The growing inflation around the globe is no secret as consumer price indices have hit new highs in both England and the United States. While the U.S feds decided to keep the interest rates unchanged and accelerate bond tapering, the Bank of England (BoE) has a different mindset.

The inflation in the UK hit a 10-year high and the BoE responded by hiking the interest rates as a measure to contain the growing inflation. It also became the first major bank to increase interest rates since the pandemic began. The nine-member Monetary Policy Committee voted 8-1 to raise Bank Rate to 0.25% from 0.1%, with external member Silvana Tenreyro providing the only dissenting voice.

Governor Andrew Bailey said,

“We’re concerned about inflation in the medium term. And we’re seeing things now that can threaten that. So that’s why we have to act,”

The no-change in interest rate by the Feds on Wednesday helped the crypto market trade-in green as the majority of the crypto assets recovered to daily highs. With BOE’s increase in interest rate, the crypto market didn’t really react much it lost the gains from Wednesday.

Can the Omicron variant trigger the next bull rally?

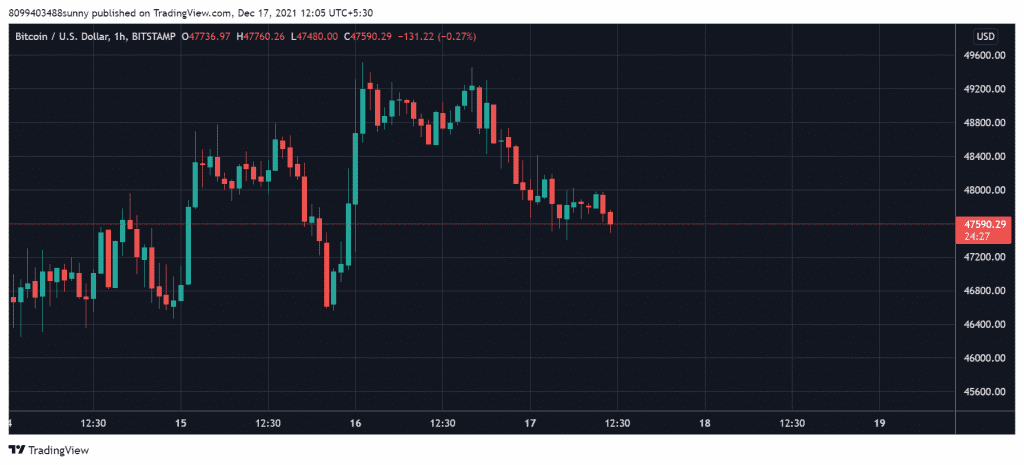

The crypto market had turned bearish in terms of monthly returns starting November and December looks worst as we head towards a new year. Bitcoin (BTC), the top cryptocurrency returned over $49K yesterday but failed to consolidate its position. BTC is currently trading at $47,533 with a 3% decline over the past 24-hours.

Ether (ETH), the second-largest cryptocurrency by market cap also lost $4,000 support again after reclaiming it yesterday. The altcoin is currently trading at $3,948 with eyes set on $4K. It has lost near 1.33% over the past 24-hours.

Apart from the top two cryptocurrencies, the rest of the crypto market also received a similar minor downtrend. As COVID’s third wave starts to show impact in the mainstream market, inflation hedges such as gold and silver will rise first, and just like the end of 2020, we can see a Bitcoin uprise that could extend well into 2022.