The king coin’s six-day recovery of around 10% during the festive season, was met with over 8% losses over the last three days. As Bitcoin traded at $46,750 at the time of writing, a high year-end close seemed like a distant dream. Nonetheless, looking back at this volatile year for BTC, some things seem to have changed.

NYE hike plans on a wait

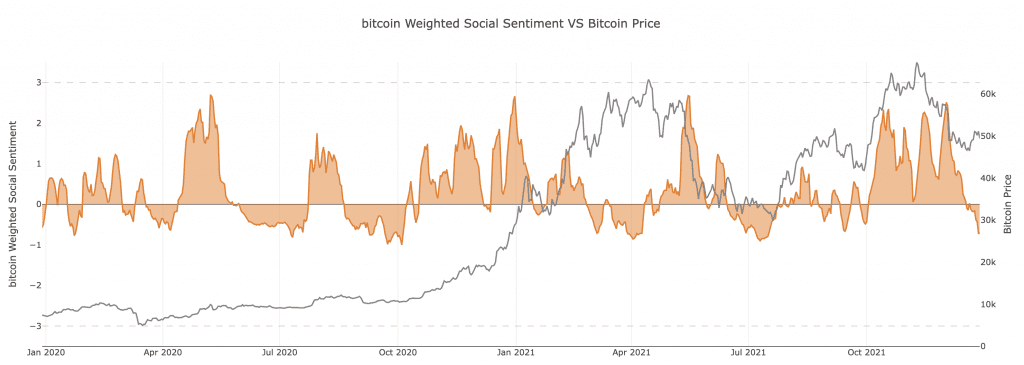

With price testing the lower bounds, the overall retail sentiment seems to have dipped in the past few weeks moving into the end of the year. The social sentiment remaining low is usually a positive sign for an asset and aids steady price growth as people remain disenchanted and in disbelief.

Further, both 7-day and 30-day MVRVs saw a major downfall highlighting BTC being undervalued at the moment. However a short-term reversal in the same sparks some optimism for the asset.

The 365-day MVRV too had fallen in the negative zone and a BTC fall to $40K would be justified in terms of MVRV. However, there was still room for growth.

Additionally, with younger coins being spent in the market, the recent shake-offs seemed to have not affected the older and more experienced hands. In fact, the average age of the BTC being spent is declining.

Bitcoin’s Network Profit Loss shows some dips and Exchange Inflows show spikes into price drops. This could mean that there are people who are immediately ‘panicking’ about the crash. This further flushes out weak hands as sell-offs take over.

It could also mean that participants are perhaps fixing profits for the year for tax optimization purposes. However, people selling on dips in general present bearishness as they believe the price would go lower in the near future.

So, what’s next?

The year 2021 on a larger scale has been the time of institutions entering the crypto market in the majority due to hedging the inflation driven by Covid-19. Inflation narratives fueled BTC’s image as an inflation hedge and a store of value as Bitcoin still presented over +62.56% yearly returns.

A worrying sign in the short term is the downtrend seen in whale entities. A pretty significant chunk of money was being offloaded by addresses with 100 – 10,000 coins. A fair percentage of which seemed to make the larger market skeptical of any moves.

Further with circulation continuing to go down every week since November the amount of Bitcoin being used over the network is declining. In the near term if the NVT ratio starts to look red the same could signal a BTC dip towards the $42K level.

However, despite the recent fall, the current market status is no buy, no sell, but HODL, which supports ranging prices in the near future. Retail newcomers might enter the market when ATH reaches and triggers FOMO in the coming year. However, for now, BTC’s price could continue the rangebound movement.