- SEBA has applied to join Arc, a permissioned layer on Aave’s DeFi ecosystem and pledged to bring with it a host of institutional clients.

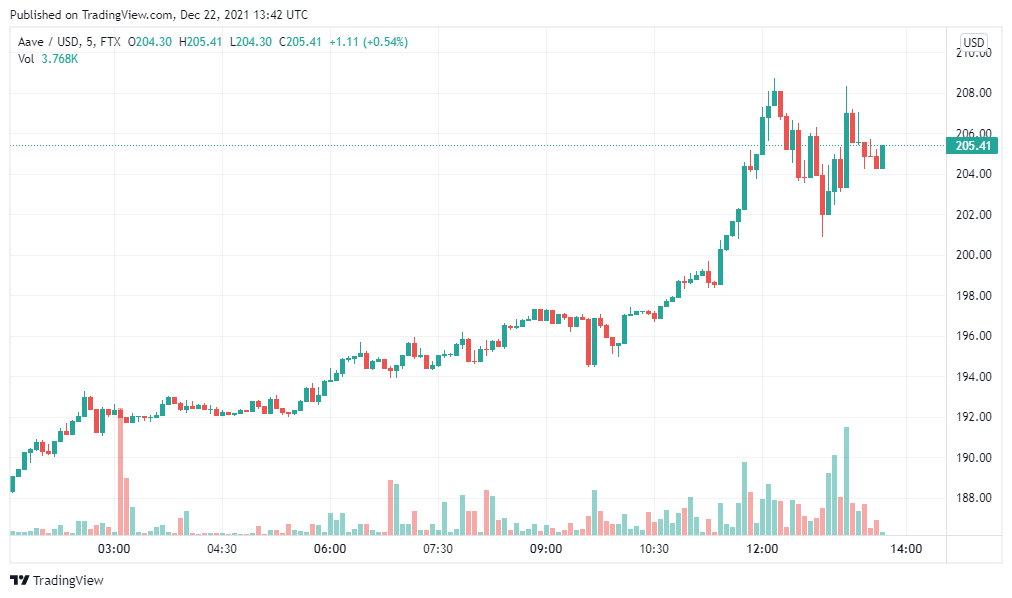

- The AAVE token has shot up 11 percent on the news and continues to outperform most of its DeFi rivals mainly due to a thriving ecosystem and strong tokenomics.

SEBA, a Swiss digital asset-focused bank, wants to dive into the world of DeFi, and it has picked Aave’s Arc platform to get started. The bank has applied to become a whitelisted member of Arc, pledging to bring institutional investors to the platform, world-class anti-money laundering (AML) practices and state-of-the-art security that attracts even more professional investors to the platform. AAVE gained over 11 percent following the news.

Arc is a DeFi platform by Aave that targets institutional clients. Rebranded from Aave Pro, the platform launched a few months back ad it allows these clients to access liquidity pools like the retailers, but only after they have been verified through a stringent KYC process. To become a whitelister on the platform, an institution has to apply to the Aave Governance, which is what SEBA has done. At launch, custody firm Fireblocks was the first to apply.

Read More: Aave Pro: The new gateway for institutional investors to enter DeFi market

In its application, SEBA noted that its clients are becoming increasingly interested in digital currencies, and DeFi ranks high on their wishlist.

“Due to various regulatory restrictions in their jurisdictions, SEBA’s institutional clientele has not been able deploy liquidities at large scale in Aave until now. The launch of Aave Arc with its permissioned layer represents a great opportunity for them to access DeFi yields while remaining compliant with their regulatory obligations,” the bank, which is based in the crypto valley of Zug in Switzerland, said.

What SEBA brings to AAVE

SEBA, if accepted by the Aave Governance as a whitelister, will be among the most high-profile on the list. And in its application, it outlined just what this means for it, and what it will bring to the Aave community.

The first is a large institutional client base eager to explore opportunities in DeFi. The bank boasts of having hedge funds, asset managers, large cryptocurrency firms and even private banks as some of its clients.

It outlined:

SEBA has a significant interest from its client base to participate in Aave Arc and with its tight connections to money managers in Switzerland and beyond, SEBA is ideally positioned to bridge institutional liquidities in the Aave Arc protocol.

The bank, which is well-regulated in Switzerland, will also bring industry-leading KYC and AML standards that would not only benefit other whitelisters, but also give the Aave community more legitimacy in institutional circles. SEBA is regulated by the Swiss Financial Market Supervisory Authority (FINMA), a globally recognized and respected body.

The AAVE price has appreciated since the news broke. At press time, the token is trading at $205, having gained 12 percent in the past 24 hours. It was the fifth-highest gainer in that time to now have a market cap of $2.75 billion. Despite the gain, the cryptocurrency trades less than a third of its all-time high which it hit in mid-May above $660.

Also Read: Aave founder confirms plans to build ‘Twitter on Ethereum’ this year