FTX Token (FTT) has bounced at a crucial support area and is showing strong signs of a bullish reversal.

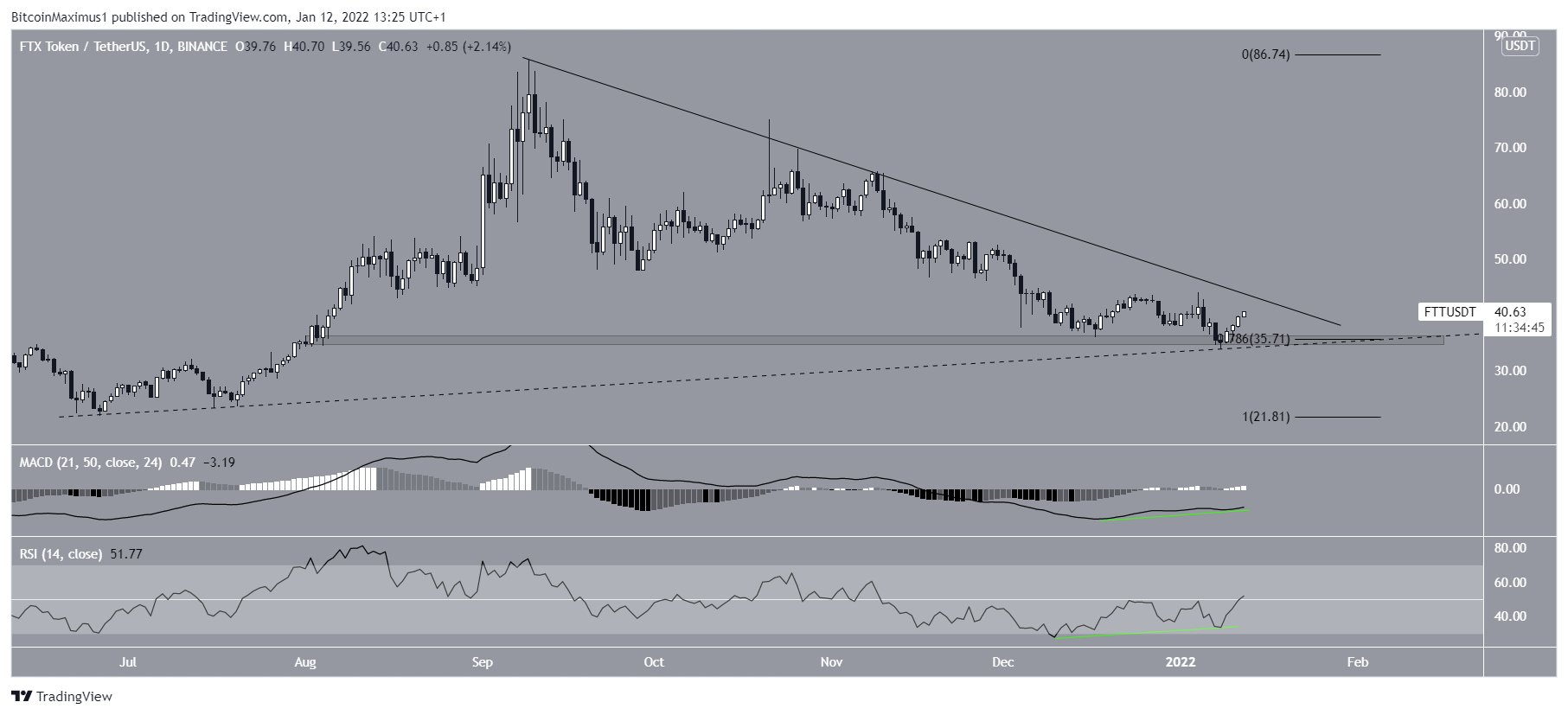

FTT has been decreasing alongside a descending resistance line since reaching an all-time high price of $85.74 on Sept 9. The decrease led to a low of $33.76 on Jan 8.

The token bounced afterwards, potentially validating an ascending support line (dashed), that has been in place since June 26. FTT is approaching the resistance line once more.

If a breakout transpires, the closest resistance would be at $53.5 – $59.7. The area is created by the 0.382-0.5 Fib retracement resistance levels.

Future movement

Trader @0xd0n tweeted a FTT chart, stating that the token has bounced at a crucial support level.

The daily chart shows that FTT bounced right at the 0.786 Fib retracement support level at $35.7. This is also a horizontal support area, further increasing its significance.

Furthermore, technical indicators are decisively bullish.

The MACD, which is created by a short- and a long-term moving average (MA), is moving upwards and is nearly positive. More importantly, it has generated a significant bullish divergence (green line), an occurrence which often precedes bullish trend reversals.

The RSI, which is a momentum indicator, has also generated bullish divergence. In addition to this, it has moved above 50, a level which is considered the threshold for a bullish/bearish trend.

Therefore, an eventual breakout from the resistance line seems likely.

FTT wave count analysis

The decrease ensuing after the Sept 10 all-time high could be an A-B-C corrective structure. There are several reasons for this.

First, the preceding upward movement (highlighted in green) resembles a bullish structure, since it is a five wave upward movement.

Secondly, waves A:C have an exactly 1:1 ratio, which is very common in such structures.

FTT has to move above the Sept 21 lows at $47.8 in order to confirm this count. This would also cause a breakout from the long-term descending resistance line.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.