Ariane Capital, a traditional family office involved in the cryptocurrency market since 2014, is launching an ARBA SPIN, a certificate actively managed with a long-term directional objective.

The fund mixes the fundamental analysis of the crypto with the ability to seize opportunities identified within for best returns.

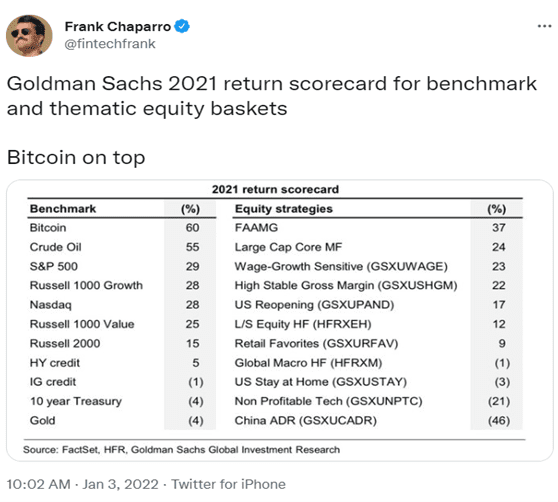

Over the past two years, the crypto industry gained mainstream attention and mass adoption, and traditional financial institutions increasingly started seeking exposure to this new asset class as well.

With demand for crypto assets evolving, Ariane Capital noted that its clients have been seeking out long-term directional exposure, and to cater to this rising demand, the firm launched ARBA SPIN to offer absolute performance.

The ARBA SPIN yielded +12.5% in its first month after launch and in a bear market. Ariane Capital attributes this performance to the “alpha generator qualities of the management team, who were able to identify several significant opportunities.”

Despite being a conservative family office, it has been seeing “growing demand” from its clients, said Benjamin Guez, co-founder of the multi-family office Ariane Capital, in an interview. The fund applies a risk management methodology with existing tools such as options or futures.

“The market is now aware of the underlying assets’ volatility and wishes to have a dedicated risk allocation given the strong potential of the crypto asset class in this universe,” Guez said.

Being Early and Strong

Ariane Capital, one of the very few operators in the European financial market, already has its arbitrate fund ARBA FUND available, whose objective is to be decorrelated from the market. It was the first regulated and structured arbitrage fund on the market.

During the downturn of May last year, where the crypto market reported losses of more than 50%, the ARBA Fund had a monthly performance of 0.12%. But as the crypto sector evolves and continues to gain adoption, arbitrage gaps and opportunities are shrinking, resulting in a 15% return in 2021 compared to 2020’s performance of +41.75%.

The technology-focused family office, Ariane Capital, got into crypto at an early stage about eight years back. At the time, the cryptocurrency sector was still opaque and new, and it took a few years for the firm to open a bank account and offer liquidity to its clients.

The firm has since then gathered a team of financial market professionals and experienced fund managers specializing in a proper risk management approach to offer services ranging from legal structuring to the opening of depositories.

It now also has the internal capability to analyze the crypto universe, invest in it, and support its development.

Being early in the game means, “it allowed us to be ahead of and in sync with the whole crypto universe,” said Guez.