While the DeFi space has seen a lot of traction in the past few years, the DeFi derivatives space faces a lot of problems that need to be solved in order to make it more open and easy-to-navigate for traders in a secure manner.

One of the platforms that are solving the issues in the DeFi derivatives space is ClearDAO. The ClearDAO platform puts forward an open protocol that would work for risk management of decentralized derivatives while allowing users to take on buy and sell positions and create financial derivatives with a profile that is risk-controlled.

What is ClearDAO?

ClearDAO presents for users a flexible protocol for open derivatives enabling them to control risk rationally and effectively. They also aim to create a derivatives ecosystem that would allow users to freely assume seller or buyer positions and also easily create a financial derivative with a controllable risk profile.

The platform intends to function as an open protocol for decentralized derivatives and support multiple mainstream public chains with interoperability. ClearDAO will have 4 core layers including the public chain layer, interoperability layer, protocol layer, and application layer.

Key features

Some of the major features of the ClearDAO platform are:

- Built for the community: ClearDAO is clear on its mission of inviting community members to launch multiple trading platforms. Different interface implementations are available on the frontend like gamification.

- Dynamic risk management: A two-tier reserve pool system has been deployed that provides users with a dynamic risk management system for derivative instruments. This module helps trading platforms enhance stability while also minimizing the resources that are required.

- An adaptable SDK: SDK is the core product of the ClearDAO platform and the platform is dedicated to adding support for more asset classes and derivative templates that would help to expand and compose it with time.

How does it work?

Software Development Toolkit or SDK are templates and tools that will help developers and traders to create notes, futures, options, and swaps in a cost-effective manner. Marketplace templates are also available in the SDK to enable rapid creation of decentralized exchanges of derivative contracts.

ClearDAO’s SDK has 3 main components along with its derivative workshop that lets users create their custom-fit derivatives with the aid of ready-to-use tools. Adding to this, they have an open marketplace that allows open-source code to be readily available for white label exchanges.

The platform also has risk management tools along with quantitative risk data that lets traders macro hedge and manage the risks on their portfolios.

Derivative templates offered

ClearDAO plans to offer 4 major template types to its users:

- Notes: These are structured notes that can be customized according to allocations as per various investable assets.

- Options: Some of the options styles that are given to users include vanilla, barrier, binary and digital. Exercise styles include European, American, and perpetual.

- Swaps: Coin default swaps (CDS) and token return swaps (TRS) are also offered to users.

- Futures: Perpetual futures will be the first template available in this category.

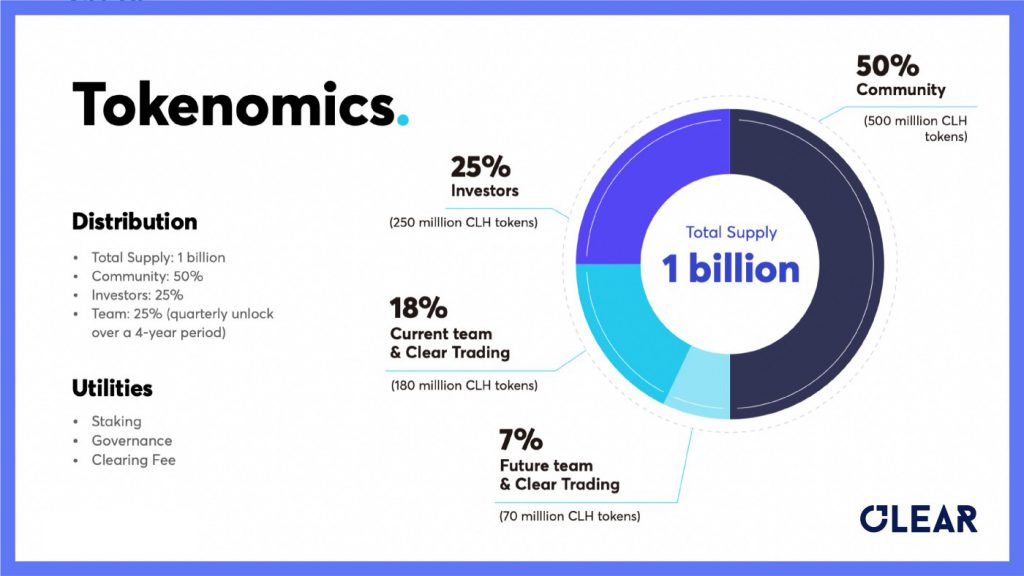

Token distribution

CLH is the native token of the ClearDAO platform with a total supply of 1 billion. A 50% share is set aside for the community, while another 25% is for the investors. 18% is reserved for the current team, the remaining 7% is for the future team. The CLH token has a lot of use cases like staking, governance, and access to priority trade clearing.

ClearDAO recently launched its token sale on KuCoin using the proportional distribution model. The supported trading pair on KuCoin is CLH/USDT. Gate.io also listed the CLH token.

The CLH token is focused on providing users utilities such as governance, enabling holders to vote on proposals and submit recommendations.

Final word

ClearDAO brings with it an innovative approach of providing an open-source platform for financial derivatives trading and development. This is important not only for traders but also for the DeFi derivatives sector which is in its early stages. As mentioned earlier, SDK is the heart of the ClearDAO project and its integration with Chainlink Oracle promises to bring value, security, and appropriate pricing for token holders and users.

When all of ClearDAO technology and governance tools are developed as specified on the project roadmap, any updates to its core capabilities will fall under DAO framework, giving back power to its token holders.

For more information on ClearDAO, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.