The Bitcoin dominance rate (BTCD) has been decreasing since Oct 2020 and reached its lowest value since 2018 on Jan 3, 2022.

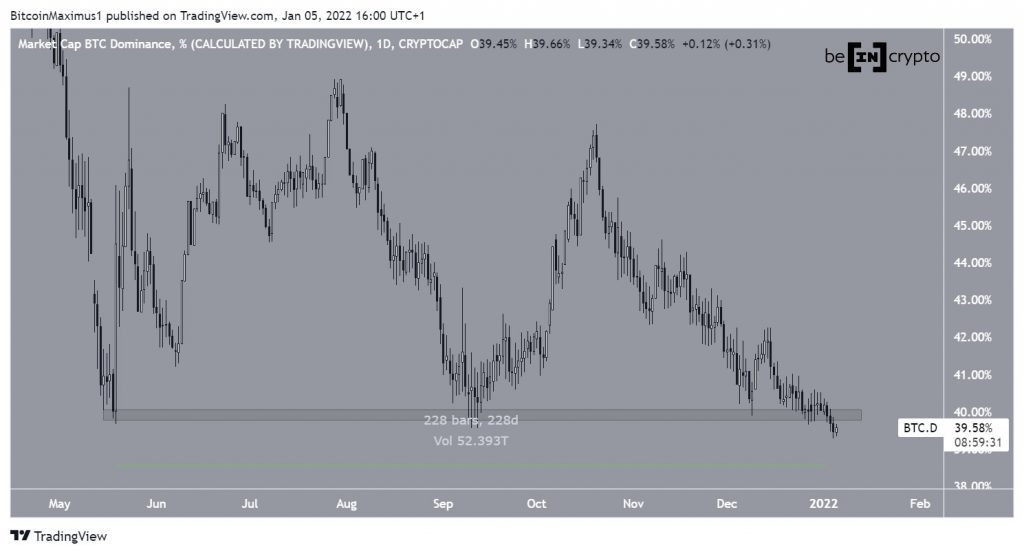

BTCD had been trading above the 40% horizontal support area since May 2021, or more exactly for 228 days. The area initiated two bounces, the second of which was weaker than the first one.

On Jan 3, it broke down from this area, in what is potentially the beginning of a longer-term downward movement.

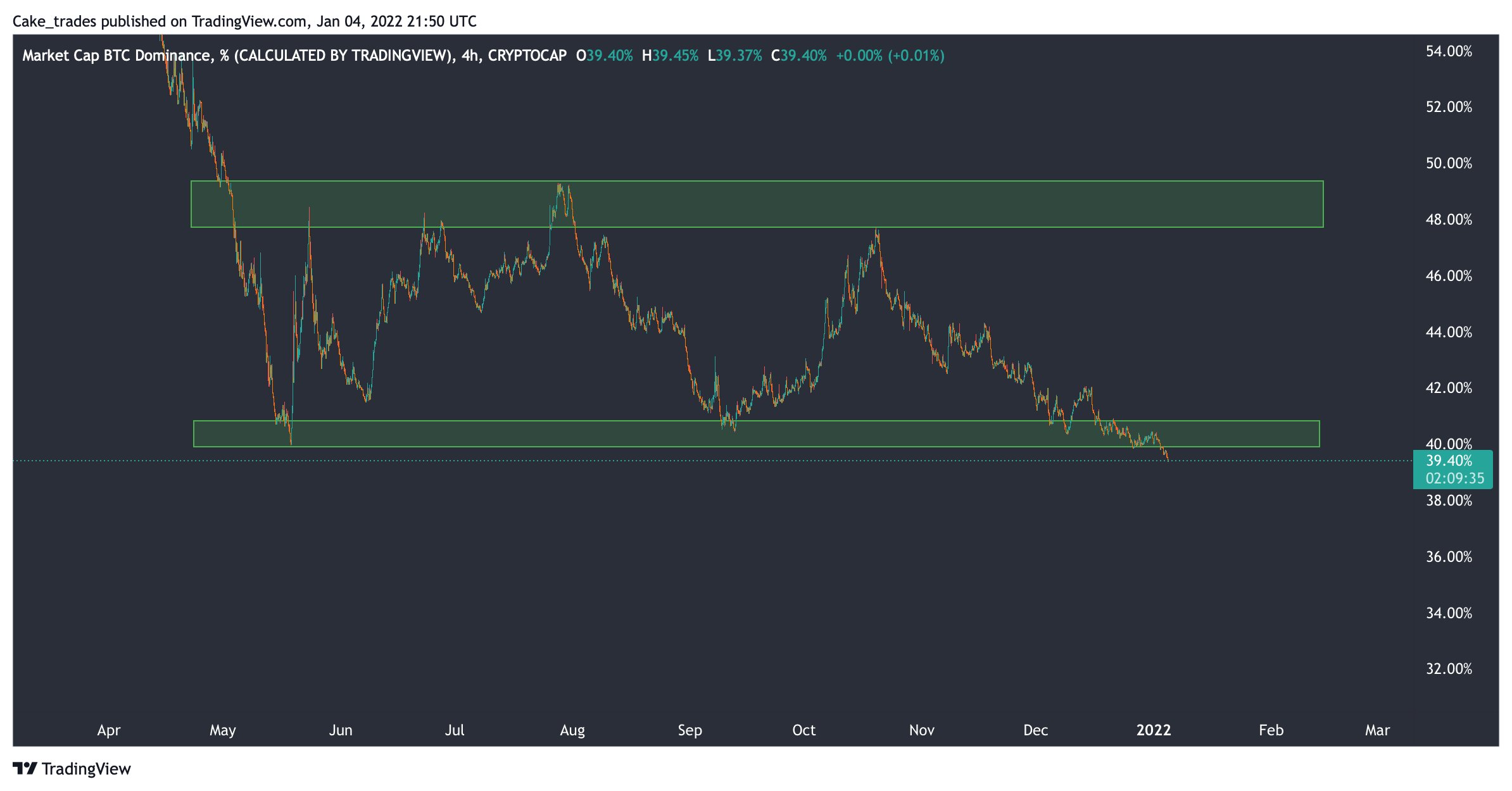

Cryptocurrency trader @kucakeC tweeted a BTCD chart, which shows that the token has fallen below a long-term support area. This is the same area outlined in the image above.

Current resistance

The daily chart also shows that BTCD has been following a descending resistance line since Oct 19. Currently, it is testing it alongside the 40% horizontal support area, which is now acting as resistance.

Due to the confluence of these two factors, this is a very significant resistance area.

If BTCD were to break out, the closest resistance area would be at 42%. However, as it stands, there are no signs that suggest a breakout will occur.

Future BTCD movement

In the longer-term, BTCD has been falling since the beginning of 2021. The decrease looks like a five wave downward movement (black), in which BTCD is currently in the fifth and final wave.

The most likely target for the bottom of the movement is at 34%. The target is found using the 1.61 external retracement of wave four (black) and the length of wave one (white).

After the target is reached, an upward movement would be likely.

Therefore, while an absolute bottom has not been reached yet, it is likely that it will be reached soon.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.