Shiba Inu had a larger market cap than Dogecoin a few weeks ago but that situation had changed as Shiba Inu saw intense selling. At the time of writing, the price held on to a support level but its grip appeared weak. Further downside appeared more likely than a bounce for SHIB.

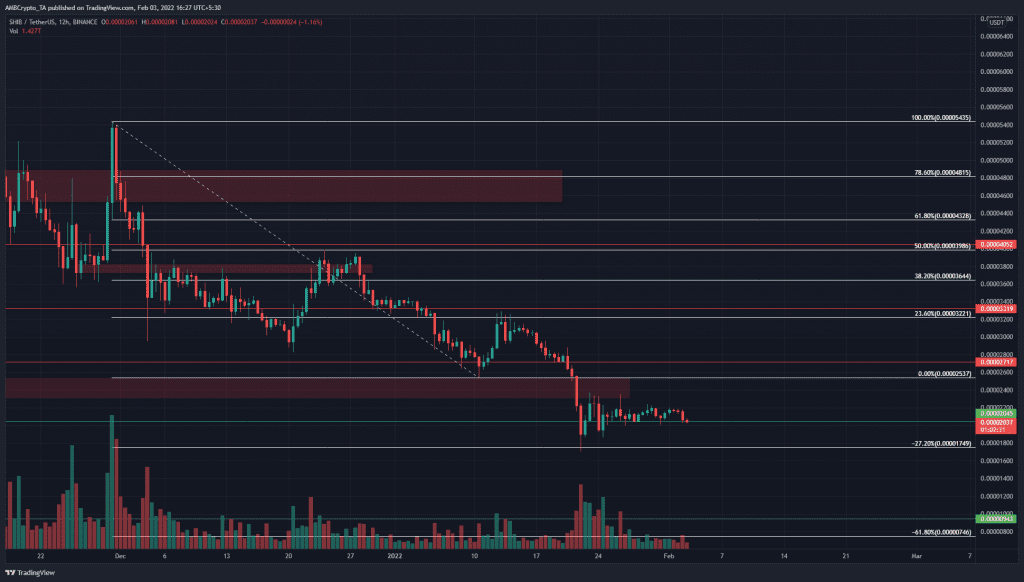

Based on the move from $0.05435 to $0.02537 (the price has been multiplied by a factor of 1000 to reduce the number of decimal places and increase clarity), a set of Fibonacci retracement levels were drawn (white). This projected a 27.2% extension level of $0.01749 for SHIB, an area from which the price did see a bounce. This showed that these Fibonacci levels held some significance, as they have been respected.

The $0.025 area (lower red box) has been highlighted. It was an area where, formerly, demand was expected to step in. But in the last two weeks, the price has dropped below this level, making it a supply zone. At press time, the price was trading beneath this area and has already tested it in search of sellers.

The $0.02045 support level has held over the past couple of weeks, but likely won’t last much longer.

Rationale

The RSI on the 12-hour chart was climbing toward neutral 50 even though no upward move was seen on the price. This suggested that the RSI was likely to be rejected near the neutral 50 area, and could accelerate southward on the back of a session close beneath the $0.02045 level.

The DMI showed that the past couple of months have seen a strong bearish trend in progress as both the -DI (red) and the ADX (yellow) were above 20. The OBV showed a steady downtrend, to highlight the selling pressure that has driven prices lower.

Conclusion

The candlewicks to the $0.024 area have faced strong selling pressure which demarcated it as a supply zone. At the time of writing, further lows appeared likely, especially as Bitcoin itself faced resistance at $39k and was headed back toward support at $34.8k. A move lower for Bitcoin could intensify selling pressure on SHIB.

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice