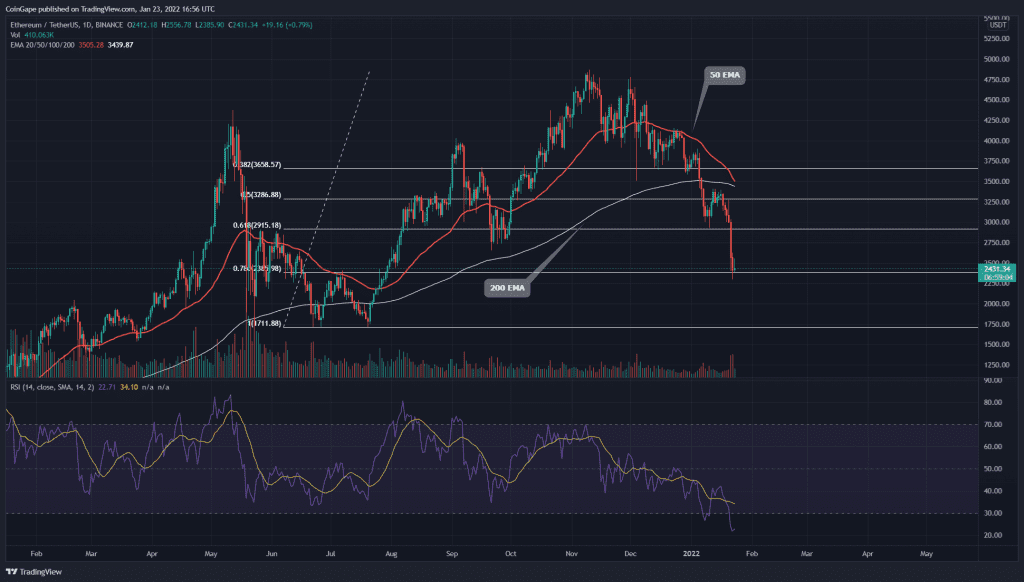

The Ethereum (ETH) price extends its correction rally as the coin loses the $3000 support. The sudden pump over last few months in ETH/USD pair has dropped to the 0.786 Fibonacci retracement level, trying to identify sufficient support. However, a death crossover among the crucial EMAs promotes downfall continuation.

Key technical points:

- The daily-RSI Slope plummeted to the oversold region.

- The 50-and-200-day EMA hints at a bearish crossover

- The intraday trading volume in ETH/USD is $1.19 Billion, indicating a 3% fall.

Source- Tradingview

In our previous coverage of Ethereum technical analysis, the ETH/USD pair displayed recovery signs at $3000 support; however, the coin failed to breach the 200-day EMA reverts and continued to drop lower.

The ongoing sell-off in the crypto market formed six consecutive red candles, which devalued the ETH price by more than 28%. The coin price currently trading at 2424% shows a 50% loss from the All-Time High of $4870.

The ETH/USD technical chart shows the 50 and 200 nearing a deathcross, fuels the current bearish sentiment. Moreover, 20 EMA line provides dynamic to ETH price.

The daily-Relative Strength index(43) slope has plunged to the oversold territory,

Will ETH Bulls Sustain The $2400 Mark?

Source-Tradingview

The ETH prices show a free fall with the breakout 0.618 Fibonacci retracement level which halts near the 0.786 Fibonacci retracement level. The coin price struggles to sustain above the $2300 mark: however, the evening star pattern in the 4-hour chart indicates a possible bearish continuation.

The Average Directional Index (53) shows a rise in the falling trend momentum in the 4-hour chart. Therefore, the indicator suggests a high possibility of a downfall below the $2300 mark.

- Resistance levels- $3000, $3670

- Support levels are $2400 and $2000.