The recent bloodbath in the crypto market took a significant toll on the majority of cryptocurrencies. Even the top coins in the ladder have lost half their value, indicating a declining trend in the price chart. However, this panic selling has brought special discounts to a few coins that can provide massive returns in their potential rally.

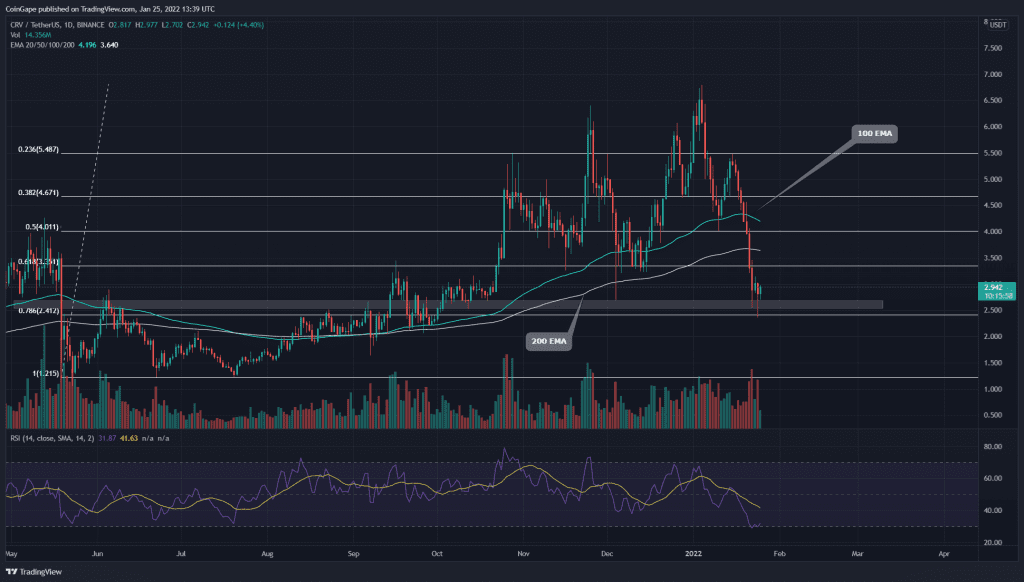

CRV Price Hints Recovery Signs At 0.786 Fibonacci Level

Source-Tradingview

On January 4th, the CRV token rally made a new higher high at $6.7. Later the price action entered a correction phase which discounted the price by 40% in just one week. The bulls attempted a relief rally from the $4 support but couldn’t surpass the $5.5 mark as the sudden sell-off in the crypto market triggered a free fall in CRV price.

This recent fall tumbled the coin by 65% from the previous swing high of $6.7 and plunged it to 0.786 Fibonacci retracement level. The coin chart shows several lower price rejection candles at this support, indicating the pressure high demand support.

The daily-RSI(32) slope barely touched the oversold neckline(30) and has started to rise again.

If the CRV price could sustain the $2.6 support, the crypto traders can mark a stop loss at $2.28 (-20%) with the expected target of $6.7(+125%), indicating a 7.7 risk to reward.

Descending Trendline Breakout Holds Key To Bullish Rally

Source- Tradingview

The RUNE price has been under a short-term downtrend since November 2021. The technical chart shows the price has faced multiple resistance from a descending trendline, which has plummeted the price to $3.4 yearly support level, indicating an 80% loss from the previous swing high of $17.3.

A daily-hammer candle formation indicates the buyer’s interest in this discounted price. However, a breakout from this falling trendline will provide better confirmation for a new rally.

Furthermore, the daily-Stochastic RSI indicator provides a bullish crossover between the K and D lines at the oversold region, supporting a bullish reversal.

The crypto traders entering a long position can place their stop loss at $2.79(-29%), for a possible gain to the $17.3 mark(+335), indicating a 10.8 risk to reward.

Falling Channel Bring Bullish Opportunity In LRC Coin

Source- Tradingview

The LRC correction phase began in November 2021 dropped to the $1.63 mark. However, the selling renewed as the crypto market expired a sudden sell-off and plunged to the $0.75 flipped support, indicating an 80% devaluation.

Moreover, the coin price is currently at combined support of $0.75 and the support trendline of a falling channel pattern. The LRC price rebounded from these support levels, with an inside day candle that could eventually break out from this chart pattern.

The daily-RSI(32) slope recovered from the oversold territory indicates increasing strength in-market buyers.

The long position traders can maintain their stop loss at $0.63(-30%), with growth potential to the $3.77 mark(+317), indicating a 10.1 risk to reward.