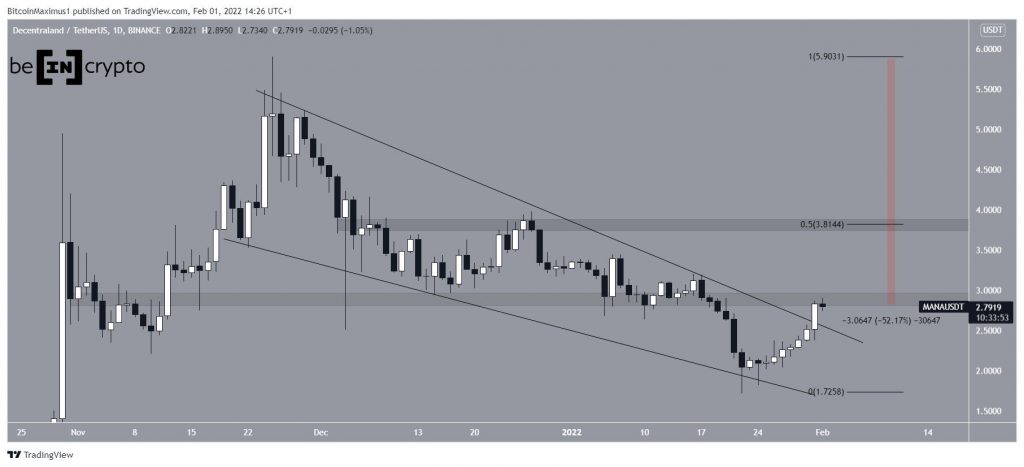

Decentraland (MANA) has broken out from a long-term pattern, potentially signaling that the correction ongoing since Nov 25 is complete.

MANA had been decreasing inside a descending wedge since reaching an all-time high on Nov 25. The downward movement led to a low of $1.70 on Jan 22. Since then, the token has been moving upwards.

On Jan 31, MANA broke out from the aforementioned descending wedge. Despite the breakout, it is still trading 52% below its all-time high price.

Currently, it is inside the $2.85 horizontal resistance area. If it were successful in moving above it, the next resistance would be at $3.81. This is both a horizontal resistance area and the 0.5 Fib retracement resistance level.

Cryptocurrency trader @PostyXBT tweeted a MANA chart, stating that the token could get rejected by the $2.85 resistance area. Since the tweet, the token has reached this area and dropped slightly afterwards.

Future MANA movement

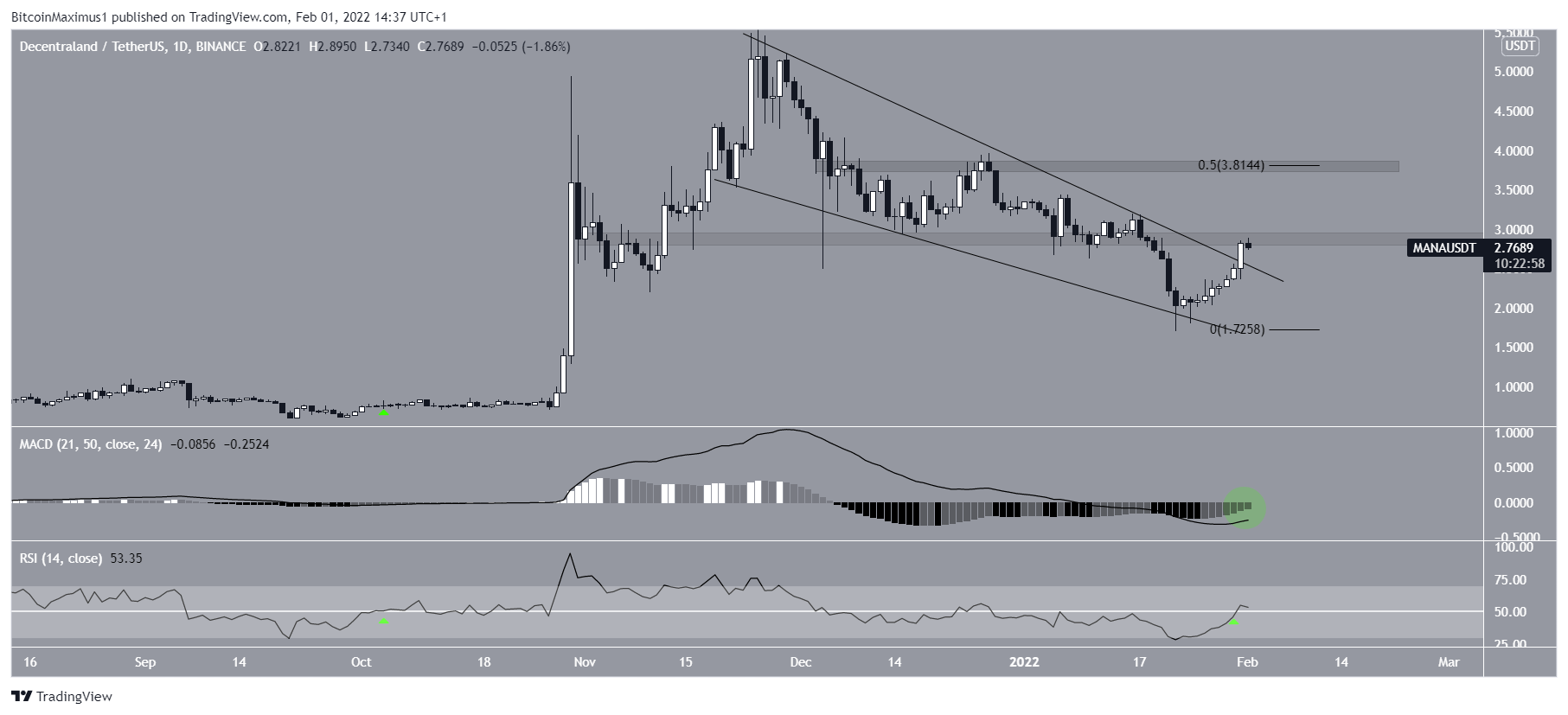

Despite the fact that MANA is trading inside resistance, technical indicators are still bullish.

The MACD, which is created by a short- and a long-term moving average (MA), is moving upwards and is nearly positive (green circle). This is a sign that the trend is gradually turning bullish.

Also, the RSI has just moved above 50. The RSI is a momentum indicator and readings above 50 are considered signs of a bullish trend. More importantly, the previous time this occurred was on Oct 2021, preceding the entire upward movement to the all-time high price.

Therefore, it is possible that an upward movement will also follow this time around, taking MANA at least to the $3.81 resistance area.

Wave count analysis

Measuring from June 2021, it seems that MANA has just begun wave five of a five wave upward movement (white). In this scenario, it completed a fourth wave pullback with its Jan 22 low.

The first potential target for the top of this move would be at $8.38, created by the 1.61 external Fib retracement resistance level. The second target would be at $11.16, created by the 0.382 length of waves 1-3 (white).

It is also worth mentioning that the only other time the MACD histogram generated bullish divergence was on May – June 2021, (green lines), preceding the current upward movement.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.