Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice

Dogecoin formed a range on higher timeframes and presented deviations which showed that the price was seeking liquidity. Another such deviation into the range lows would present a buying opportunity targeting double-digit percentage gains in the weeks/months to come.

Bitcoin’s rally from its $45.5k lows of last week was reflected in Dogecoin’s rally too.

Dogecoin 1-day chart

Source: DOGE/USDT on TradingView

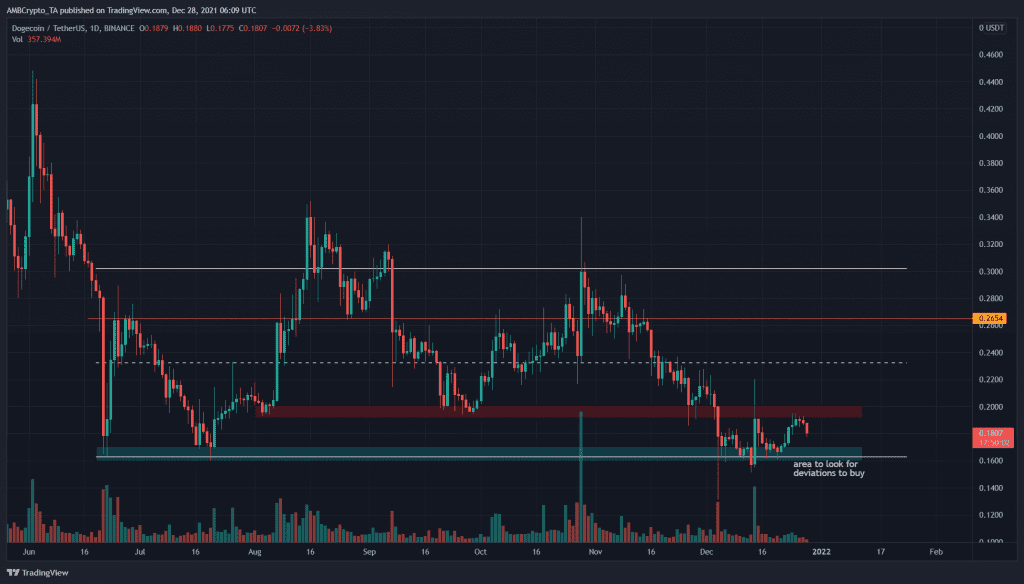

Back in June, Dogecoin established a multi-month range that was still respected, at the time of writing. The range lows and highs lie at $0.16 and $0.3, respectively, with some significant levels in between such as $0.265, $0.233, and $0.194.

The past couple of weeks saw DOGE tap the liquidity in the $0.16-area and run toward the $0.19-area in search of sellers. Subsequently, sellers did step in with strength and the small move reversed once more. Neither the Tesla-DOGE-merchandise news of 14 December nor the short-term rally last week was able to flip the $0.19-zone from supply to demand. This highlighted the importance of the $0.19-$0.2 area for DOGE bulls and bears.

The price action of December saw DOGE establish a miniature range between $0.16 and $0.19. This meant that price deviation into the $0.158-$0.152 area presented juicy buy opportunities with a long-term horizon.

Rationale

Source: DOGE/USDT on TradingView

On the RSI, 41.4 and 61.1 were levels that have acted as significant levels over the past few months. When DOGE dropped below 41.1 and stayed below on the daily, it indicated a strong downtrend in progress. Similarly, the RSI climbed past 61.1 to show strong bullish strength. Alas, it only managed to stay above 61.1 in August.

The MACD was slowly climbing back towards the zero line. The OBV has not formed a higher high nor a lower low over the past two months either.

Conclusion

Bitcoin and market cycles will most likely be the events that catalyze a strong move for DOGE. That is, Bitcoin has to register strong gains and consolidate while the capital rotates into major altcoins, including DOGE. This could spark the next move up.

Or, Dogecoin could face strong selling pressure and flip the $0.16-area from demand to supply in the coming weeks. While this was the less likely scenario, it was still a possibility. Until that happens, the $0.16-area (cyan box) will represent the most attractive risk-to-reward area to buy DOGE at.