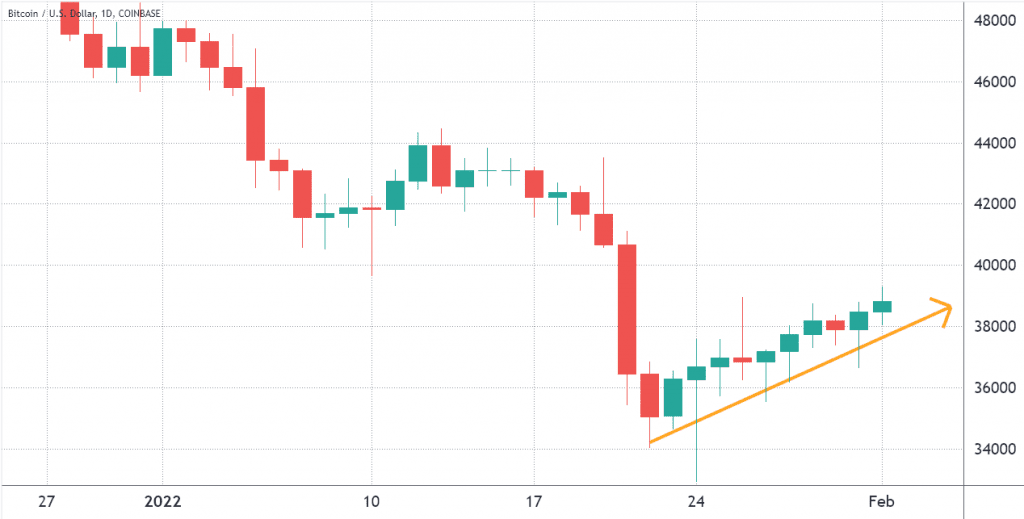

The Bitcoin (BTC) daily price chart seems to be making a steady recovery pattern, but some concerning indicators are coming from derivatives markets. At the moment, the futures and options markets are showing a lack of confidence from Bitcoin pro traders, but there’s a positive spin to the data.

The road to $40,000 seems uncomfortably predictable, and cryptocurrency traders usually call it “manipulation” when such price movements happen.

If you #bitcoin around that region, just be careful.

A picture speaks a thousands words and I think mine says it all.

Make it or break it time around the corner for #btc. This weekend is weekly close & monthly close as well so expect volatility and manipulation.#Crypto pic.twitter.com/kPhDKAjupQ

— @Maze (Will never DM 1st or Follow) (@_CryptoMaze_) January 28, 2022

Regardless of the rationale behind Bitcoin’s price recovery, investors should analyze derivatives markets to understand how whales, market makers and arbitrage desks are positioned.

While retail traders’ favorite instrument is the perpetual contract (inverse swaps), pro traders often opt for fixed-calendar futures and options. Although they are more complicated to trade, these derivatives offer more complex strategies.

Liquidations are behind us, but so is the route to $69,000

Data shows that there hasn’t been a relevant futures contract liquidation since Jan. 23. When leverage long (buyers) have their positions terminated, it accelerates the price correction, because derivatives exchanges need to sell those futures at market prices.

Notice how the last “big” forced position termination on longs was $290 million on Jan. 23. This partially explains why Bitcoin’s recovery was relatively tranquil over the past week. Still, the market is nowhere near being out of the water, considering that BTC is currently trading 44% below the $69,000 all-time high.

The Bitcoin futures annualized premium should run between 5% to 12% to compensate traders for “locking in” the money for two to three months until the contract expiry. Levels below 5% are extremely bearish, while the numbers above 12% indicate bullishness.

The above chart shows that this metric dipped below 5% on Jan. 21 and hasn’t yet shown signs of confidence from pro traders.

So the big question is: Is the glass half full? For example, if Bitcoin breaks the $42,000 resistance, some traders will likely be caught off guard, so there’s additional buying activity because no one wants to be left behind.

Bitcoin futures markets are neutral, but options traders are skeptical

Currently, it’s a bit difficult to discern a direction in the market, but the 25% delta skew is a telling sign whenever arbitrage desks and market makers overcharge for upside or downside protection.

If traders fear a Bitcoin price crash, the skew indicator will move above 10%. On the other hand, generalized excitement reflects a negative 10% skew.

As displayed above, we’ve been near 10% for almost a week despite the 18% BTC price recovery since the $33,000 bottom. The options skew data shows that pro traders are still pricing higher odds for a market crash.

Despite the not-so-positive indicator from Bitcoin options, these arbitrage desks and market makers will be forced to reverse bearish positions once the price breaks $42,000. However, considering that the futures premium did not show signs of desperation even as the market crashed 52% from the all-time high, the data provides a constructive view.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.