It’s been a pop-and-drop show for the broader cryptocurrency market after the Fed commentary on Wednesday, December 15. However, one area that needs to be closely watched is the tremendously rising supply of Tether’s USDT stablecoin.

Well, this is obvious looking at the way the crypto markets have corrected and the liquidations have happened. A large number of traders have liquidated their positions and are currently holding USDT in massive quantities.

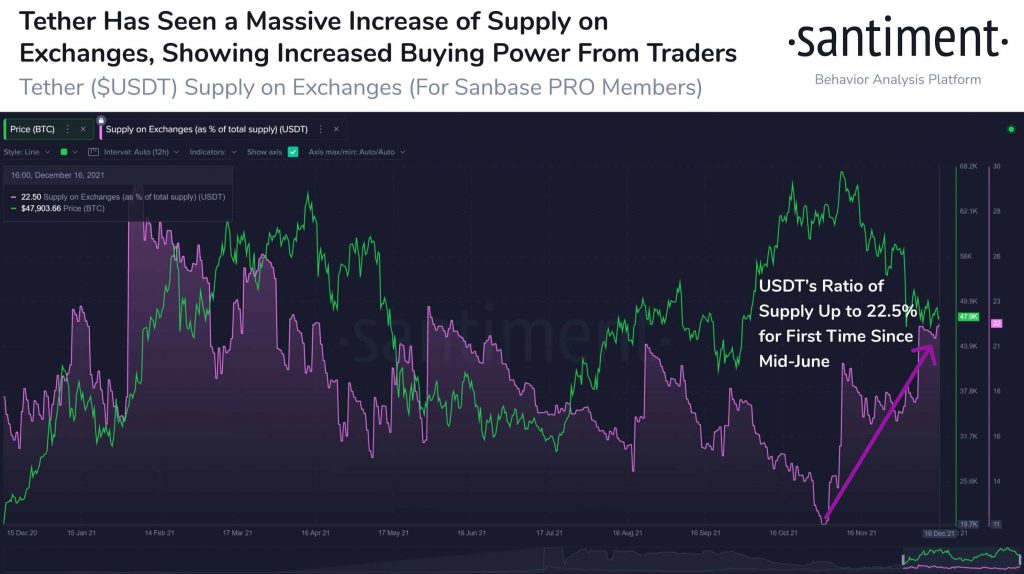

As per on-chain data provider Santiment, the supply of USDT stablecoins on the exchange has touched a 6-month high. The data provider notes:

The ratio of Tether stablecoins on exchanges has risen to 22.5%, which is the highest level in over 6 months. This amount of supply converts to $8.99B, indicating a rising level of buying power accumulating on exchanges.

Tether Issues $4 Billion Fresh USDT In a Month

Stablecoin issuer Tether has been quite aggressive in its USDT issuance this year. Just over the last month, Tether has issued an additional $4 billion worth of additional USDT with its market cap crossing $76.5 billion recently.

The Tether (USDT) supply to the crypto market has increased tremendously this year in 2021. If we look at the year-to-date chart, the USDT supply has jumped four-fold from $20 billion to nearly $80 billion.

Well, there have been multiple reports stating that Tether has been printing USDT from thin air without actually backing them 1:1 with the U.S. Dollar. However, Tether has denied all such allegations stating that it has all its reserves in place. On its website it noted:

“100 percent backed by reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables”.

Tether has been adopted even by some of the political parties. Recently, Myanmar’s parallel government NUG announced Tether’s USDT as its official currency. Tether has reciprocated calling it a bold move.