten yet. Moreover, this level has been a significant level of support since late September.

At $6.16, a bullish order block was observed. There was a good chance that this area would see a positive reaction from the price due to the confluence with the $6.16 support level.

Two sets of Fibonacci retracement levels (yellow and white) were plotted. They had confluence at $7.72 and $8.2. With DOT retaining its higher timeframe bullish structure, it was likely that a move above $6.8 could propel DOT to $7.7 and $8.2.

The Relative Strength Index (RSI) remained above neutral 50 on the daily chart to show that momentum remained biased in favor of the buyers. Yet, the On-Balance Volume (OBV) didn’t see a surge in recent days, which somewhat undermined the idea of a strong rally for DOT in the past week.

Development activity is on a downtrend, and weighted sentiment also down

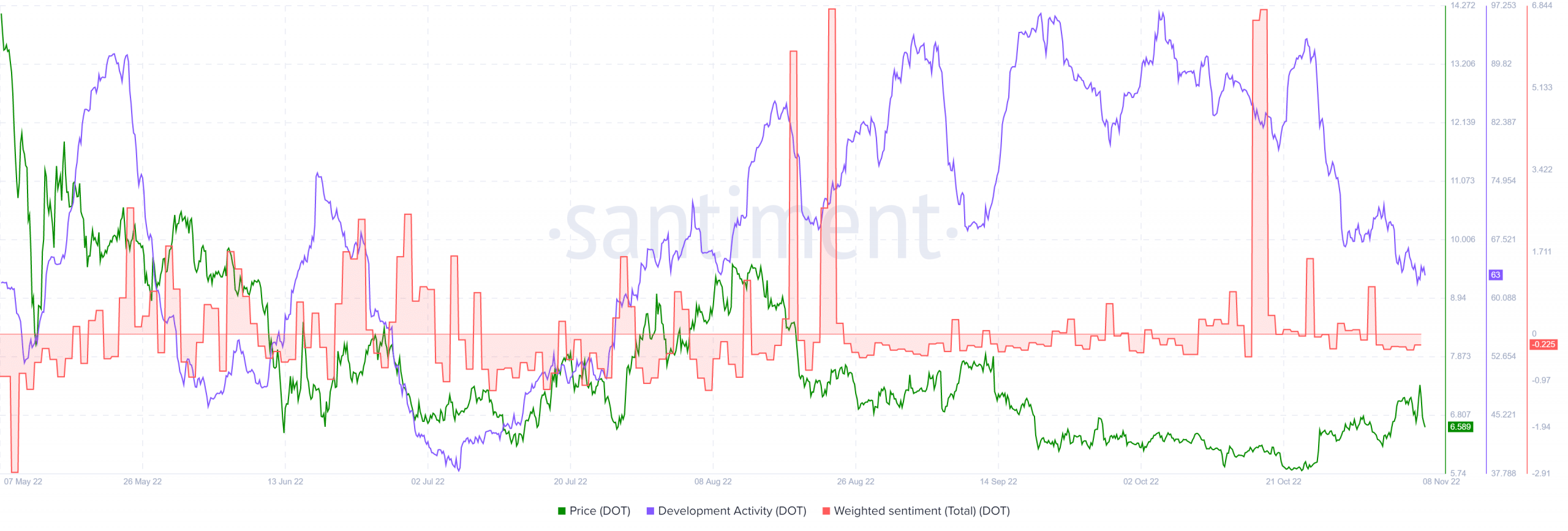

Source: Santiment

Despite the rally from $5.7 in October, weighted sentiment has not been positive. This suggested a lack of considerable positive engagement on social media, and could also point toward the lack of hype around DOT in recent days.

Development activity was also in a downtrend but remained well above the July lows. The funding rate remained in the positive territory on some exchanges over the previous day, with Binance and Okex being the exceptions.

If DOT can climb past $6.8 with a hefty buying volume, a push further north would become more credible. At the time of writing, the bearish sentiment behind Bitcoin in recent hours could see the king post further losses, which in turn would drag DOT southward.