Bitcoin (BTC) starts a new week with a bang — but not in the right direction for bulls.

A promising weekend nonetheless saw BTC/USD attract warnings over spurious “out of hours” price moves, and these ultimately proved timely as the weekly close sent the pair down over $1,000.

At $37,900, even that close was not enough to satisfy analysts’ demands, and the all-too-familiar rangebound behavior Bitcoin has exhibited throughout January thus continues.

The question for many, then, is what will change the status quo.

Amid a lack of any genuine spot market recovery despite solid on-chain data, it may be an external trigger that ends up responsible for a shake-up. The United States’ executive order on cryptocurrency regulation is due at some point in February, for example, while exact timing is unknown.

The Federal Reserve is a further area of interest for analysts, as any cues on inflation, interest rate hikes or asset purchase tapering could significantly impact traditional markets, to which Bitcoin and altcoins remain closely correlated.

With frustrating times characterizing the first month of 2022, Cointelegraph takes a look at the state of the market this week.

We’ve identified five things worth considering when working out Bitcoin’s next moves.

Bears “hammer” down on BTC weekly close

Even the meagre gains into the weekly close were a short-lived reason to celebrate for Bitcoin bulls this Sunday.

Midnight UTC saw an immediate rejection candle sweep in, with BTC/USD diving to $36,650 on Bitstamp.

As noted by trader, analyst and podcast host Scott Melker, strong volume accompanied the move, underscoring the unreliable nature of weekend price action when it comes to building a position.

As several other sources said last week, Melker reiterated that $39,600 needs to be reclaimed for a more bullish outlook to prevail.

$BTC Weekly

Pretty hammer candle (or high wave spinning top, choose).

Strong volume, long wick into demand.

Not really bullish until >$39,600.

Have not had consecutive green wks in months, need confirmation. 2 weeks ago was a “bullish candle” as well, didn’t work out. pic.twitter.com/HlI8XI6RO2

— The Wolf Of All Streets (@scottmelker) January 31, 2022

Just as uninspired by the weekly candle was fellow trader and analyst Rekt Capital, who in a fresh Twitter update said that BTC “continues to struggle with $38,500 resistance.”

“This is the area BTC needs to Weekly candle Close above to ensure upside beyond ~$39,000,” he added.

With a disappointing performance behind it, Bitcoin is thus back in the same old range — one which some warn could yet result in a retest of lower levels.

“Personally looking forward to any opps to compound if we trade this 29-40k range for long,” popular trader Pentoshi confirmed.

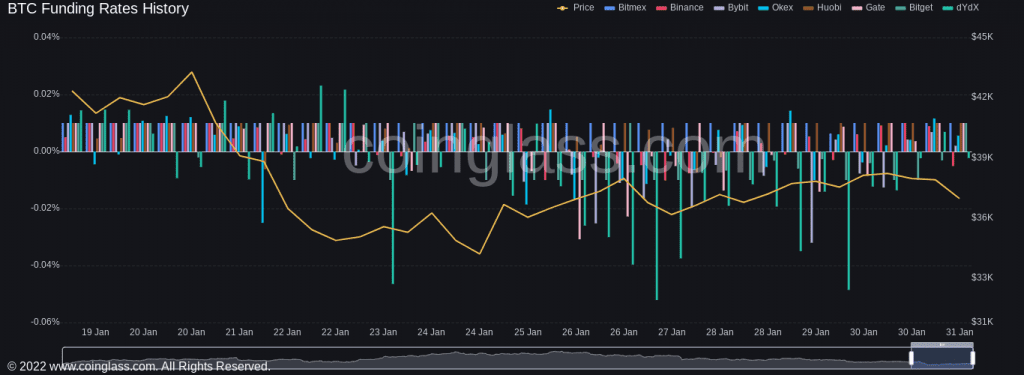

The trip to highs around $38,600 meanwhile succeeded in raising previously negative funding rates on derivatives as sentiment swiftly changed from expecting further downside to expecting a bullish continuation.

The reversal, however, sent funding rates broadly back into negative territory, with most hovering just under neutral at the time of writing.

Can S&P 500 upend worst month since March 2020?

While Bitcoin’s monthly close is not yet slated to bring any surprises, stock markets may nonetheless provide some last-minute relief.

With futures up pre-session Monday, the S&P 500, with which Bitcoin has displayed growing positive correlation in recent months, is heading for its worst monthly performance since March 2020.

The S&P is down 7% this month, echoing the jittery start to the year for Bitcoin, as Fed policy begins to bite enthusiasm which accompanied unprecedented liquidity provision at the start of the Coronavirus pandemic.

While the Fed is now tight-lipped over the timetable for rate hikes which should follow the turning-off of the “easy money” spigot, closer to home, another problem for Bitcoiners is on the horizon.

The Biden administration’s upcoming executive order on crypto, ostensibly moved forward to February, could put the cat among the pigeons once again in terms of already battered sentiment.

The specter of the Infrastructure Bill remains for many a market participant, and further disadvantageous treatment of the crypto phenomenon would be seriously unwelcome from a country now hosting the lion’s share of the Bitcoin mining hash rate.

According to a report from Bloomberg last week, the order should focus on the “risks and opportunities” crypto affords.

The plans have already seen “multiple meetings” with officials, with the aim seemingly to unify government regulatory approaches to the crypto sphere.

Old hands age well

Behind the scenes, the more comforting trend of seasoned Bitcoin hodlers clinging to their assets continues to play out.

Data from on-chain analytics firm Glassnode this week confirms that the number of coins that last moved between five and seven years ago has reached an all-time high.

That cohort of coins now totals 716,727 BTC.

At the same time, January in fact saw an overall decrease in Bitcoin exchange reserves despite price losses. As per Glassnode data, major exchanges are down around $243 million this week alone.

Previously, Cointelegraph reported on the ongoing depletion of exchanges’ BTC holdings.

Separate figures from CryptoQuant, which track 21 major trading platforms, further confirm that balances are at their lowest since 2018.

GBTC dives to record 30% discount

Things aren’t going so well for the Grayscale Bitcoin Trust (GBTC).

Despite data showing the reemergence of institutional interest in Bitcoin in January, demand for the industry’s flagship BTC investment product continues to wane.

According to data from on-chain analytics firm Coinglass, last week saw GBTC trade at its biggest ever discount relative to the Bitcoin spot price.

This discount to net asset value (NAV) — the fund’s BTC holdings — used to be a premium investors paid for exposure, but now, the tables have long turned.

On Jan. 22, new entrants were technically able to buy GBTC shares at nearly 30% below the spot price on the day.

As Cointelegraph reported, GBTC has faced a rapidly changing environment in recent months, thanks to a combination of price action and the launch of exchange-traded funds (ETFs). GBTC itself is due to become a spot-based ETF — but only with U.S. regulatory approval.

Precising the situation, on-chain analyst Jan Wuestenfeld said that in spite of the discount, GBTC did not necessarily represent a way for institutional investors to profit from “easy money” in the long term.

“Yes, if you believe it will be converted into a spot ETF at some point, but there are also the fees to consider and also that you don’t really hold the keys,” he said as part of a Twitter debate at the weekend.

Not so fearful after all?

Trustworthy or not, something is happening to Bitcoin on-chain sentiment this week.

Related: Top 5 cryptocurrencies to watch this week: BTC, LINK, HNT, FLOW, ONE

After spending almost all of January in the depths of “extreme fear,” accompanied by a revisit of rare lows seen only a handful of times, the Crypto Fear & Greed Index is finally looking up.

On Sunday, the Index exited the “extreme fear” zone — a reading between 0 and 25 — for the first time since Jan. 3.

Fear & Greed uses a basket of factors to determine overall market sentiment, and its range highs and lows have accurately depicted extremes in price.

That a more positive mood may finally be entering is a welcome signal for analysts, but as ever, all depends on whether such a recovery is sustainable and remains uninterrupted by external surprises.

The party proved to be fleeting, as the weekly close hammer candle sent readings back into “extreme fear.”

Nonetheless, with brief trip to 29 — “fear” — the Index thus avoided the dubious honor of spending the longest-ever amount of time in the “extreme fear” zone since it was created in 2018.

The fickle nature of sentiment overall, meanwhile, was not lost on veteran trader Peter Brandt, who at the weekend poked fun at how perspectives have changed since the price correction began.

I find it fascinating that many (not all) on social media who wore laser eyes in Mar/Apr and predicted a rocket shot for $BTC in Nov now are predicting that the $30k level will be violated

When bulls wear laser eyes — time to SELL

When bulls become bears — time to BUY???? pic.twitter.com/ytchaFLDfN— Peter Brandt (@PeterLBrandt) January 30, 2022

With the all-time highs in November as a focal point, Brandt described the latter half of 2021 as the “Laser Greed Era.”