Bitcoin’s price trajectory post-November has been a major concern for investors as well as institutions. In fact, the king coin’s price action also had an effect on Grayscale’s digital asset portfolio. Well, Grayscale Investments is currently holding $43.6 billion as assets under management (AUM) under its various crypto offerings.

December 2021

12/31/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $43.6 billion$BTC $BAT $BCH $LINK $MANA $ETH $ETC $FIL $ZEN $LTC $LPT $XLM $ZEC $UNI $AAVE $COMP $CRV $MKR $SUSHI $SNX $YFI $UMA $BNT $ADA $SOL pic.twitter.com/vCkExTIjHh

— Grayscale (@Grayscale) December 31, 2021

As per the manager’s last tweet, Grayscale’s digital asset portfolio has gone down by some 19% when compared to its AUM of $53.9 billion earlier in December.

It is noteworthy that the fall is bigger against a November AUM figure of $60.9 billion. However, despite the fall, the Digital Currency Group claimed to be one of the largest digital currency asset managers in the world.

This largely owing to the fact that the AUM decrease has followed a sluggish price action in Bitcoin and other major cryptocurrencies. Bitcoin’s 62.6% return in the last 12 months is accompanied by an over 17% monthly fall in ROI in the last month and -7% in the last week. The 24-hour range at press time remains under $50K between $45,701.91 and $48,779.11 on CoinGecko. Moreover, at the time of writing, Bitcoin’s Dominance Ratio remains close to 40%, improving the outlook for altcoins.

Over the last year

Looking at the Grayscale Bitcoin Trust with an inception date of September 2013, it is the oldest and the largest fund in the basket that has returned 31,278.57% since the beginning. GBTC has a reported AUM of $30.4 billion as of 31 December. It follows the Grayscale Ethereum Trust as the second-biggest holding of $11.6 billion. Despite a significant fall during the currently bearish market sentiments in all these funds under management, Grayscale has seen massive growth over the last year. When we look at December figures of 2020, the current figure of $43 billion has grown up from AUM of $13 billion as of 14 December 2020.

12/14/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $13.0 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/3KCMu0z8Dy

— Grayscale (@Grayscale) December 14, 2020

That being said, GBTC and ETHE have grown from a fund size of $10.82 billion and $1.72 billion respectively in the same period.

It is also noteworthy that ResearchAndMarkets.com’s institutional interest report had stated that GBTC and Grayscale Ethereum Trust are popular cryptocurrency funds through which investors gain exposure to BTC and Ether. Thus, adding,

“[It] is an important measure of institutional interest and confidence in Bitcoin and other cryptocurrencies.”

The Metaverse

On the latest figures, Grayscale also holds $61.3 million on its Decentraland Trust that provides exposure to the metaverse and was started in February 2021 amid skyrocketing interest in the sector.

In a company blog post, Head of Research David Grider had noted that,

“It is estimated that revenue from virtual worlds could grow from ~$180 billion in 2021 to ~$400 billion in 2025.”

Further adding that the continued shift of game developer monetization is a key dynamic within this growth trend.

Other funds

Moving forward, we also need to note that another $510.6 million is under Grayscale’s Digital Large Cap Fund. However, $11 million sits on its DeFi fund. The DeFi fund has returned 5.20% since inception.

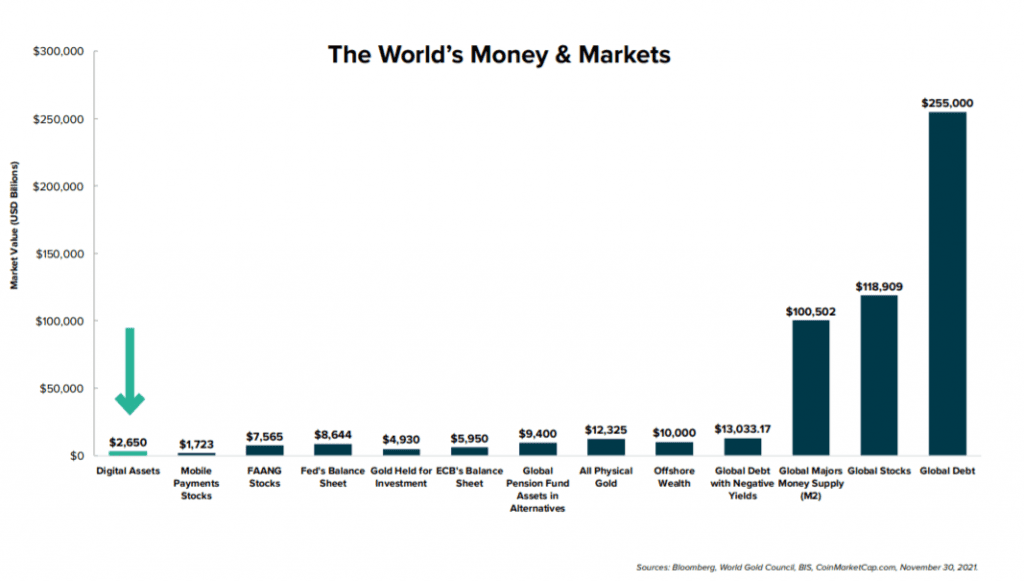

Notably, with that, Grayscale has noted in its December research that in relative terms, digital assets are still only a fraction of the size of other markets.

That being said, here’s a word of advice on Grayscale’s largest fund by Peter Schiff himself,

finally, something logical from CT’s strongest proponent… 🤣 $GBTC https://t.co/BBtNurpTfH

— Sonnenshein (@Sonnenshein) December 30, 2021