The world’s largest cryptocurrency continues to test lower levels while moving below $42,000 levels at the start of the weekend. While it’s difficult to predict any bottom at this point, some useful indicators can help us in deciding the further line of action.

The Bitcoin Fear and Greed Index has dropped to the lowest since July 2021. This shows that there’s extreme fear among Bitcoin investors and as per historical trends, it could be a good time for Bitcoin Dip Buyers.

The Crypto Fear and Greed Index fell to 10, the lowest since July 21, 2021. pic.twitter.com/ZNbTnuH3cb

— Wu Blockchain (@WuBlockchain) January 8, 2022

Benjamin Cowen, another popular crypto market analyst from CryptoQuant, said: “We do not usually go this low on fear and greed (for Bitcoin). If we bounce here, I’m not convinced we won’t revisit these prices, but some short-term relief would be nice. Daily RSI is also technically oversold, $40k-$42k is theoretically a support area too”.

Speaking to CNBC recently, Wall Street veteran and Galaxy Digital founder Mike Novogratz said that Bitcoin could seek a bottom either at $40,000 and the next at $38,000. Novogratz believes that institutional players are waiting for an entry at this level as we can see fresh capital flowing into it very soon.

Key Bitcoin Metrics to Watch Out

As per the recent report from CoinGape, some of the top-tier whale addresses have already started buying the dips! Of the top 100 Bitcoin addresses, three of them have increased their holdings by a minimum of 1000 BTC.

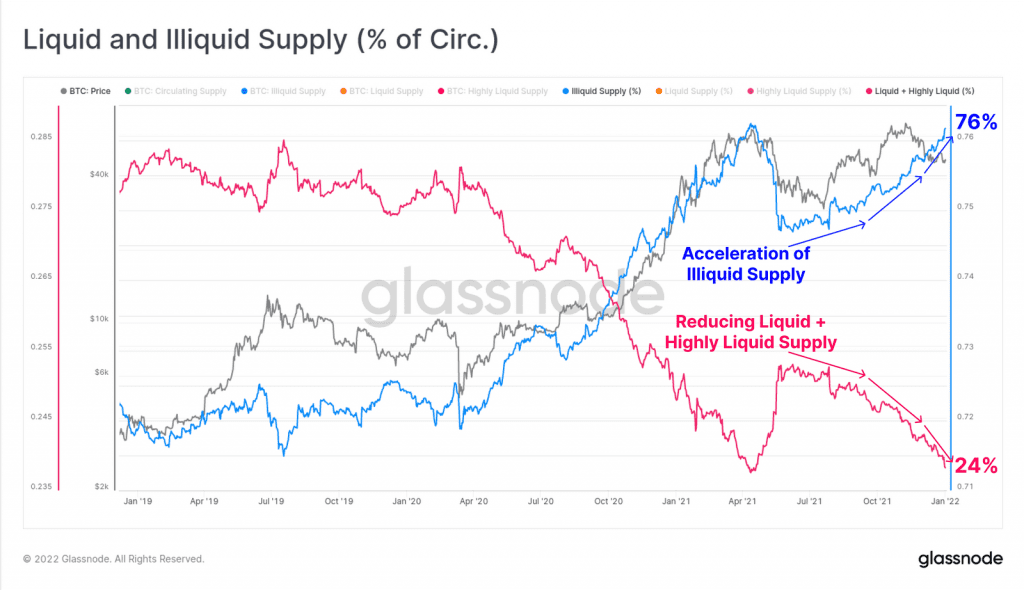

Furthermore, despite this current downtrend, the Bitcoin liquid supply has been on the rise. Meaning a lot of Bitcoin accumulation is happening and moved off the exchanges by HODLers. This clearly shows that Bitcoin bulls are quite positive over the long-term prospects for the cryptocurrency.

It will be interesting to see whether or not Bitcoin will reverse its downward trajectory. But considering the fact that Bitcoin has already corrected 40% from its all-time high of $69,000, this could be a good buying zone for investors.