As the cryptocurrency industry continues to establish its legitimacy, an increasing number of institutional investors have flocked to the sector to reap its fruitful gains. However, the complications and constant evolution characteristic of digital assets have also led to the emergence of crypto-themed hedge funds. These are aimed at providing safer and diverse institutional-grade investment products to these investors.

Diversification is key

Their popularity and preferences are reflected in the fact that crypto-hedge funds managed to outperform Bitcoin in November, according to a recent Bloomberg report. While Bitcoin closed in November with a loss of 6.5%, hedge funds with diverse crypto-exposure lost only 2%.

Bitcoin has, in fact, been in trouble for almost a month now, as it continues to face resistance around $50,000. Since hitting a new ATH of over $69,000, the crypto has followed a downtrend. The same has seen it lose 31.9% of its value.

The saving grace for hedge funds has been portfolio diversification. This allows for exposure to a number of promising altcoins.

The biggest example of the same is Ethereum, with the same seeing gains of over 500% over the past year, compared to Bitcoin’s 67%. Similarly, there are other emerging altcoins such as Solana, now the 5th largest crypto after rallying by 10,650%. Even Terra, which has appreciated by 14,748%, has provided these funds with additional profits

An NFT-focused fund

With a growing appetite for these products and their continued success, asset managers are expanding their offerings in creative manners. Earlier this week, Bitwise introduced a new NFT-focused fund to add to its growing suite of newly launched crypto-products. Crypto-investment firm Pantera Capital also recently raised $600 million for its fourth fund, with about 75% of the capital coming from institutional investors.

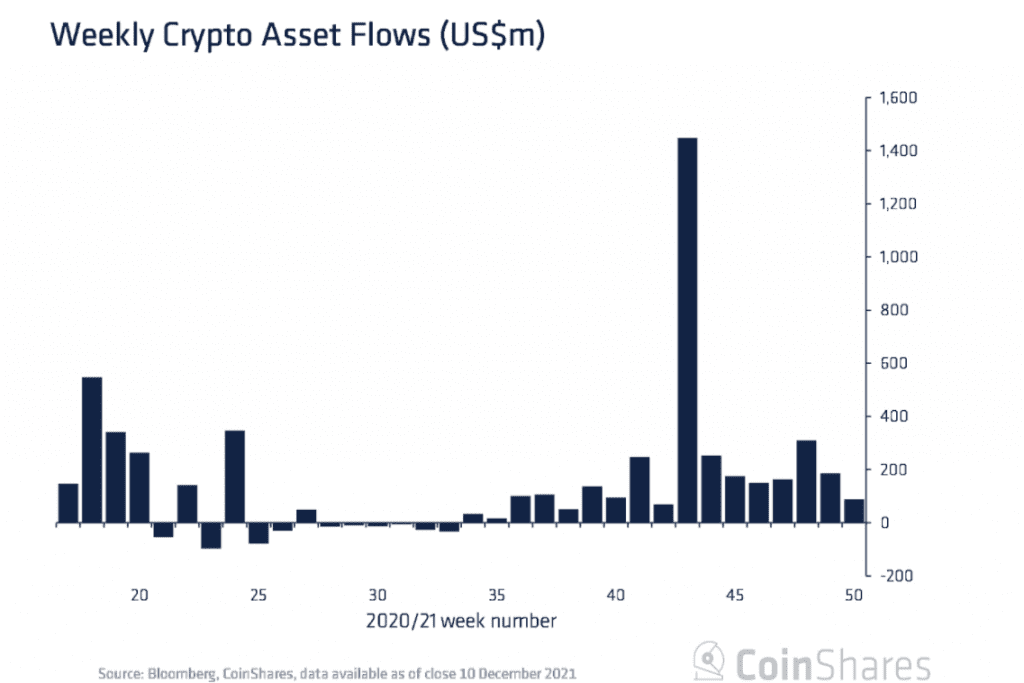

Another milestone was achieved by crypto-hedge funds recently when they hit weekly record inflows of $1.5 billion when the first BTC ETF was launched in the U.S.

Source: CoinShares

However, this surge has significantly mellowed down since, with the latest CoinShares report noting weekly fund inflows at $88 million for the week ending 10 December. It added that some providers saw outflows representing as much as 11% of assets under management (AUM), while others saw inflows of almost 14% of their total AUM. It further noted,

“Suggesting extremely polarised opinion amongst investors, with some panic selling during this most recent price decline, while others seeing it as a buying opportunity… All the panic selling was focused on Bitcoin last week.”